November 6, 2025 by Dan Mitchell @ International Liberty

The case against the value-added tax (VAT) is not complicated.

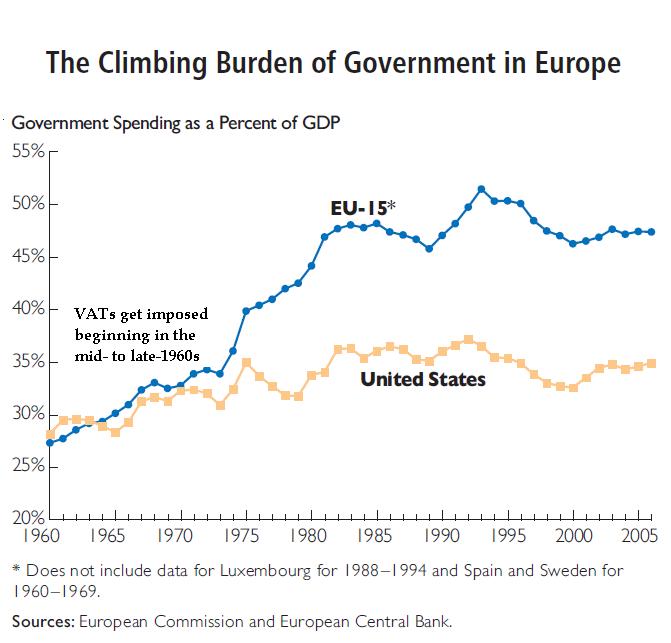

Simply stated, this hidden type of national sales tax was a key precursor for the expansion of the European welfare state. As you can see in the chart, the burden of government spending in Europe after World War II was similar to the size of the public sector in the United States.

Then European governments began to adopt the VAT in the late 1960s. Those VATs quickly expanded and became money machines for more spending (and more debt!).

Needless to say, the United States should not make the same mistake. Bigger government has led to worse economic outcomes in Europe, as I’ve documented in my four-part series (here, here, here, and here).

Even the pro-tax International Monetary Fund inadvertently produced a study showing why the VAT is a money machine for big government.

Financing bigger government with a VAT would weaken economic performance. In a 2010 study for the Mercatus Center, Professor Randall Holcombe crunched some numbers and reached some depressing conclusions.

…the effect of various VAT rates on GDP looking 10 years out and 20 years out. …In the revenue-enhancement case, where VAT revenue adds to existing sources of tax revenue, a 3 percent VAT would exact a 2.1 percent GDP penalty by 2020 and a 3.7 percent GDP penalty by 2030. A 5 percent VAT rate would bring with it a 3 percent GDP penalty by 2020 and a 5.6 percent GDP penalty by 2030. A 7 percent VAT rate…would reduce GDP by 4.1 percent by 2020 and 7.5 percent by 2030.

And here’s one of his tables, showing the negative effect on economic output (as well as some calculations showing that the VAT would not collect as much money as supporters hope).

Now let’s look at some more-recent research.

In 2024, Adam Michel wrote a report on the tax implications of bigger government.

Here’s his section on the VAT.

…consumption taxes (taxes on goods and services) account for almost three times as much revenue in the EU countries than in the United States. Every European country uses a value-added tax (VAT), a type of national sales tax collected by businesses at each stage of production instead of at the point of sale.

In the United States, most consumption tax revenue is collected by state governments through a point-of-sale retail sales tax. In 2022, the average standard VAT rate in the EU countries was 21.8 percent, and the average state and local sales tax rate in the US was 6.6 percent.

EU country VATs raise revenue equal to 12 percent of GDP, compared to sales taxes, which collect 4.3 percent of GDP in the United States. The adoption of VATs is closely associated with government growth because new revenue sources, especially when the cost of the tax is not transparent, tend to fuel new public expenditures and reduce pressure on spending reforms. This association is evident in the reliance on VAT revenue across EU countries, where governments are almost 20 percent larger than in the United States.

Here’s Adam’s chart, showing how the absence of a VAT is the main reason the United States has a fiscal advantage over the European Union.

The clinching argument is that one of America’s best presidents opposed a VAT and one of America’s worst presidents supported a VAT. That tells you everything you need to know.

P.S. You can enjoy some amusing – but also painfully accurate – cartoons about the VAT by clicking here, here, and here.

No comments:

Post a Comment