View More Cartoons

Washington D.C., where two out of the three parasites do business, has the worst income inequality in the country. The bottom fifth of Washington D.C. account for just 2% of the city’s income. It has one of the highest poverty rates in the country and the highest food stamp use. And under Obama, the Imperial City of the politicians and the poor was surrounded by some of the wealthiest districts in the country.

Washington D.C., where two out of the three parasites do business, has the worst income inequality in the country. The bottom fifth of Washington D.C. account for just 2% of the city’s income. It has one of the highest poverty rates in the country and the highest food stamp use. And under Obama, the Imperial City of the politicians and the poor was surrounded by some of the wealthiest districts in the country.…demonstrators should…demand a repeal of the Second Amendment. …that amendment…is a relic of the 18th century. …to get rid of the Second Amendment would be simple and would do more to weaken the N.R.A.’s ability to stymie legislative debate and block constructive gun control legislation than any other available option. …That simple but dramatic action would…eliminate the only legal rule that protects sellers of firearms in the United States.

They’re talking about repealing the Second Amendment. It started with former Supreme Court Justice John Paul Stevens and George Washington University Law Professor Jonathan Turley. …Turley and Stevens were joined this week by op-ed writers in the pages of Esquire and the Seattle Times. Democratic candidates for federal office have even enlisted in the ranksvvvvvvvv of those calling for an amendment to curtail the freedoms in the Bill of Rights. …anti-Second Amendment themes…have been expressed unashamedly for years, from liberal activists like Michael Moore to conservative opinion writers at the New York Times. Those calling for the repeal of the right to bear arms today are only echoing similar calls made years ago in venues ranging from Rolling Stone, MSNBC, and Vanity Fair to the Jesuit publication America Magazine.

One of the biggest threats to the recovery of the Democratic Party these days is overreach. …But rarely do we see such an unhelpful, untimely and fanciful idea as the one put forward by retired Supreme Court justice John Paul Stevens. …Stevens calls for a repeal of the Second Amendment. The move might as well be considered an in-kind contribution to the National Rifle Association, to Republicans’ efforts to keep the House and Senate in 2018, and to President Trump’s 2020 reelection bid. In one fell swoop, Stevens has lent credence to the talking point that the left really just wants to get rid of gun ownership. …This is exactly the kind of thing that motivates the right and signals to working-class swing voters that perhaps the Democratic Party and the political left doesn’t really get them.

One problem with Stevens’ position is that he is dead wrong about the legal history. …For example, consider how the Second Amendment was treated in St. George Tucker’s 1803 View of the Constitution of the United States, which was the first extended analysis and commentary published about the Constitution. For generations of law students, lawyers, and judges, Tucker’s View served as a go-to con-law textbook. …He observed the debates over the ratification of the Constitution and the Bill of Rights as they happened. And he had no doubt that the Second Amendment secured an individual right of the “nonmilitary” type. “This may be considered as the true palladium of liberty,” Tucker wrote of the Second Amendment. “The right of self-defense is the first law of nature.” In other words, the Heller majority’s view of the Second Amendment is as old and venerable as the amendment itself.

Malcolm looks nothing like a hardened veteran of the gun-control wars. Small, slender, and bookish, she’s a wisp of a woman who enjoys plunging into archives and sitting through panel discussions at academic conferences. Her favorite topic is 17th- and 18th-century Anglo-American history… She doesn’t belong to the National Rifle Association, nor does she hunt. …She is also the lady who saved the Second Amendment — a scholar whose work helped make possible the Supreme Court’s landmark Heller decision, which in 2008 recognized an individual right to possess a firearm.

For her dissertation, she moved to Oxford and Cambridge, with children in tow. …Malcolm’s doctoral dissertation focused on King Charles I and the problem of loyalty in the 1640s… The Royal Historical Society published her first book.

