March 19, 2022 by Dan Mitchell @ International Freedom

I’m a big fan of tax competition.

Why? Because if they’re not constrained by the fear that taxpayers can escape, I worry that short-sighted politicians (i.e., “stationary bandits“), will over-tax and over-spend.

And that can lead to Greek-like fiscal and economic chaos, which I’ve referred to as “goldfish government.”

Now let’s consider a wonky aspect of this debate. In order for tax competition to be an effective constraint on the greed of politicians, taxpayers need an ability to actually benefit from better tax policy in other jurisdictions.

In some cases, they achieve that goal by moving their bodies (“voting with their feet“). In other cases, they achieve that goal by moving their businesses (companies relocating to low-tax jurisdictions).

And in some cases, they achieve that goal by moving their money – which is why so-called tax havens traditionally played a beneficial role in the world economy.

These jurisdictions had very strong human-rights laws with regard to financial privacy and – equally important – they did not view it as their responsibility or obligation to help enforce the bad tax policies of high-tax governments.

All of which explains why those high-tax governments were so determined to destroy financial privacy as part of their broader fight to replace tax competition with tax harmonization.

In part, this was a fight over fiscal policy. High-tax governments wanted the ability to track money around the world so they could impose extra layers of tax on income that is saved and invested.

But this was also a fight about legal principles, especially the concept of “dual criminality” – which is the idea that governments only help each other enforce laws where there is mutual agreement about what’s legal and illegal.

Which is why people liked putting their money in places like Switzerland and the Cayman Islands.

The tax havens not only had strong human rights laws regarding privacy, but they also had various types of tax laws (no income taxes, territorial tax systems, no tax bias against saving and investment) that were incompatible with the onerous tax policies in most nations.

The net result was that high-tax governments couldn’t track and tax the money. And this made me happy because politicians from those nations instead faced pressure to lower tax rates.

But I’m not happy any more. Sadly, the big nations of the world have largely prevailed in their anti-tax competition campaign. At least with regards to financial privacy.

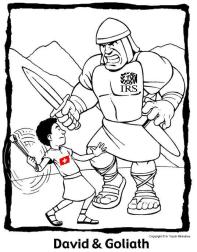

Even the Swiss agreed to weaken their human rights policies so high-tax nations could impose extraterritorial tax enforcement, notwithstanding the absence of dual criminality (in this case, Goliath beat David).

This was bad news. No longer constrained by the principle of dual criminality, politicians now feel more empowered to boost tax rates.

As you might imagine, my leftist friends usually dismiss my concerns. But I’m guessing they will change their tune about extraterritoriality after reading this column in the New York Times.

The authors (David S. Cohen, Greer Donley and are very worried that some states want to impose their abortion laws outside their borders. Here are some excerpts.

Some states will go beyond banning abortion within their borders. They will try to impose their policy preferences on other states, in an attempt to stop their citizens from getting abortions anywhere at all. …it will be up to abortion-supportive states to determine the future of abortion law and access. …All states have statutes that require their civil and criminal courts to assist in another state’s depositions, subpoenas and legal processes. Abortion-supportive states could amend these laws; such states could prohibit their courts from cooperating with out-of-state civil and criminal cases that stem from abortions that took place legally within their borders. To further protect abortion providers, states could block their law enforcement agencies from cooperating with out-of-state investigations related to the provision of otherwise lawful abortions. And they could change their extradition laws to refuse to extradite abortion providers… States where abortion remains legal can instruct their medical boards and in-state malpractice insurance companies to abstain from taking any adverse action against providers who give out-of-state patients abortions that are legal in the provider’s state.

In a world where people are intellectually honest, they will have consistent views on dual criminality, regardless of the underlying laws.

I strongly suspect, however, that most of my left-leaning friends will now embrace the principle of dual criminality as a constraint on extraterritoriality while still thinking it is good that low-tax jurisdictions have been coerced into acting as vassal tax collectors for high-tax governments.

Heck, some of my right-wing friends also will be hypocrites. They will support fiscal sovereignty but embrace extraterritoriality for abortion laws.

The bottom line – regardless of how we feel about tax policy or abortion policy – is that the power of governments should be constrained by borders.

If you don’t like the tax laws of Jurisdiction A or the abortion laws of Jurisdiction B, work to change those laws by devoting your time, energy, and money to an issue campaign. That’s the right approach, especially when compared to trying to achieve the same goals by using the laws of Jurisdiction C or Jurisdiction D.

P.S. The battle over the taxation of online sales was really a fight over whether businesses in some states could be forced into enforcing the tax laws of other states.

P.P.S. As a result of my efforts to protect tax havens, I’ve been subjected to slurs, attacks, and even potential imprisonment.

No comments:

Post a Comment