Time for Part III in my series on the economics of creative destruction (here’s Part I and Part II).

We’ll start with this clip from a recent trans-Atlantic interview.

As you can see from the discussion, I openly acknowledge that the progress enabled by free enterprise can produce economic pain.

This is why I’ve called creative destruction the best and worst feature of capitalism.

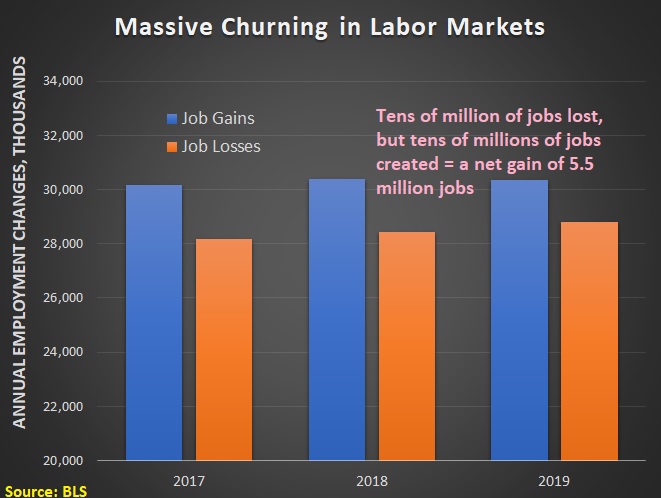

For instances, millions of jobs are destroyed every year. But (assuming politicians aren’t causing too many problems) more jobs usually are created.

And, over time, our incomes grow and our living standards increase (with some countries doing better than others for obvious reasons).

For today’s column, let’s look at some additional evidence.

We’ll start with some findings from a 2019 study published by the Australian Bureau of Statistics. The researchers found that failure is a necessary feature of a market economy.

Here are some excerpts from the abstract.

We examine the components of this productivity growth by estimating the contribution of entry, exit, within-firm growth and re-allocation to productivity growth in Australia in the period 2002- 2013. We use an experimental linked dataset of 10 million workers across 1.5 million firms. …We find that firm entry and exit are by far the largest contributors to productivity growth across all industries.

In general, firm exit contributes positively to productivity growth whereas firm entry generally contributes negatively. This would suggest that policies which facilitate firm entry and exit are likely to help achieve increased productivity gains. Policies which provide large advantages to incumbent firms are likely to detract from productivity growth.

That final sentence is key. It shows why politicians should not coddle big business with handouts, bailouts, subsidies and protectionism, and other forms of cronyism and industrial policy.

That’s a recipe for zombie firms and stagnation. This is why it is good news that the vast majority of Fortune 500 companies in the U.S. lost ground over a 60-year period.

Let’s now look at another study, this one published by the National Bureau of Economic Research. James Feigenbaum and Daniel P. Gross looked at how the economy adapted after massive job losses in the telephone industry.

Using panel variation in the local adoption of mechanical switching and population outcomes from complete count census data from 1910 to 1940, we show that dial cutovers presented a large negative shock to local labor demand for young, white, American-born women, with the number of young operators dropping by upwards of 80%—a near-total collapse in entry-level hiring in one of the country’s largest occupations for young women—and accordingly around 2% of jobs for this group being permanently replaced by machines, essentially at the flip of a switch.

These 2% of jobs represented entry-level opportunities for several times as many young women, and the fear was that its automation might choke off future generations from the labor force. We find that this shock did not reduce future cohorts’ employment rates. It appears that comparable middle-skill office jobs and some lower-skill service sector jobs absorbed future generations of young workers workers, and did so fairly quickly, with women of only the youngest ages on average ending up in lower-paying occupations than they would have been in otherwise.

The adverse consequences of automation were concentrated in incumbent telephone operators, who were subsequently less likely to be working, and conditional on working, more likely to be in lower-paying occupations—but even then, the magnitudes of these impacts were relatively modest.

In other words, “creative” generally outweighs “destruction.” Which was one of Joseph Schumpeter’s main points when he explained the concept last century.

Speaking of which, let’s close by looking at Professor Richard Ebeling’s column about Schumpeter.

Schumpeter…defined “the entrepreneur” as the central and dynamic figure of the market process who introduces transformative innovations that radically change the forms and directions of economic activity. …Looking over the nearly century and a half from the start of the nineteenth century to his own time…, Schumpeter pointed to the dramatic increase in the output of goods and services, including new and better goods that were not available to even the wealthiest of kings and princes in, say, 1790 or 1810. …

In doing this, capitalism was also serving as a great “leveler” that was raising the economic well-being of all, while also narrowing the differences in the quality of life between “the rich” and the rest. …The “culture of capitalism,” Schumpeter said, also had eliminated political privileges and favoritism and had increasingly fostered equality before the law for all, including women and religious and ethnic minorities. Capitalism replaced primitive tribal and social collectivism with an ethic and a politics of individualism that established the ideal of individual rights, private property, and human association based on freedom of contract. …

Fortunately, even in the face of the regulatory and redistributive state, the market economy has still possessed enough competitive openness and profit-earning opportunity that continuing prosperity has been a reality.

By the way, Schumpeter was actually pessimistic about the survival of capitalism. He feared that it was just a matter of time before supporters of statism would get the upper hand.

For all intents and purposes, he was describing the tension in my 16th Theorem of Government. In other words, will politicians give the economy enough “breathing room” to deliver more prosperity?

No comments:

Post a Comment