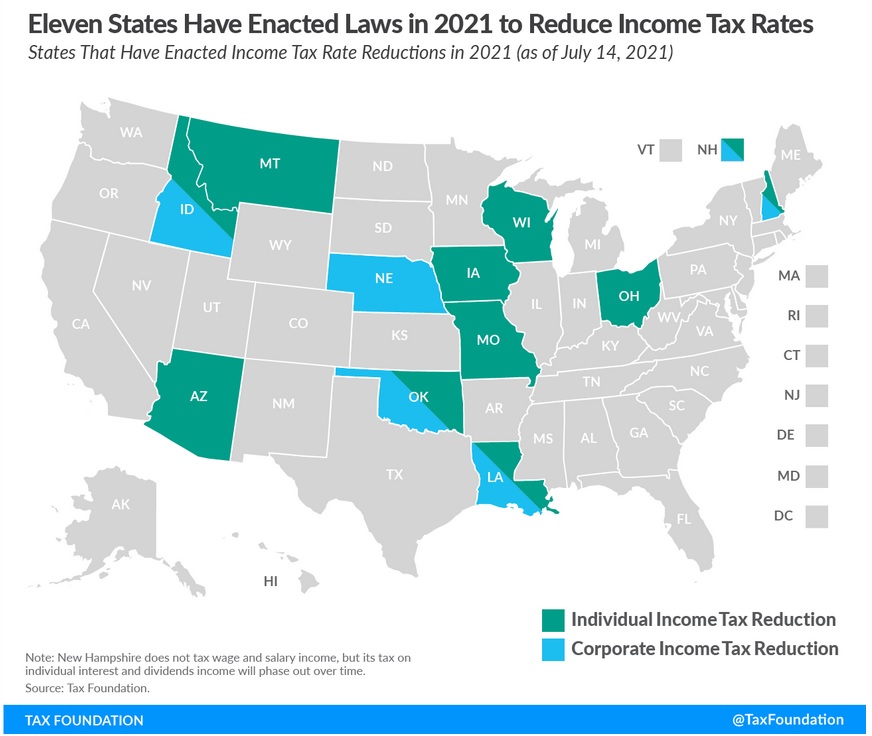

Last year I shared a very encouraging map, which identified the many states that have been cutting tax rates.

After the November elections, I wrote a couple of encouraging columns about voters making sensible decisions when given the ability to vote for higher or lower taxes.

Later that month, I updated my five-column table showing which states have the best and worst tax systems.

And I ended the year with a look at the Tax Foundation’s State Tax Business Climate Index.

All things considered, not a bad year. At least at the state level.

Well, we may see more progress this year.

Grover Norquist of Americans for Tax Reform has a column in the Wall Street Journal about an ongoing revolution of pro-growth tax cuts at the state level.

…in the 50 states there is a dramatic increase in tax competition to provide the best government at the lowest cost. …Americans have noticed that high-tax states don’t provide better roads, education or other services. Florida (with 22 million residents) has no income tax and the state spends half as much as New York (20 million residents). New York has a top state income tax of 8.82% (soon rising to 10.9%) and was the only state to raise its personal income-tax rate during the pandemic. …state leaders have discovered that…marginal income-tax rate…reduction is enabled by spending restraint. North Carolina provided the best example of this strategy over the past seven years. …Louisiana, under the leadership of Senate Majority Leader Sharon Hewitt, has set a path to reduce its income tax every year triggers are met. These triggers could take Louisiana’s income tax to zero by 2034… Ten other states have begun the march to a zero rate.

The column also mentions other states, such as Iowa, that hopefully will replace discriminatory regimes with simple and fair flat taxes.

Not everyone is happy about these developments.

In a column for the Washington Post, Catherine Rampell points out that some of the tax cutting was enabled by Biden’s big handouts to state governments.

Democrats in Congress have made it much easier for state-level Republicans to slash taxes this year… That’s because Democrats have shoveled a ton of federal money onto the states… Big budget surpluses have inspired the governors of Missouri, South Carolina and Iowa to propose cuts to their income tax rates. Utah’s Senate recently approved a $160 million tax cut, with its state House of Representatives expected to make the proposal even more expansive. And Mississippi is working to cut taxes on food sales and car tags — and to phase out its income tax entirely. …Even blue and purple states may jump on the traditionally conservative tax-cut bandwagon, too. …after President Biden took office, Democrats decided to go big with their stimulus bill… Democrats sent states and localities an additional $500 billion, including direct state and local covid relief grants, plus separate funding for education, transit and other programs. …many states have more cash than they know what to do with. …total state and local receipts were 26 percent higher in 2021 than they were in 2019.

Here’s the part she doesn’t like.

Republicans are taking these deficit-financed federal dollars, passing them on to constituents in the form of lower taxes and reaping the political benefits — all while being able to blame Democrats for the enormous cost they add to the federal debt. …perhaps red states reasonably assume that Democrats won’t learn their lesson — and will keep the federal dollars flowing, even if doing so hands Republicans home-state political victories.

Interestingly, congressional Democrats recognized this might be a problem.

But the anti-tax cut language they included in their handout legislation has not been effective.

Democrats did include legislative language that forbade any pandemic relief funds from being used to “either directly or indirectly” finance tax cuts. But enforcing that provision was always going to be difficult… Federal judges have already blocked Treasury from enforcing the no-tax-cut provision in at least 15 states… More litigation is pending, but these developments have emboldened Republicans, who are eager to use Democrats’ sloppy bill design against them.

All of this may be a quandary for libertarians and conservatives.

Biden’s boondoggle stimulus was bad legislation. And the same can be said for major parts of Trump’s pandemic emergency spending bills.

Yet one fortunate side effect is that state governments have had so much money that some of them have been cutting taxes.

But some of them also have been spending more money, and that won’t lead to good results.

All things considered, this really shouldn’t be a quandary. We got two bad things (more federal spending and more spending in some states) and one good thing (tax cuts in some states).

P.S. At some point, the politicians in Washington will have to restore some fiscal sanity, but I’m not holding my breath for good policy.

P.P.S. I suspect we’ll see even more interstate tax migration over the next few years. Simply stated, many people would rather live in libertarian-oriented states rather than greed-oriented states.

No comments:

Post a Comment