Let’s look today at the wonky issue of “book income” because it’s an opportunity to point out that there are three types of leftists.

- Honest leftists who understand economics and recognize tradeoffs (I think of them as “Okunites“).

- Dishonest leftists who understand economics but pretend that tradeoffs don’t exist (the “demagogues“).

- Leftists who have no idea what they’re saying or thinking (I think of them as, well, Joe Biden).

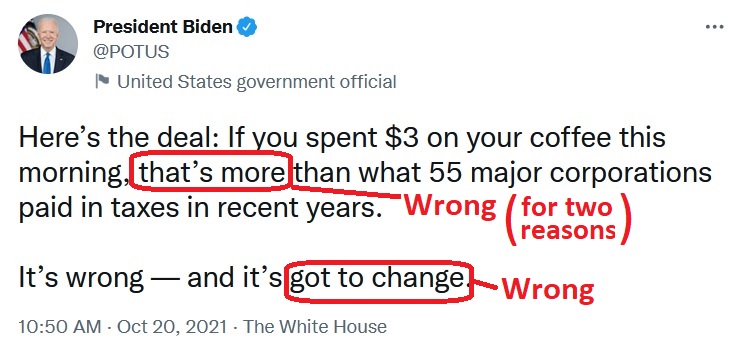

I’m being snarky about the President because of this recent tweet, which contains a couple of big, glaring mistakes.

What are the mistakes (I’m not calling them lies because I don’t think Biden has the slightest idea that he is wrong, much less why he’s wrong).

- The first mistake is that corporations pay a lot of tax (payroll tax, property tax, etc) even if they are losing money and don’t owe any corporate income tax.

- The second mistakes is that Biden is relying on a report about corporate income taxes that has been debunked because it relied on book income rather than taxable income.

- The third mistake is that the President implies that his plan force all big companies to pay the corporate tax when that’s obviously not true.

Regarding that third mistake, Kyle Pomerleau of the American Enterprise Institute explains why there will still be companies paying zero corporate income tax.

While the Biden administration’s proposals would increase the tax burden on corporations by about $2 trillion over the next decade, they would not change the basic structure of the corporate income tax. The Democrats’ proposal would not end corporations paying zero federal income tax in certain years. Corporations will still be able to carryforward losses, and credits will still be available for corporations to offset their tax liability. The administration has proposed a minimum tax to address these headlines by tying federal tax liability to book income. The minimum tax would require corporations with net income over $2 billion to pay the greater of their ordinary corporate tax liability or 15 percent of their book or financial statement income. Corporations would still be able to offset the book minimum tax with losses and general business credits.

Glenn Kessler of the Washington Post tried to defend Biden’s tweet as part of his misnamed “Fact Checker.”

He had to acknowledge Biden was using a made-up number, but nonetheless concluded that the President’s assertion was “probably in the ballpark.”

This is one of Biden’s favorite statistics. …the president has used it in speeches or interviews 10 times since April. Normally he is careful to refer to “federal income taxes” so the tweet is little off by referring just to “taxes.” …Let’s dig into this statistic. It’s not necessarily wrong but there are some limitations. …The number comes from…the left-leaning Institute on Taxation and Economic Policy (ITEP). …Company tax returns generally are not made public, so ITEP’s numbers are the product of its own research and analysis of public filings. But it is an imperfect measure. …the information in the filings may not reflect what is in the tax returns. …Nevertheless, the notion that 10 to 20 percent of Fortune 500 companies do not pay federal income taxes is consistent with a 2020 report by the nonpartisan Joint Committee of Taxation. …This “55 corporations” number is probably in the ballpark.

For what it’s worth, I don’t care that Kessler gave Biden a pass for writing “taxes” instead of “federal income taxes.”

After all, that’s almost surely what he meant to write (just like Trump almost surely meant “highest corporate tax rate” when complaining about America being the “highest taxed nation”).

But I’m not in a forgiving mood about the rest of Biden’s tweet (or Kessler’s biased analysis) for the simple reason that there is zero recognition that companies occasionally don’t pay tax for the simple reason that they sometimes lose money.

I’ve made this point when writing about boring issues such as depreciation, carry forwards, and net operating losses.

At the risk of stating the obvious, companies shouldn’t pay any corporate income tax in years when they don’t have any corporate income.

P.S. I’m not mocking Biden’s tweet for partisan reasons. I was similarly critical of one of Trump’s tweets that was glaringly wrong on the issue of trade.

Editor's Note: Dan and I don't necessarily agree on this issue about Trump's trade decisions, as they were perdicated on a value system, whether or not you agree with his values. Biden on the other hand is now and has always been a slack jawed vacant eyed dweeb. RK

No comments:

Post a Comment