The burden of federal spending today is too high, diverting resources from the productive sector of the economy and sapping America’s economic vitality. Unfortunately, today’s bad news about excessive government spending will become tomorrow’s terrible news.

The problem is entitlement programs.

When politicians created programs such as Medicare, Medicaid, and Social Security, they did not understand (or did not care) about what might happen if people started living longer and/or having fewer children.

These demographic changes are profoundly important because they translate into an ever-growing burden of government spending. Simply stated, the United States is becoming a society with more and more people expecting benefits from the government and fewer and fewer taxpayers to pay for those goodies.

The Center for Freedom and Prosperity has just released a three short studies to explain this problem. Authored by Robert O’Quinn, who has held senior positions in both the executive and legislative branches, this three-part series will make you better informed than most so-called budget experts in Washington.

Part I of the three-part series is a primer on the federal budget. It explains all sorts of wonky topics such as the differences between “mandatory spending” and “appropriations.” Readers will learn about the importance of “budget reconciliation” and “federal debt held by the public.” This paper does not look at policy choices, but readers will learn about the process of making fiscal policy (something I explained with far less detail back in 2018).

Part II of the three-part series a primer on federal spending, revenue, and red ink. Readers will learn how federal spending and revenue have changed over time (hint: both have increased, but spending has grown at the fastest rate). The paper explains the economic impact of spending, taxes, and deficits. For those who don’t have time to read the study, here’s the most important thing to understand.

Federal outlays are growing significantly faster than the U.S. economy, while federal receipts are growing slightly faster than the U.S. economy. Consequently, federal budget deficits and federal debt held by the public are widening as a percent of GDP. …the key problem is the growing burden of spending. Replacing debt-financed spending with tax-financed spending would leave the nation’s fiscal burden unchanged. Or it might make a bad situation even worse if politicians increase spending because of an expectation of additional revenue.

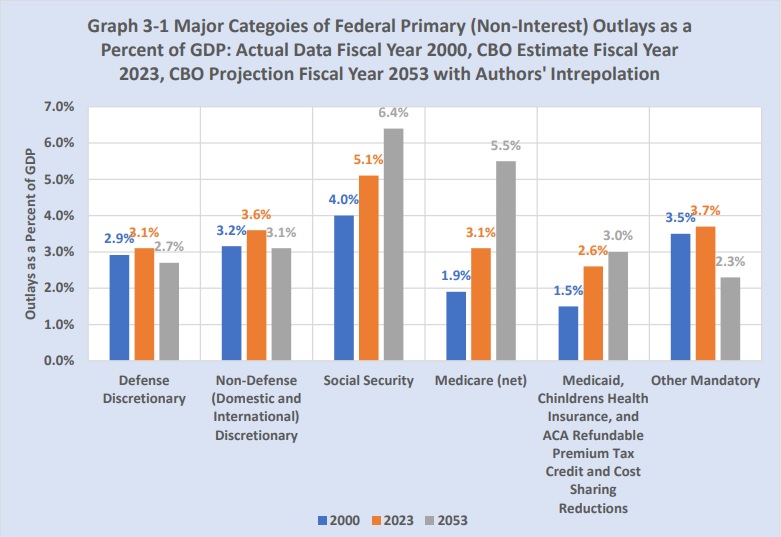

Part III of the three-part series is a primer on entitlement programs. It explains that entitlements are responsible for America’s growing burden of government spending. Readers will learn about the fiscal consequences of Medicare, Medicaid, and Social Security. Everyone should read this report, but for those of you with limited time, this chart is the most important thing to understand. You can see the burden of different spending categories in 2000, 2023, and 2054, and the problem areas are quite obvious.

All three studies are primarily designed to inform readers about basic facts so they have a real-world understanding of America’s deteriorating fiscal outlook.

I’ll conclude this column, though, by making a very important point about public policy. Simply stated, the United States will not be able to issue endless amounts of government debt.

As a result, this means that the nation will have to close the huge long-run gap between spending and revenue by making an unavoidable choice between massive tax increases and genuine entitlement reform.

Because of their opposition to entitlement reform, politicians such as Joe Biden and Donald Trump prefer giant tax increases. And because there are not enough rich people to finance big government, the Biden-Trump tax increases will target lower-income and middle-class households.

No comments:

Post a Comment