Almost exactly one year ago, I wrote a column about a coordinated effort to impose class-warfare tax increases in seven left-wing states.

Fortunately, that effort fizzled.

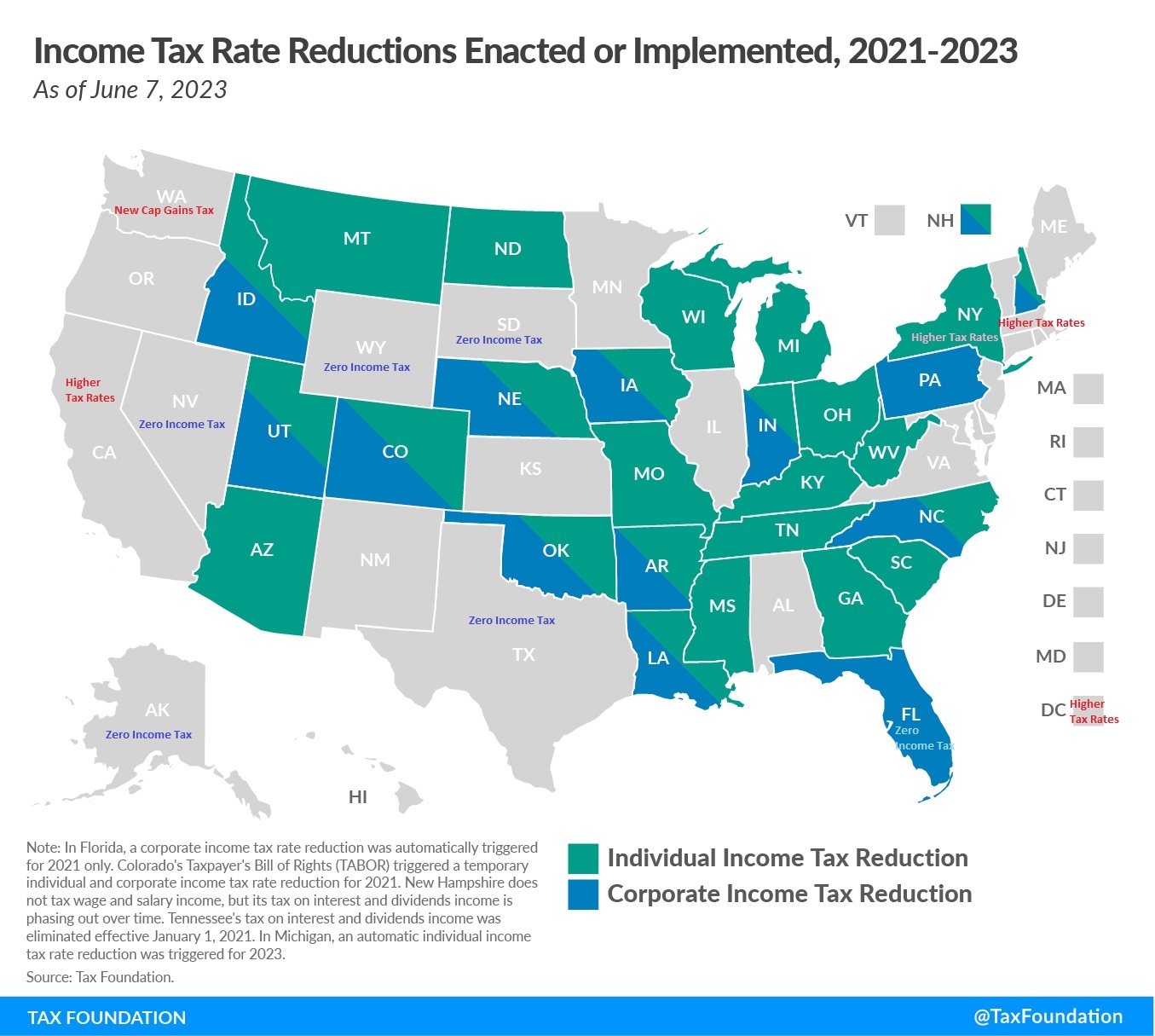

Meanwhile, there was continued progress in other states to lower tax rates. The net effect was “the feel-good map of 2023.”

