Remember the supposedly breathtaking revelations from the “Panama Papers” back in 2016?

We were told those stolen documents were an indictment against so-called tax havens, but the real lesson was that politicians and other government insiders are very prone to corruption.

Well, it’s happened again. Thieves stole millions of documents (the “Pandora Papers”) from various firms around the world that specialize in cross-border investment.

Some journalists want us to believe that these documents are scandalous, but I poured cold water on this hysteria in an interview with the BBC. If you don’t want to listen to me pontificate for about five minutes, here are the main points from the interview.

- International investment is a good thing (much like international trade) and it necessarily requires the use of “offshore” entities such as companies, funds, and bank accounts.

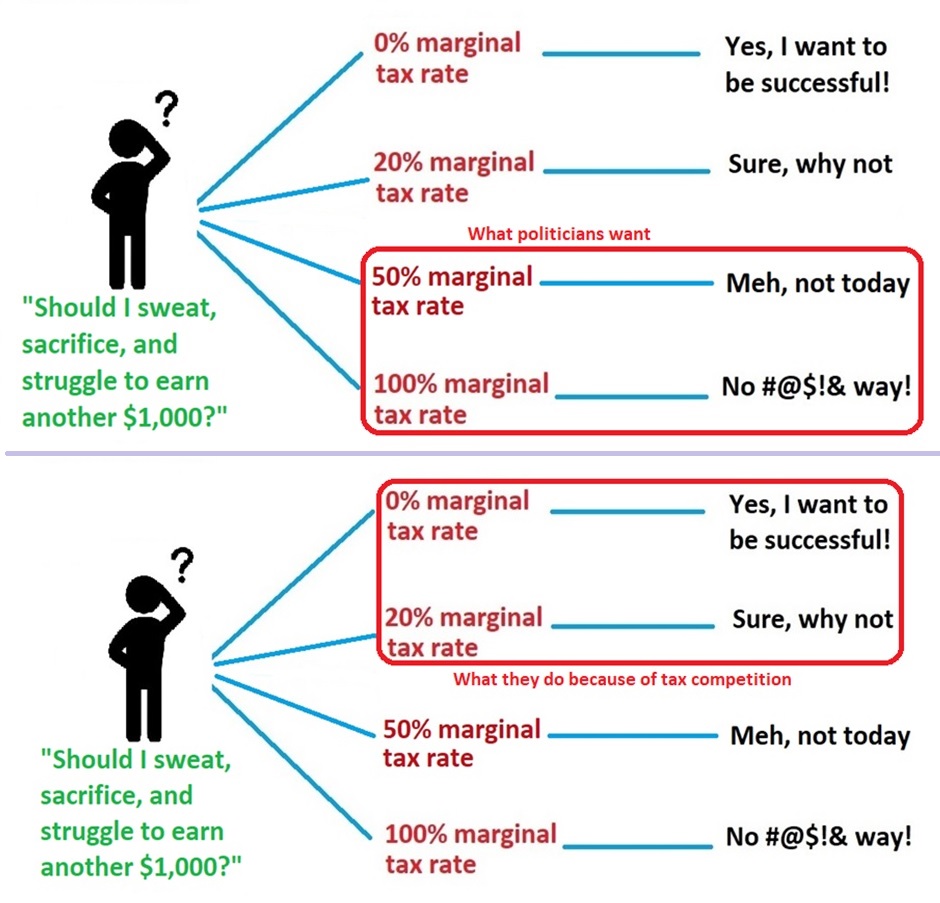

Politicians

don’t like cross-border investment because economic activity tends to

migrate to places with lower tax rate, and this puts downward pressure on tax rates.

Politicians

don’t like cross-border investment because economic activity tends to

migrate to places with lower tax rate, and this puts downward pressure on tax rates.- There is no evidence that people in the private sector use “offshore” entities in ways that are disproportionately dodgy.

- By contrast, there is considerable evidence that politicians use “offshore” in ways that are disproportionately dodgy.

- More than 99 percent of people engage in legal tax avoidance and that’s a good thing because it keeps money out of the hands of profligate politicians.

- People should not have to share their private financial affairs, such as bank accounts and investment holdings, with the general public.

It’s not worth a separate bullet point, but my favorite part of the interview is when I noted the grotesque hypocrisy of the International Monetary Fund, which pimps for higher taxes all around the world, yet its employees get tax-free salaries.

The bottom line is that tax competition and so-called tax havens should be applauded rather than persecuted. We should instead be condemning the “tax hells” of the world. Those are the jurisdictions that cause economic misery. Since we’re on this topic, let’s also enjoy some excerpts from an article in Reason by Steven Greenhut.

Leftists are thrilled by the Biden administration’s plan to stamp out the bogeyman of tax havens—low-tax jurisdictions where corporations and other investors can keep their money away from the prying hands of the government. …Let’s dispense with the outrage about tax havens. There is nothing wrong with companies and individuals that shelter their earnings from governments, which are like organized mobs that can never seize enough revenue. …If you believe that tax havens are immoral, then you should not claim any deductions on your tax bill. President Joe Biden apparently thinks it’s wrong for corporations to locate their headquarters in low-tax Bermuda, Ireland, and Switzerland, yet why does his home of Delaware house so many U.S. corporate headquarters? …Tax havens provide pressure on big-spending governments to limit tax rates, and lower tax rates boost economic activity, create jobs, and incentivize investors to invest more. …Those who oppose tax havens simply want the government to take more money and have more power.

I’ll close by noting that many Nobel Prize-winning economists defend tax competition as a necessary check on the greed of the political class.

P.S. As you can see from this tweet, not everyone appreciated my BBC interview.

P.P.S. There was also a manufactured controversy involving stolen documents back in 2013.

P.P.P. S. My work on this issue has been…umm…interesting, resulting in everything from a front-page attack by the Washington Post to the possibility of getting tossed in a Mexican jail.

No comments:

Post a Comment