I’m obviously fond of the video on tax complexity that the Center for Freedom and Prosperity released 15 years ago.

Here’s a more-recent video from the Tax Foundation on the compliance burden.

As stated in the video, complexity imposes real economic costs.

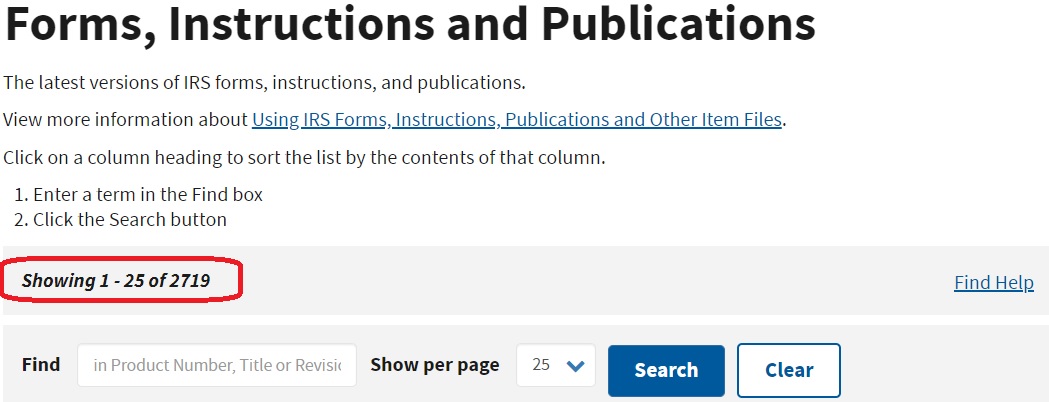

But before getting into that issue, I want to share a screenshot I took this morning from the IRS’s website. One measure of tax complexity is that you would need to download more than 3,000 different documents to be at least somewhat knowledgeable about America’s tax code.

This sounds daunting, and it obviously shows the tax code is a nightmare.

But here’s the really depressing part. When I did the same thing back in 2023, there were “only” a bit more than 2,700 forms.

In other words, the problem has become significantly worse in a very short period of time.

Part of the problem is that Trump’s “Big Beautiful Bill” may have had some very desirable provisions, but it definitely did not advance the cause of tax simplification.

Indeed it made the tax code more of a mess because of goofy special-interest gimmicks (no tax on tips and deductions for interest on auto loans, for instance).

Not let’s consider the economic cost of tax complexity. The Tax Foundation just released a report on this issue and some of the findings are very grim.

Americans will spend almost 7.1 billion hours complying with IRS tax filing and reporting requirements in 2025. This is equal to 3.4 million full-time workers—almost the population of Los Angeles and nearly 38 times the workforce the IRS employed in FY 2024—doing nothing but tax return paperwork for a full year. If we assume a reasonable hourly wage, the 7.1 billion hours Americans spend complying with the tax code costs the economy roughly $388 billion in lost productivity.

In addition, the IRS estimates that Americans spend roughly $148 billion annually in out-of-pocket costs to comply with the tax code. This brings total compliance costs to $536 billion, or nearly 1.8 percent of GDP. …While a considerable amount of taxpayer hours and dollars are spent on individual tax forms (over 2.1 billion hours at a total annual cost of $146.9 billion), this accounts for less than 28 percent of the total time and burden cost of tax compliance. Thus, most of the remaining tax compliance burden is borne by businesses.

For wonky readers, here are the top-6 most-expensive parts of the tax code.

I’ll close with an excerpt from the report about the impact of this year’s tax legislation.

This analysis is based on data produced before the passage of the OBBBA, which became law on July 4, 2025. Aspects of that law, such as repealing some green energy credits passed in the Inflation Reduction Act, may result in reduced compliance costs. On the other hand, the OBBBA included plenty of provisions that will likely increase compliance costs, from new tax deductions for tipped income, auto loan interest, and overtime pay to complex requirements related to foreign entities of concern (FEOC) layered on top of the IRA green energy credits that are not fully repealed.

Wouldn’t it be nice to instead have a simple and fair flat tax?

P.S. There’s lots of research about red tape and corruption, but not many people realize that tax complexity is a major source of political dishonesty.

No comments:

Post a Comment