Reducing the corporate tax rate from 35 percent to 21 percent was the crown jewel of Trump’s 2017 Tax Cut and Jobs Act (TCJA).

- It was good for workers since a lower rate means more investment, which translates to increased productivity and higher wages.

- And it was good for U.S. competitiveness since the United States corporate tax rate no longer was the highest in the developed world.

Some critics downplayed those benefits and warned that a lower corporate tax rate would deprive the government of too much revenue.

Since I don’t want politicians to have more money, that was not a persuasive argument. Moreover, I argued during the debate in 2017 that a lower corporate tax rate would generate “revenue feedback.”

In other words, there would be a “Laffer Curve” effect as corporations responded to a lower tax rate by earning and reporting more income.

Based on the latest fiscal data from the Congressional Budget Office (CBO), I was right.

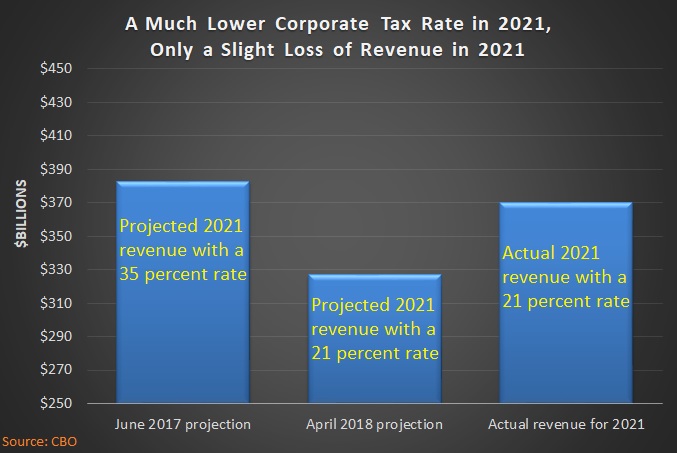

Corporate tax revenues for the 2021 fiscal year (which ended on September 30) were $370 billion. As shown in this chart, that’s only slightly below CBO’s estimate back in 2017 of how much revenue would be collected – $383 billion – if the rate stayed at 35 percent.

The chart also shows CBO’s 2018 estimate of what revenues would be in 2021 with a 21 percent rate (and if you want more data, the Joint Committee on Taxation estimated that the Trump tax reform would reduce corporate revenues in 2021 by $131 billion).

This leads me to ask two questions.

- Is this a slam-dunk argument for the Laffer Curve?

- Did the lower corporate tax revenue generate so much revenue feedback that it was almost self-financing?

The answer to the first question almost certainly is “yes” but “don’t exaggerate” is probably the prudent response to the second question.

Here are a few reasons to be cautious about making bold assertions.

- CBO’s pre-TCJA estimate in 2017 may have been wrong for reasons that have nothing to do with the tax rate.

- CBO’s post-TCJA estimate in 2018 may have been wrong for reasons that have nothing to do with the tax rate.

- The surge of 2021 revenues may have been a one-time blip that will disappear or fade in the next few years.

- The coronoavirus pandemic, or the policy response from Washington, may be distorting the numbers.

These are all legitimate caveats, so presumably it would be an exaggeration to simply look at the above chart and claim Trump’s reduction in the corporate tax rate almost “paid for itself.”

But we can look at the chart and state that there was a lot of revenue feedback, which shows that the lower corporate tax rate did produce good economic results.

Perhaps most important, we now have more evidence that Biden’s plan to increase the corporate tax rate is very misguided. Yes, it’s possible that the President’s plan may generate a bit of additional tax revenue, but at a very steep cost for workers, consumers, and shareholders.

P.S. If you want an example of tax cut that was self-financing, check out the IRS data on how much the rich paid before and after the Reagan tax cuts.

No comments:

Post a Comment