June 26, 2022 by Dan Mitchell @ International Liberty

In Part I, I warned that “stakeholder capitalism” is not just empty virtue signaling. Some advocates are using the concept to promote a statist agenda.

For Part II, let’s start with this video.

The main message of the video is that ethical profits are good for shareholders, but also good for everyone else (the supposed stakeholders).

By contrast, companies that don’t prioritize profits wind up hurting workers and consumers, not just the company’s owners (i.e., shareholders).

Let’s dig deeper into this topic.

Stakeholder theory reflects the more interventionist approach of continental Europe’s “civil law” while the shareholder approach is more consistent with the “common law” approach of the Anglosphere (the United Kingdom and many of its former colonies, including the United States).

That’s a key observation in Samuel Gregg’s column for Law & Liberty, which reviews a book by Professor Nadia E. Nedzel.

…stakeholder theory reinforces continental European rule through law inclinations and vice-versa, not least because of shared hard-communitarian foundations. …Such goals undermine the ability of corporations to produce prosperity. An emphasis on stability and maintaining levels of employment, for instance, exacts a cost in terms of organizational dynamism, not least by discouraging risk-taking and entrepreneurship. …

Without such adjustments, however, a business will become complacent and uncompetitive. Eventually it will disappear, along with all the jobs once provided by the business. Likewise, if boards of directors are not focused on delivering shareholder value because profit is considered only one of many company objectives, a decline in earnings is sure to follow. …

To the extent that stakeholder theory draws upon hard-communitarian principles which it shares with continental European rule through law models, it risks undermining already fragile commitments to rule of law in America and elsewhere. That’s just one more reason to shore up the priority of shareholder interests throughout corporate America. These priorities help explain the weaker economic performance of many corporations in civil law jurisdictions compared to those businesses located primarily in the Anglo-American sphere.

Allison Schrager of he Manhattan Institute wrote for the City Journal that Biden is on the wrong side and that his mistake, along with others, is failing to understand that so-called stakeholders benefit when companies are profitable.

…one thing that stood out was Biden’s vow to “put an end to the era of shareholder capitalism.” …disdain for the notion that a corporation’s primary objective is to maximize value for its shareholders has united the disparate likes of Elizabeth Warren and Bernie Sanders and the Davos/Larry Fink crowd. It’s no surprise that Joe Biden is against it, too. …Maximizing shareholder value…does not create conflicts between different stakeholders, because economic success is not zero-sum. …long-term success requires happy and loyal employees, a healthy relationship with the community, and a thriving environment.

In a column for the Wall Street Journal, and

…we dug deeper, investigating an array of corporate documents for the 136 public U.S. companies whose CEOs signed the statement. …we found evidence that the signatory CEOs didn’t intend to make any significant changes to how they do business. …We’ve identified almost 100 signatory companies that updated their corporate governance guidelines by the end of 2020.

We found that the companies that made updates generally didn’t add any language that elevates the status of stakeholders, and most of them reaffirmed governance principles supporting shareholder primacy. …We also found that about 85% of the signatory companies didn’t even mention joining the “historic” statement in their proxy statements sent to shareholders the following year. Among the 19 companies that did mention it, none indicated that joining the statement would cause any changes to how they treat stakeholders.

Speaking of insincere hypocrites, that’s a good description of the Davos crowd. Matthew Lesh of the Adam Smith Institute wrote about their trendy support for stakeholders in a column for CapX.

…the man behind the World Economic Forum has declared that Covid warrants a ‘Great Reset’. With tedious predictability, Klaus Schwab’s bogeymen are the twin menaces of “neoliberal ideology” and “free market fundamentalism”. …he’s also calling for a “stakeholder model of corporate capitalism”…

But it’s an idea based on a false dichotomy. A business that fails to return a profit to its shareholders cannot do anything for its other stakeholders, such as providing useful products to customers, paying its staff, procuring from suppliers… Delivering for shareholders is ultimately indivisible from benefiting your other ‘stakeholders’ because you can’t do one without the other. …

Shivaram Rajgopal of Columbia Business School has found that top European companies who brandish their social and environmental credentials do no better in these criteria than American companies. But the European firms are much worse at ensuring good corporate governance. For example, worker representation on Germany’s supervisory boards has often meant worker representatives teaming up with managers to push against new technology and methods. In the longer run, this undermines returns to shareholders, but also means poorer products for customers, lower salaries for employees.

The bottom line is that there are lots of misguided attacks against capitalism, but none of the criticisms change the fact that free enterprise is the only system to ever deliver mass prosperity to ordinary people.

And that’s true even if big companies don’t support the system that enabled their very existence (perhaps because they fear they will got knocked from their perch by the the forces of “creative destruction“).

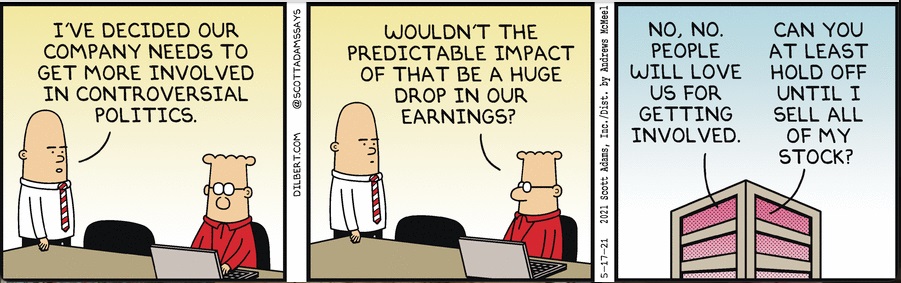

P.S. Just like yesterday, I can’t resist adding this postscript about the left-leaning executive who thought he was rejecting Milton Friedman, but actually did exactly as Friedman recommended.

No comments:

Post a Comment