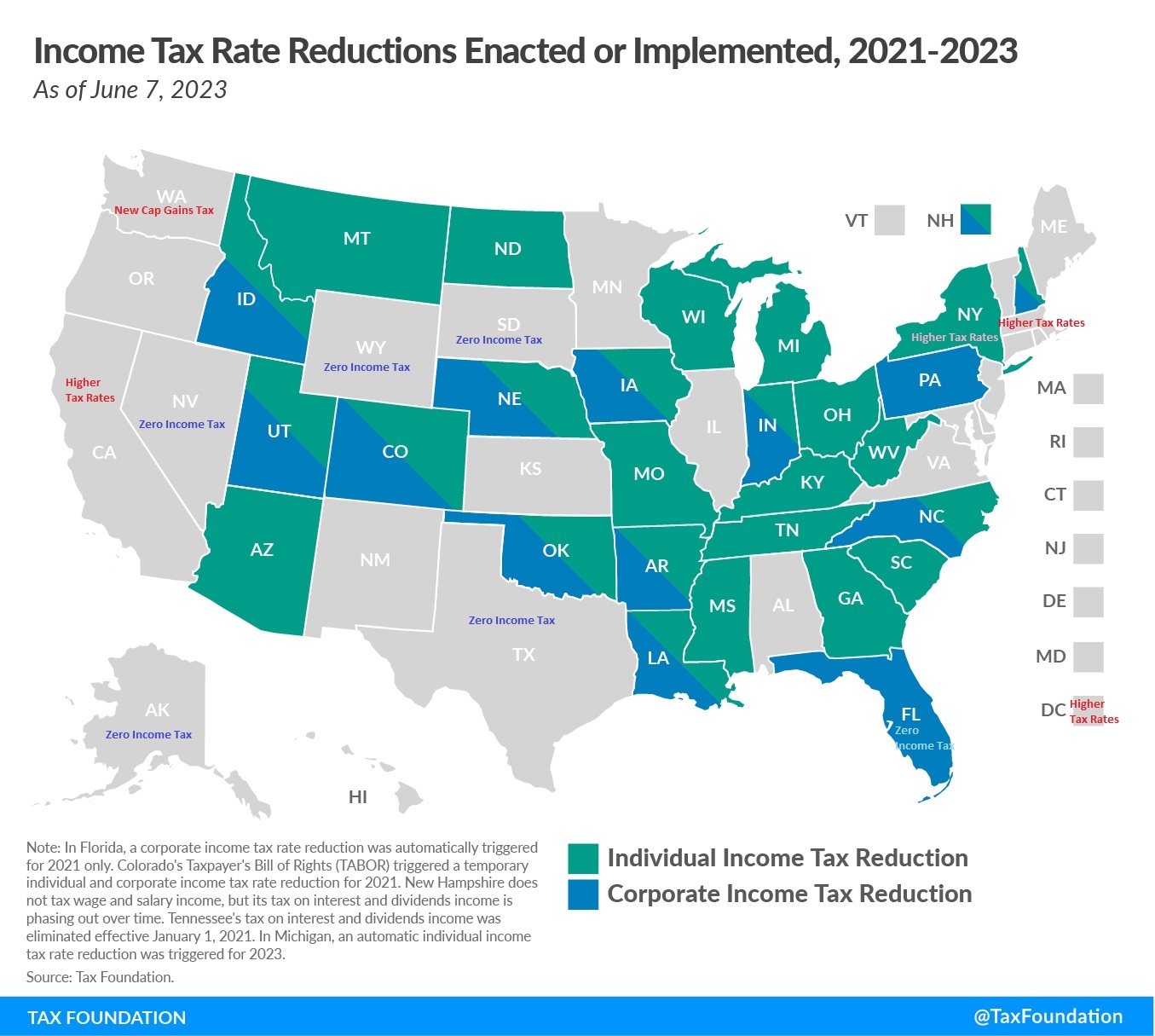

Last year, I shared the “Feel-Good Map of 2022” that showed 18 states had lowered personal and/or corporate income tax since the start of 2021.

And that was after showing a map of 11 state lowering tax rates the previous year.

Courtesy of the Tax Foundation, we now have the 2023 version of that map. As you can see, more than half the states (27 if I can count correctly) have now joined the tax-cutting club.

This map does not even capture all the good news.

- Some states can’t lower tax rates because they wisely don’t have income taxes.

- Some states not only lowered tax rates, but also shifted to simpler and fairer flat taxes.

But there also is a bit of bad news.

A small handful of states have raised tax rates. That’s a very foolish approach when other states are making their systems more competitive.

But I guess we should not be surprised to see bad fiscal policy from California, the District of Columbia, and Massachusetts (and I believe the map is mistaken and New York also belongs to that ignoble group).

P.S. While the above map is good news, some of the progress is for a bad reason. States have been able to lower tax rates in part because Trump and Biden squandered so much money during the pandemic. Much of that new spending was transfers to state governments. In many cases, state politicians used the transfers to increase spending. But the silver lining to that dark cloud is that many states also lowered tax rates.

P.P.S. Another feel-good map, once it is updated, is what’s happening with school choice at the state level.

No comments:

Post a Comment