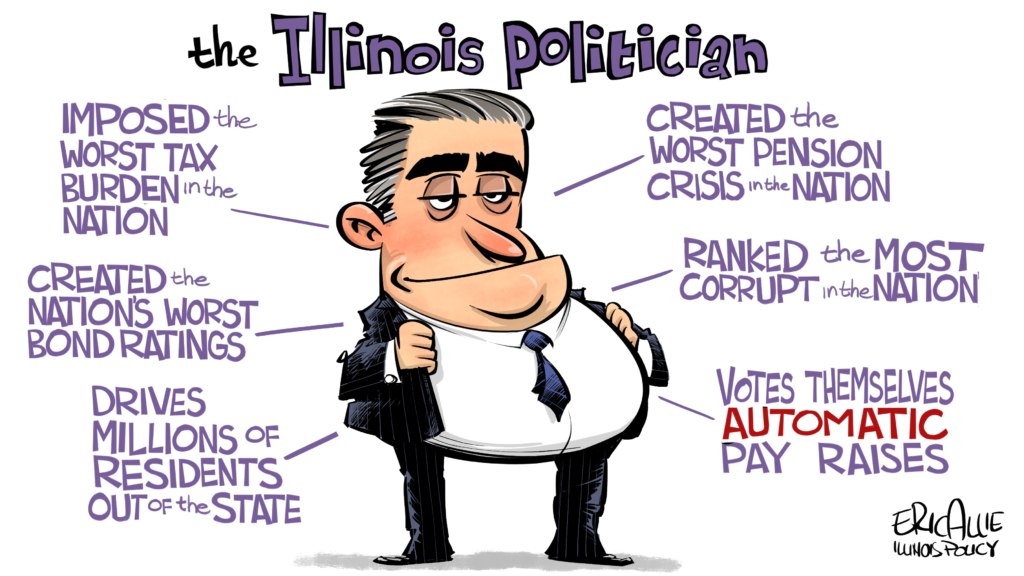

June 23, 2022 by Dan Mitchell @ International Liberty / Illinois and Fiscal Suicide, Part II

I wrote a couple of days ago about California’s grim future. But now I’ll share some good news. No matter how bad California gets, the Golden State probably won’t have to worry about people and about people and businesses fleeing to Illinois.

That’s because the Prairie State is an even bigger mess. If California is committing “slow motion suicide,” Illinois is opting for the quickest-possible fiscal demise.

Politicians in Springfield (the Illinois capital) have a love affair with higher taxes. A very passionate love affair. But the state’s productive people have a different point of view. More and more of them have been escaping.

And they are now being joined by the state’s most-famous company, as Matt Paprocki of the Illinois Policy Institute explains in a column for the Washington Post.

When Boeing announced last month that it was moving its headquarters from Chicago to Arlington, Va., it sent shudders through the Illinois business community and state capital. But last week, when the heavy-equipment manufacturer Caterpillar said it was moving its headquarters to Texas, it felt more like a bulldozer ramming into the news. …If you’re an Illinois business owner or resident, as I am, the economics of staying are tough and the enticements to move away are many. …According to the U.S. Census Bureau, last year the state had the third-largest loss of residents due to domestic migration in the nation (-122,460), trailing only California and New York.

It’s easy to understand why people and businesses are leaving.

In 2017, Illinois lawmakers raised the personal income tax rate to 4.95 percent, from 3.75 percent, and hiked the corporate rate to 7 percent, from 5.25 percent. When J.B. Pritzker took office as governor in 2019, he passed another 24 tax and fee hikes costing taxpayers over $5 billion. …With 278,475 regulatory restrictions and requirements — double the national average — Illinois has the third most heavily regulated environment in the country. …Illinois owes over $139 billion in state pension debt as of last year, and local governments owe about $75 billion, which is the primary driver for Illinois’ spiraling property taxes, second-highest in the nation.

Mr. Paprocki offers all sorts of suggestions for reform, including a spending cap.

But the chances of pro-growth reform are effectively zero. The governor is a hard-core leftist (as well as a hypocrite) and the state legislature is controlled by government employee unions.

So if you’re hoping for a TABOR-style spending cap, there’s little reason to be optimistic.

And if you’re hoping for reforms that will improve the state’s “least friendly” tax climate, don’t hold your breath.

Illinois and Fiscal Suicide, Part II

June 24, 2022 by Dan Mitchell

Yesterday’s column discussed Caterpillar’s decision to move its headquarters from high-tax Illinois to low-tax Texas.

Today, we have more bad news for the Prairie State.

A major investment fund, Citadel, also has decided to leave Illinois.

Is the company moving to a different high-tax state, perhaps California or New York? Maybe Connecticut or New Jersey?

Nope. Citadel is going to Florida, a state famous for having no income tax.

The Wall Street Journal opined this morning about Citadel’s move.

The first step to recovery is supposed to be admitting you have a problem. But Illinois Gov. J.B. Pritzker still won’t, even after billionaire Ken Griffin on Thursday said he’s moving his Citadel hedge fund and securities trading firm to Miami from Chicago. …Meantime, Democrats in Springfield continue to threaten businesses and citizens with higher taxes… It’s no wonder so many companies and people are leaving, and mostly to low-tax states. …In 2020, $2.4 billion in net adjusted gross income moved to Florida from Illinois, about $298,000 per tax filer. …Mr. Griffin has spent tens of millions of his personal fortune trying to rescue Illinois from bad progressive governance. Maybe he figures it’s time to cut his losses.

Other (former) Illinois residents cut their losses last decade.

Scott Shackford of Reason shared grim data at the end of 2020 about the ongoing exodus from Illinois.

For the seventh year in a row, census figures show residents moving out of Illinois in significant numbers. …Perhaps demanding that your excessively taxed residents give the government even more money is not the best way to keep those residents in your state… Over the course of the last decade, Illinois lost more than a quarter-million people…not even California…has seen Illinois’ population loss. …Government leaders have responded not with better fiscal management (the state’s powerful unions blocked pension reforms), but with more taxes and fees, even as residents leave.

The bottom line is that Illinois is currently losing people and businesses.

Just as it lost people and businesses last decade.

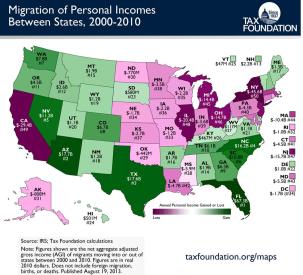

And you can see from this map that taxpayers also were fleeing the state earlier this century.

I’m guessing the state’s hypocritical governor probably thinks this is a good thing because the people who left probably didn’t vote for tax-and-spend politicians.

But that’s a very short-sighted viewpoint.

After all, parasites need a healthy host. If you’re a flea or a tick, it’s bad news if you’re on a dog that dies.

As Michael Barone noted many years ago, that’s a lesson that Illinois politicians haven’t learned.

No comments:

Post a Comment