Donald Trump played Santa Claus in his first term, with both tax cuts and big spending increases. Unsurprisingly, he wants to play Santa Claus in his second term as well.

But he faces a couple of big challenges.

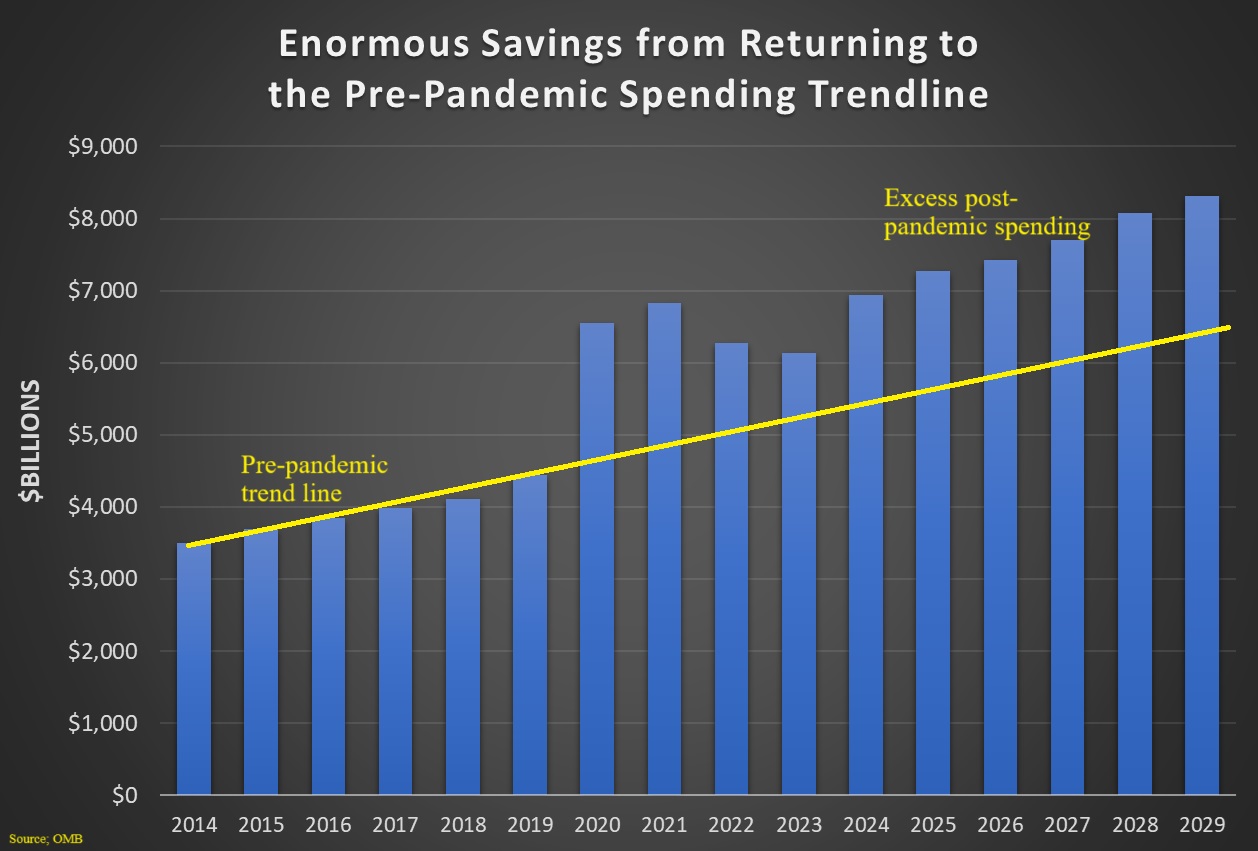

First, as I wrote about two days ago, the spending baseline is now much higher, meaning there is less “fiscal space.” Though, to be accurate, we’ve moved from less-than-zero fiscal space to far-less-than-zero fiscal space.

