October 7, 2021 by Dan Mitchell @ International Liberty

There are many reasons to reject Joe Biden’s proposal for higher corporate tax rates, and I listed many of them when I narrated this nine-minute video.

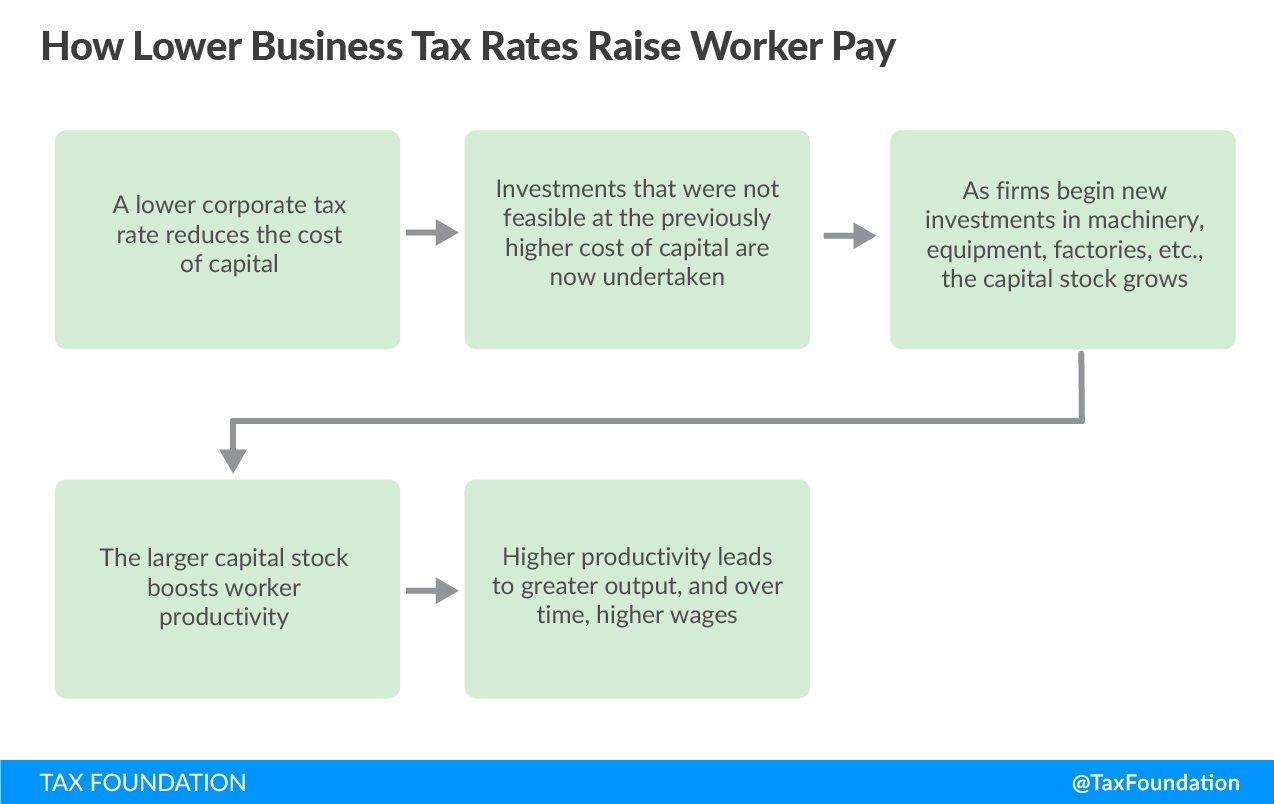

This two-minute video from the Tax Foundation has a similar message.

The main message is that workers, consumers, and shareholders are the ones who actually pay when suffer when politicians impose higher taxes on business.

And the damage grows over time because higher corporate tax rates reduce investment, which inevitably leads to lower wages.

By the way, while a low tax rate is very important, there are many other policy choices that determine the overall damage of business taxation.

- Is there double taxation of dividends?

- Is there worldwide taxation?

- Is there deprecation or expensing?

- Is there equal treatment of debt and equity?

This is just a partial list. There are other policies – such as alternative minimum taxation, book income, loopholes, and extenders – that also can increase the damage of the corporate taxation.

The bottom line is that we know the sensible approach to business taxation, but the Biden Administration is motivated instead by class warfare and grabbing revenue.

P.S. For more information on corporate taxation and wages, click here, here, here, here, and here.

P.P.S. For more information on corporate tax rates and corporate tax revenue, click here, here, here, and here.

No comments:

Post a Comment