At a time when armies were marching around England, ordinary people became anxious about surrendering guns. Then, in 1689, the English Bill of Rights responded by granting Protestants the right to “have Arms for their Defence.” Malcolm wasn’t the first person to notice this, of course, but as an American who had studied political loyalty in England, she approached the topic from a fresh angle. “The English felt a need to put this in writing because the king had been disarming his political opponents,” she says. “This is the origin of our Second Amendment. It’s an individual right.” …Fellowships allowed her to pursue her interest in how the right to bear arms migrated across the ocean and took root in colonial America. “The subject hadn’t been done from the English side because it’s an American question, and American constitutional scholars didn’t know the English material very well,” she says. …The Second Amendment, she insisted, recognizes an individual right to gun ownership as an essential feature of limited government. In her book’s preface, she called this the “least understood of those liberties secured by Englishmen and bequeathed to their American colonists.”

…in 2008, came Heller, arguably the most important gun-rights case in U.S. history. A 5–4 decision written by Scalia and citing Malcolm three times, it swept away the claims of gun-control theorists and declared that Americans enjoy an individual right to gun ownership. “…it gave us this substantial right.” She remembers a thought from the day the Court ruled: “If I have done nothing else my whole life, I have accomplished something important.” …the right to bear arms will not be infringed — thanks in part to the pioneering scholarship of Joyce Lee Malcolm.

David Hogg Rejected By Four Colleges To Which He Applied and whines about it. (Dinged by UCLA with a 4.1 GPA…totally predictable given acceptance rates.)Hogg, who has made extensive use of his First Amendment free speech rights, immediately turns around and demands that a free press that displeases him — Ingraham’s Fox News show — be “boycotted” by advertisers. Immediately the adults who sponsor Ingraham’s show stand up and do his bidding.

A Los Angeles judge has determined that coffee companies must carry an ominous cancer warning label because of a chemical produced in the roasting process. Superior Court Judge Elihu Berle said Wednesday that Starbucks and other companies failed to show that benefits from drinking coffee outweighed any risks. He ruled in an earlier phase of trial that companies hadn’t shown the threat from the chemical was insignificant. The Council for Education and Research on Toxics, a nonprofit group, sued Starbucks and 90 other companies under a state law that requires warnings on a wide range of chemicals that can cause cancer. One is acrylamide, a carcinogen present in coffee.

But what should be done? Some folks on the left, such as Barack Obama and Hillary Clinton, support huge tax increases to prop up the program. Such an approach would have a very negative impact on the economy and, because of built-in demographic changes, would merely delay the program’s bankruptcy.

But what should be done? Some folks on the left, such as Barack Obama and Hillary Clinton, support huge tax increases to prop up the program. Such an approach would have a very negative impact on the economy and, because of built-in demographic changes, would merely delay the program’s bankruptcy.While that study holds up very well, let’s look at more recent research so we can see how the Swedish system has performed.Swedish policymakers decided that both individual workers and the overall economy would benefit if the old-age system were partially privatized. …Workers can invest 2.5 percentage points of the 18.5 percent of their income that they must set aside for retirement. …the larger part-16 percent of payroll-goes to the government portion of the program. …What makes the government pay-as-you-go portion of the pension program unique, however, is the formula used for calculating an individual’s future retirement benefits. Each worker’s 16 percent payroll tax is credited to an individual account, although the accounts are notional. …the government uses the money in these notional accounts to calculate an annuity (annual retirement benefit) for the worker. …the longer a worker stays in the workforce, the larger the annuity received. This reform is expected to discourage workers from retiring early… There are many benefits to Sweden’s new system, including greater incentives to work, increased national savings, a flexible retirement age, lower taxes and less government spending.