And we have more and more evidence that taxpayers are “voting with their feet” by moving to the lower-tax states.

So it would seem that the issue is settled, right?

Not exactly. Our friends on the left have not given up.

David Chen of the New York Times reports that there’s now an effort to impose class-warfare taxes in 10 states.

Here are some excerpts from his story.

Lawmakers in Vermont are introducing legislation this week that would impose new taxes on the state’s wealthiest residents, joining a growing national campaign… One proposal in Vermont would tax people with more than $10 million in net worth on their capital gains, even if the gains have not yet been realized. Another would add a 3 percent marginal tax on individual incomes exceeding $500,000 a year…

The package of bills is part of a broader push across the country by progressive groups… the campaign began in earnest a year ago, when legislators in seven states…coordinated the introduction of bills… None of those proposals got out of committee. But this year, with Vermont, Pennsylvania and possibly other states joining the fold, organizers are redoubling their efforts… Some of the ultrawealthy agree: More than 250 billionaires and millionaires, including heirs to the Rockefeller and Disney fortunes, recently signed an open letter, coinciding with the World Economic Forum in Davos, Switzerland, that urged world leaders to tax them more.

With regards to the rich people who claim to want higher taxes, I invite them to follow these instructions on how to voluntarily pay extra money to Washington.

But since none of them ever go for that option, we can safely assume that they are virtue-signalling hypocrites.

So let’s instead consider what will happen if politicians succeed in raising taxes in any of the 10 states mentioned in the article. And we’ll use Vermont as an example.

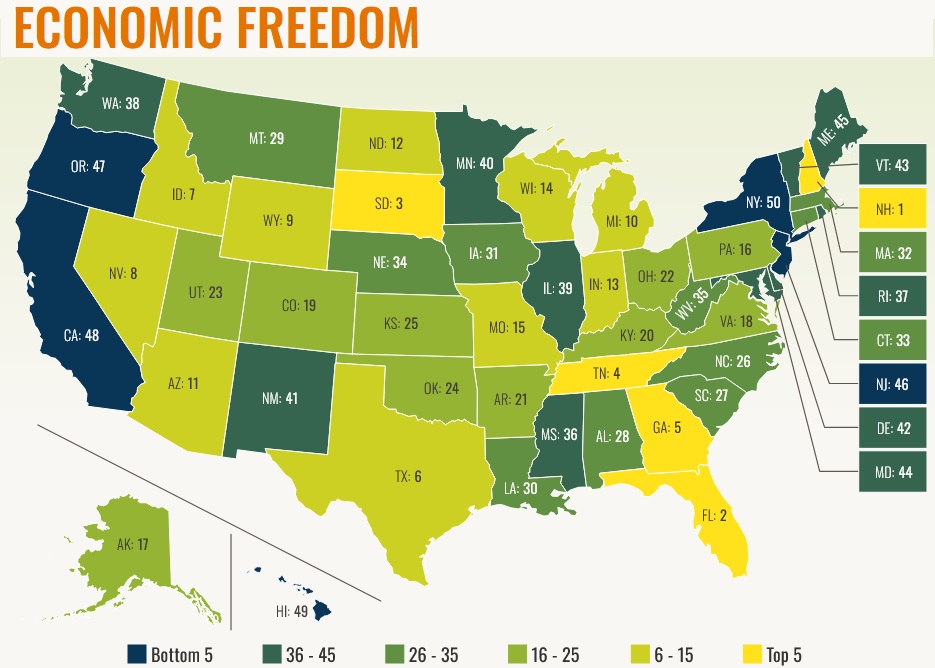

The top tax rate in Vermont is currently 8.75 percent and some politicians want to push that rate to 11.75 percent. If they are successful, Vermont will have the nation’s second-highest top tax rate, with only California being worse.

That’s economic suicide, especially since Vermont is right next to zero-tax New Hampshire.

And if Vermont politicians also impose a tax on unrealized capital gains (an idea so crazy that no other government has ever imposed such a levy), then the state’s suicide timetable will get even more compressed.

For what it’s worth, part of me perversely hopes Vermont goes down this path.

Just like it is helpful to have good examples, it’s also helpful to have bad examples. New Hampshire vs. Vermont could be the domestic version of Switzerland vs Greece.

No comments:

Post a Comment