Second, to avoid a Senate filibuster, Trump and congressional Republicans will want to use “reconciliation” legislation, but there are budget rules that require some degree of deficit neutrality using that legislative vehicle.

So how will Trump fit a size-18 fiscal agenda into a size-4 outfit?

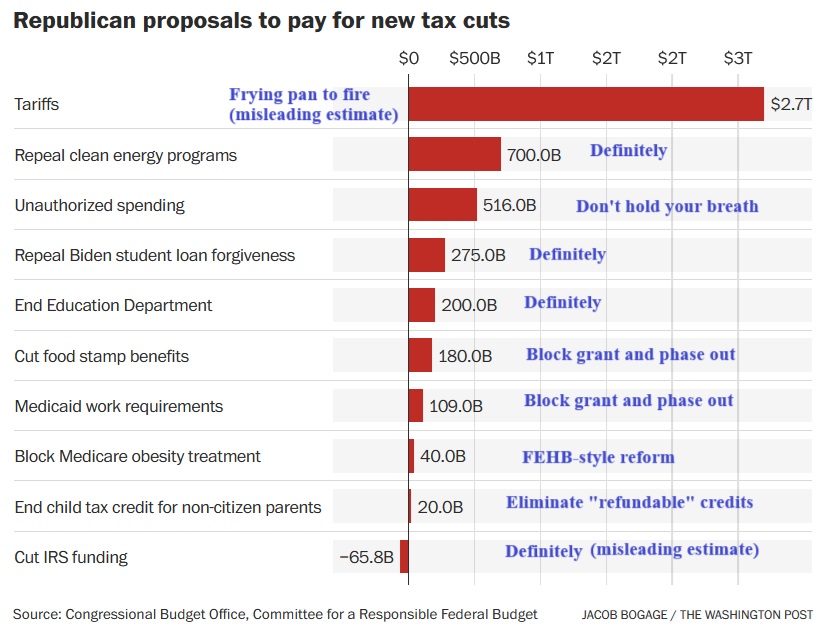

Jacob Bogage of the Washington Post reports on the “offsets” that Republicans are considering. Here are some excerpts.

Advisers to President-elect Donald Trump and congressional Republicans have begun floating proposals to boost federal revenue and slash spending so their plans for major tax cuts and new security spending won’t further explode the $36.2 trillion national debt. …with most of Trump’s 2017 tax cuts set to expire at the end of 2025, the GOP plan to extend the law could increase the debt by close to $5 trillion over the next decade.

(Nonpartisan scorekeepers project that Trump’s entire campaign platform would add up to $15 trillion to future borrowing.) To avoid busting the budget, Republican leaders are counting on savings from spending cuts and new revenue from tariffs.

The article contains a table showing the projected offsets.

I’ve added my commentary (in blue, just in case that’s not obvious) on the desirability/feasibility of the various options.

The biggest problem with the above list is that there won’t be much if any pro-growth impact of extending the 2017 tax cuts if the “pay-for” is a giant increase in trade taxes.