The final part of the above excerpts is key. The system automatically adjusts, thus presumably averting the danger of future tax hikes.Sweden enacted a reform of its public pension system that combines a defined-contribution approach with a traditional pay-as-you-go financing structure. The new system includes better work incentives and is more transparent to participants. It is also permanently solvent due to provisions that automatically adjust payouts based on shifting demographic and economic factors. …A primary objective…in Sweden was to build a new system that would be solvent permanently within a fixed overall contribution rate. …pension benefits are calculated based on notional accounts, which are credited with 16.0 percent of workers’ creditable wages. …The pensions workers get in retirement are tied directly to the amount of contributions they make to the system. …This design improved incentives for work… To keep the system in balance, this rate of return is subject to adjustment, to correct for shifts in demographic and economic factors that affect what rate of return can be paid within the fixed budget constraint of a 16.0 percent contribution rate.

And here’s a chart from the Swedish Pension Agency’s annual report showing that pension assets are growing rapidly (right axis), in part because “premium pension has provided a 6.7 percent average value increase in people’s pensions per year since its launch.” Moreover, administrative costs (left axis) are continuously falling. Both trends are very good news for workers.The Premium Pension was created mainly for three purposes. Firstly, funded individual accounts were believed to increase overall savings in Sweden. …Secondly, the policy makers wanted to allow participants to take account of the higher return in the capital markets as well as to tailor part of their pension to their risk preferences. Finally, an FDC scheme is inherently immune against financial instability, as an individual’s pension benefit is directly financed by her past accumulated contributions. The first investment selections in the Premium Pension plan took place in the fall of 2000, which is known as the “Big Bang” in Sweden’s financial sector. …any fund company licensed to do business in Sweden is allowed to participate in the system, but must first sign a contract with the Swedish Pensions Agency that specifies reporting requirements and the fee structure. Benefits in the Premium Pension Plan are paid out annually and can be withdrawn from age 61.

According to European Union projections, Sweden’s total public pension obligations will equal 7.5 percent of GDP in 2060, which is a substantial reduction from the…8.9 percent of GDP it spent in 2013. …In 2060, EU countries are expected to spend 11.2 percent of GDP on pensions. Germany’s public pension spending is projected to increase…to 12.7 percent of GDP in 2060. …The EU forecast shows France’s pension obligations will be 12.1 percent of GDP in 2060 and Italy’s will be 13.8 percent of GDP.I think 8.9 percent of GDP is still far too high, but it’s better than diverting 11 percent, 12 percent, or 13 percent of economic output to pensions.

A surprisingly common misconception about spies is that they set out to change policy in the countries where they operate. A book published in 2013, for example, alleged that Stalin’s spies in the 1940s had effectively “occupied” the United States and guided the policies of the Roosevelt administration.

An intelligence service has two main functions in a target country. One is to collect information from either classified or unclassified sources. The second is to influence the situation in that country.

That power to influence policy has always been the ultimate purpose of the Communist Party’s infiltration. It was much more dangerous, and, as events have proved, much more difficult to detect, than espionage [stealing secrets], which beside it is trivial, though the two go hand and hand.

Vic announced that Steve had meant to come to Washington but the repercussions from the news were keeping him at headquarters.

to prepare to answer any doubt. Second, we must not expose ourselves as Party members. We groaned, knowing the problem this raised. Even answering at all, John said, marked you as a Communist. Yet he knew he had to take the chance. The trials had all but undone a year’s work on his chief, whom he had been allowed to try to recruit. (Emphasis added.)

In a situation with few parallels in history, the agents of an enemy power were in a position to do much more than purloin documents. They were in a position to influence the nation’s foreign policy in the interests of the nation’s chief enemy, and not only on exceptional occasions, like Yalta (where Hiss’s role, while presumably important is still ill-defined) or through the Morgenthau Plan for the destruction of Germany (which is generally credited to [Harry Dexter] White), but in what must have been the staggering sum of day-to-day decisions.

You can never overestimate the impact of an agent of influence. If you have an individual who is an adviser to a minister or a president, or if you have a minister himself as your agent of influence, you can do a tremendous amount in a country as far as actives measures are concerned. It is the most insidious, pernicious thing to deal with as far as a countermeasure is concerned.

