The goal of fiscal policy should be limited government and that means complying with the Golden Rule of spending restraint.

When countries control the disease of excessive spending, that also seems to be the only effective way of reducing and eliminating the symptom of red ink.

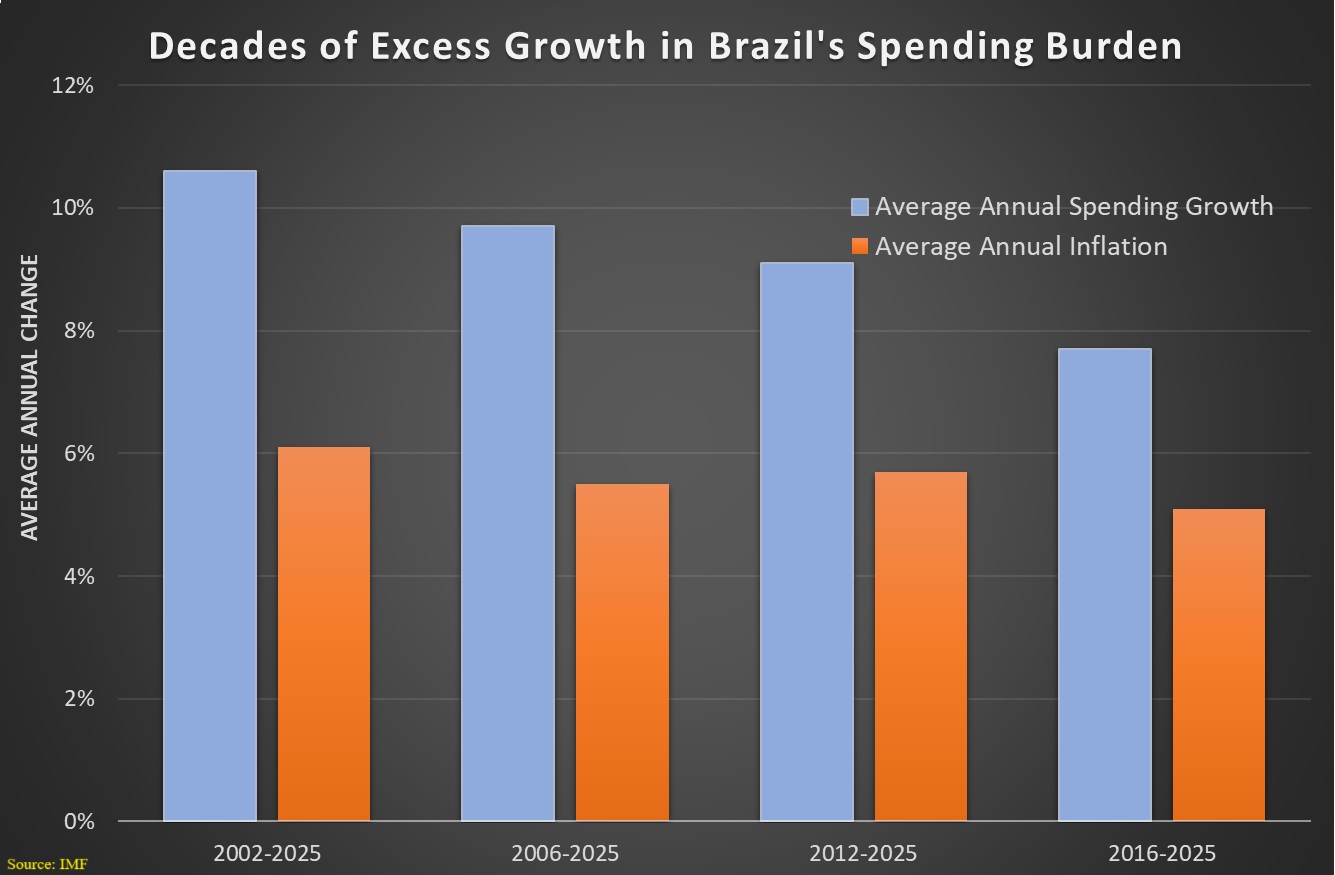

Sadly, Brazil has not followed this sensible approach. Here’s a chart based on IMF data showing how spending has grown significantly faster than inflation, no matter which base year is used.

Why am I writing about Brazil?

Because that country’s fiscal profligacy may be creating the conditions for a fiscal crisis.

Here are some excerpts from an article by Desmond Lachman of the American Enterprise Institute.

Brazil is on an unsustainable debt path as a result of left-leaning President Lula’s public spending largesse. Since the start of his third term in office in January 2023, Brazil’s budget deficit has approximately doubled from almost five percent to 9.5 percent of GDP. …This is raising red flags…

Typically, emerging markets get into trouble when the debt level gets into the 80–90 percent of GDP range. …the Brazilian real has lost more than 20 percent of its value against the dollar taking it to a record low… Meanwhile, this year the Brazilian stock market has lost nearly 10 percent in value…while its credit default spreads have increased by 50 percent to over 200 basis points. …President Lula seems to be in denial.

All of this is further evidence for my 20th Theorem of Government, which was unveiled just a couple of months ago.

|

While it is possible, at least in theory, for a government to get in fiscal trouble by cutting taxes a lot and to get out of trouble by raising taxes a lot, I’m not aware of any real-world examples.

By contrast, there are lots of real world examples showing that excess spending is a recipe for fiscal trouble and spending restraint is a recipe for fiscal recovery.

I’ve already cited Colombia and France as real world examples. Now we can add Brazil to the mix.

P.S. Government spending is only growing slightly faster than GDP in Brazil. That might be a mitigating factor, but the problem is that Brazil started with an excessive burden of spending, which government consuming more than 40 percent of the nation’s economic output.

P.P.S. What especially tragic about Brazil’s fiscal mess is that it briefly had a spending cap.

No comments:

Post a Comment