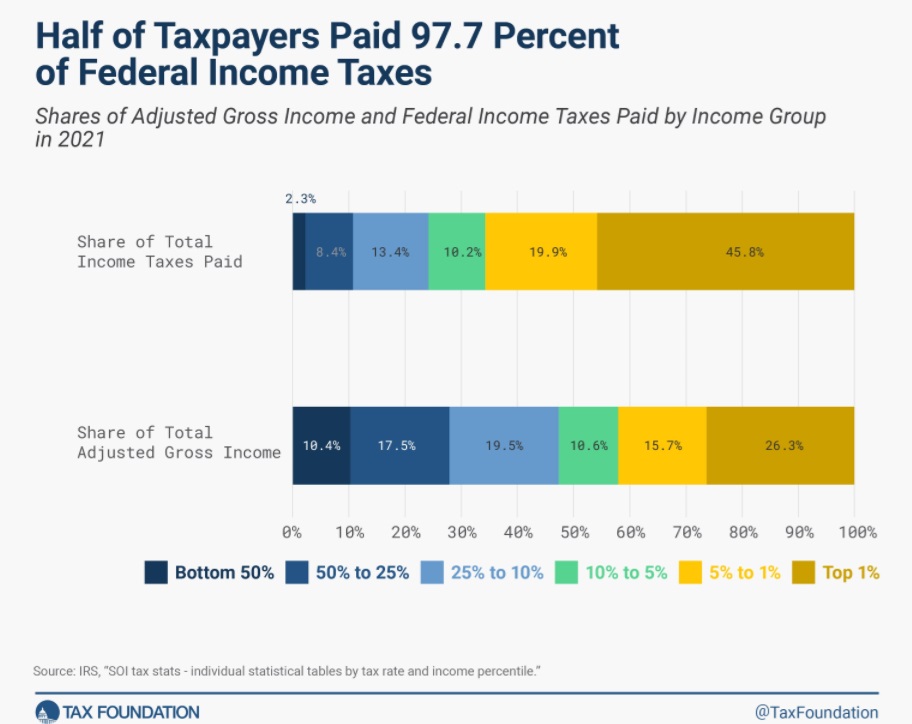

I’ve written a couple of columns (in 2016 and earlier this year) about how upper-income taxpayers finance the vast majority of the welfare state.

The data I shared involved the federal budget in Washington.

And I explained that the Bernie-AOC crowd, instead of despising the rich, should be grateful for them (yes, I realize that is very unlikely, but I view myself as the Don Quixote of economic freedom).

The same lesson applies to state and local governments. Or perhaps I should say it especially applies to state and local governments since internal tax migration is much easier than international tax migration.

Interestingly, some folks in New York are capable of learning. Here are some excerpts from a column by Matthew Haag in the New York Times.

The rate at which New York State has been adding millionaires to its population in recent years has fallen below that of other large states, potentially costing the state billions in unrealized tax revenue, according to a new report from a nonpartisan fiscal watchdog group. At the same time, California, Florida and Texas had large increases in the number of people with annual incomes of at least $1 million residing in their states, all adding them at a faster rate than New York did from 2010 to 2022. The millionaire population in New York nearly doubled over that same time period, but it more than tripled in those other states. …“We have a debate about affordability, but we need to raise more revenue,” said Andrew Rein, the president of the Citizens Budget Commission, “and we can raise even more revenue if we have even more millionaires.” …the group’s arguments that New York City needs more millionaires and that any increase in personal income taxes could drive them away…is in opposition to the platform of Zohran Mamdani, a state assemblyman who is the Democratic nominee. Mr. Mamdani has proposed a new 2 percent tax on income greater than $1 million.

Here are the most important numbers in Haag’s column.

While just 1 percent of the city’s taxpayers are millionaires, their contributions make up 40 percent of all personal income tax collected. If New York’s rate of growth had kept pace with that of other states, the group said, the state and city would have together collected $13 billion in additional taxes in 2022.

The bottom line is that folks on the left in New York have to decide what matters most.

- Is their main goal to persecute rich people and drive them away? If that’s the case, they should continue what they’re doing and (for the ones in New York City) even take it to the next level by electing Zohran Mamdani, the Champagne Socialist with a lunatic agenda.

- Or, is their main goal to provide benefits and services to lower-income people? If that’s the case, they should realize that rich taxpayers are the geese with the golden eggs. As such, they should be very grateful for them and maybe, just maybe, they should hope for more of them.

Sadly, I fear that many folks on the left are motivated by envy and instinctively prefer the persecution option.

P.S. It was interesting to read in the NYT column that California still creates millionaires, but perhaps that is not surprising since the state hasn’t figured out how to tax unrealized capital gains. The problem for the not-so-Golden State is that many of those successful taxpayers then emigrate.

No comments:

Post a Comment