But the largest share by far of their personnel and resources goes toward the collection of secret information through human and technical espionage and the subsequent analysis of that information. This was just as true of the Soviet Union in the 1930s and ’40s as it is of the United States today. Influencing policy was rarely, if ever, their main goal — indeed, it was discouraged if it would raise red flags and thereby endanger access to classified materials.

FDA released guidance for posting calorie disclosures at restaurants with more than 20 locations, and the ostensible point is to help folks choose healthier foods. The regulations…are an outgrowth of the 2010 Affordable Care Act… The reason some restaurants have spent years fighting these rules is not because executives lay awake at night plotting how to make Americans obese. It’s because the rules are loco. …Take pizza companies, which have to display per slice ranges or the number for the entire pie. Calories vary based on what you order—the barbarians who put pineapple on pizza are consuming fewer calories than someone who chooses pepperoni and extra cheese. But the number of pepperonis on a pizza depends on the pie’s size and whether someone also adds onions and sausage. ..The rules are so vague that companies could face a crush of lawsuits, which will be abetted by this “nonbinding” FDA guidance.By the way, you won’t be surprised to learn that academic researchers have found these types of rules have no effect on consumer choices.

A systematic review and meta-analysis determined the effect of restaurant menu labeling on calories and nutrients…were collected in 2015, analyzed in 2016, and used to evaluate the effect of nutrition labeling on calories and nutrients ordered or consumed. Before and after menu labeling outcomes were used to determine weighted mean differences in calories, saturated fat, total fat, carbohydrate, and sodium ordered/consumed… Menu labeling resulted in no significant change in reported calories ordered/consumed… Menu labeling away-from-home did not result in change in quantity or quality, specifically for carbohydrates, total fat, saturated fat, or sodium, of calories consumed among U.S. adults.Shocking, just shocking. Next thing you know, somehow will tell us that Obamacare didn’t lower premiums for health insurance!

Wow, sort of reminds me of the guy who was hassled by the feds for building a pond on his own property. Or the family persecuted for building a house on their own property.A farmer faces trial in federal court this summer and a $2.8 million fine for failing to get a permit to plow his field and plant wheat in Tehama County. A lawyer for Duarte Nursery said the case is important because it could set a precedent requiring other farmers to obtain costly, time-consuming permits just to plow their fields. “The case is the first time that we’re aware of that says you need to get a (U.S. Army Corps of Engineers) permit to plow to grow crops,” said Anthony Francois, an attorney for the Pacific Legal Foundation. “We’re not going to produce much food under those kinds of regulations,” he said. …The Army did not claim Duarte violated the Endangered Species Act by destroying fairy shrimp or their habitat, Francois said. …Farmers plowing their fields are specifically exempt from the Clean Water Act rules forbidding discharging material into U.S. waters, Francois said.

And here’s an info-graphic that accompanied the article.Indian Ladder Farms, a fifth-generation family operation near Albany, …sells homemade apple pies, fresh cider and warm doughnuts. …This fall, amid the rush of commerce — the apple harvest season accounts for about half of Indian Ladder’s annual revenue — federal investigators showed up. They wanted to check the farm’s compliance… Suddenly, the small office staff turned its focus away from making money to placating a government regulator. …The investigators hand delivered a notice and said they would be back the following week, when they asked to have 22 types of records available. The request included vehicle registrations, insurance documents and time sheets — reams of paper in all. …the Ten Eyck family, which owns the farm, along with the staff devoted about 40 hours to serving the investigators, who visited three times before closing the books. …This is life on the farm — and at businesses of all sorts. With thick rule books laying out food safety procedures, compliance costs in the tens of thousands of dollars and ever-changing standards from the government…, local produce growers are a textbook example of what many business owners describe as regulatory fatigue. …The New York Times identified at least 17 federal regulations with about 5,000 restrictions and rules that were relevant to orchards. …Mr. Ten Eyck…fluently speaks the language of government compliance, rattling off acronyms that consume his time and resources, including E.P.A. (Environmental Protection Agency), OSHA (Occupational Safety and Health Administration), U.S.D.A. (United States Department of Agriculture) and state and local offices, too, like A.C.D.O.H. (Albany County Department of Health).