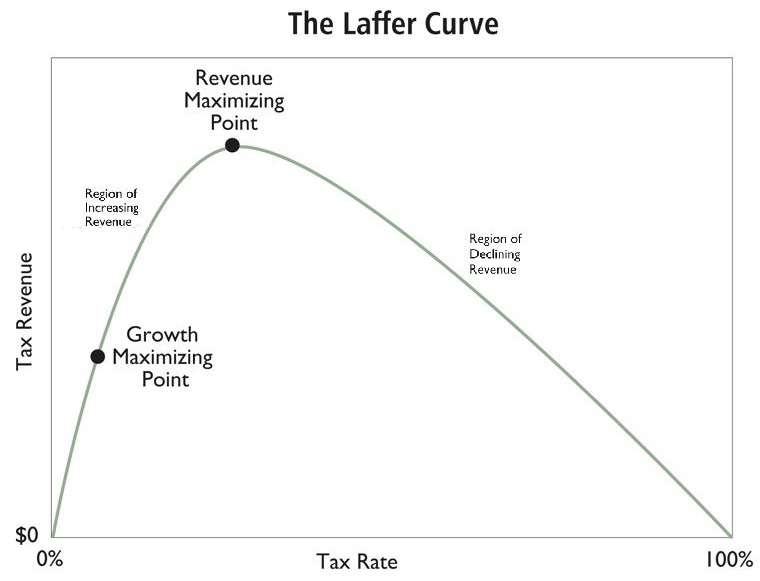

And don’t forget that there is a huge Laffer Curve for protectionist taxes since consumers can avoid such taxes by buying American-produced goods (indeed, that’s exactly what Trump wants).

So there will not be anywhere close to $2.7 trillion of additional revenue, especially when you also consider how the damaging impact of protectionism will mean less income tax revenue and less payroll tax revenue.

I normally like the idea of less revenue for Washington, but I want that to happen because we’re sliding down the left side of the Laffer Curve, not the right side.

Regarding the other offsets, some of them are good (getting rid of Biden’s green-energy pork and his student-loan bailout) while others are too timid (we should be block-granting Medicaid and food stamps, not tinkering with them).

I would love for Republicans to get rid of the Department of Education. I’m not holding my breath.

Last but not least, I obviously want to cut IRS funding, but I can’t resist pointing out that the revenue estimate is nonsensical.

Dealing with Unauthorized Spending

As part of yesterday’s column

about potential “offsets” for Trump’s tax agenda, I wrote “Don’t hold

your breath” next to the line that stated taxpayers could save more than

$500 billion if Congress refuses to spend any money on unauthorized

programs.

My skepticism does not mean disagreement.

After all, if Congress is too incompetent to reauthorize the programs (normally a pro-forma step), why not use that as an excuse to stop funding?

The problem is that I don’t think either Trump or congressional Republicans actually have the principles or the courage to actually turn off the spigot for these programs (which are listed in Table 3 of this document from the Congressional Budget Office).

But perhaps I’m being too pessimistic about the potential for progress.

In a column for the Wall Street Journal, Warren Peterson, the president of the Arizona State Senate, recommends that Washington adopt his state’s rule for program authorizations.

Here are some excerpts.

Mr. Trump should also consider pushing for a federal law that has been effective at the state level. Every federal agency should be subject to a periodic sunset review requiring affirmative congressional reauthorization for the agency to continue in existence. …Enacting a sunset law would put in place a process to prevent bureaucratic backsliding…

It will also make the agencies more accountable to voters through their elected representatives. …Since 1978, Arizona has had a sunset law, which was signed by Democratic Gov. Bruce Babbitt. To combat the sins of government complacency, Arizona law requires the automatic expiration of all state agencies in 10 years or less, unless continued by the Legislature.

In recent years, lawmakers have generally renewed agencies for eight years. During an agency’s “sunset review process,” the Legislature’s independent auditor identifies inefficiencies, exposes fraud or abuse, quantifies costs imposed on consumers, and analyzes the continued need for the agency. …Other states such as California, Colorado, Connecticut, Delaware, Idaho and Texas, have similar laws.

This sounds good, but I have two cautionary observations.

- First, I notice that Senator Peterson did not provide a list of programs that were eliminated as a result of the rule. I suspect and fear that he didn’t provide a list because nothing would be on it. Or at least nothing major.

- Second, California and Connecticut are two of the most- profligate states in the nation. That doesn’t mean a reauthorization rule should be blamed for their bad fiscal policy, but it does suggest that the rule is not very helpful.

I’ll close by saying that it’s good news that people are complaining about unauthorized spending. And I hope Elon Musk’s unofficial Department of Government Efficiency gets people angry about the way Washington wastes our money.

But don’t count on Republicans to eliminate unauthorized programs as part of this year’s tax bill.

P.S. I’m focused on real results, not feel-good policies. It’s why I favor a spending cap over a balanced-budget requirement.

No comments:

Post a Comment