By Jonivan Jones March 27, 2018

By Jonivan Jones March 27, 2018 And if Virginia politicians tried to impose such an absurd policy, I certainly would hope and expect that Nevada authorities wouldn’t provide any assistance.

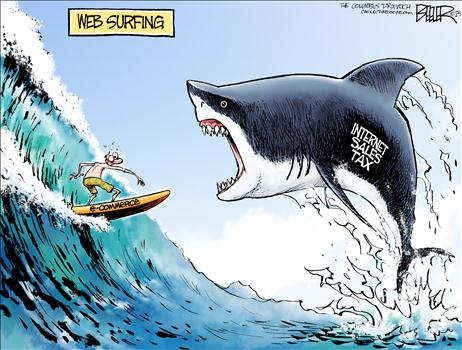

And if Virginia politicians tried to impose such an absurd policy, I certainly would hope and expect that Nevada authorities wouldn’t provide any assistance.The state of Alabama is openly defying the U.S. Supreme Court in an effort to squeeze millions of dollars of tax revenue from businesses beyond its borders. …This unconstitutional tax grab cuts to the heart of the Commerce Clause, which gives Congress the power to regulate trade “among the several States.” Alabama’s regulation directly contravenes the Supreme Court’s 1992 ruling in Quill v. North Dakota. In that case, the court held that North Dakota could not require an out-of-state office-supply company to collect sales taxes because the firm had no offices or employees there. …Alabama’s revenue commissioner, Julie Magee, is putting forward an untested and suspect legal theory: The state claims that if its residents buy more than $250,000 a year from a remote business, then the seller has an “economic presence”… There are around 10,000 sales-tax jurisdictions in the U.S., with varying rates, rules and holidays, and different definitions of what is taxable. Keeping track of this ever-changing patchwork is a burden, and forcing retailers to scramble to comply would profoundly hinder interstate commerce in the Internet age.And here are some excerpts from a column published that same year by Fortune.

When politicians call for “fairness,” it’s important to take a closer look at their definition of fair. See, for example, the nationwide push in state capitols to slap online sales taxes on out-of-state retailers—a simple tax grab… states are constitutionally prohibited from collecting sales taxes from retailers that have no presence within their borders…thanks to the U.S. Supreme Court’s 1992 ruling in Quill Corp. v. North Dakota… Any national online sales-tax system will burden online retailers to a degree never felt by brick-and-mortar businesses. Local businesses only have to deal with a limited number of sales taxes—usually only the state, county, and local levies that apply to specific stores. Online retailers, on the other hand, would have to calculate and apply sales taxes across the entire nation—and roughly 10,000 jurisdictions have such taxes. Complying with this convoluted system would necessarily raise costs for consumers and stifle competition.And the debate continues this year. The Wall Street Journal editorialized against extraterritorial state taxing last week.

A large faction of House Republicans are pressing GOP leaders to attach legislation to the omnibus spending bill that would let states collect sales tax from remote online retailers. South Dakota Rep. Kristi Noem’s legislation…would let some 12,000 jurisdictions conscript out-of-state retailers into collecting sales and use taxes from their customers. …Contrary to political lore, sales tax revenues have been increasing steadily in states with healthy economies. Over the past five years, Florida’s sales tax revenues have grown 27%. South Dakota’s are up by nearly 30% since 2013. …Twenty or so states have adopted “click-through” taxes to hit remote retailers that have contracts with local businesses. In 2016 South Dakota invited the High Court to revisit Quillby extending its sales tax to out-of-state sellers. …the Court could enable broader taxation and regulation of out-of-state businesses. This is what many states want to happen. …Raising taxes on small business and consumers won’t be a good look for Republicans in November, nor an inducement for investment and growth.Jeff Jacoby also just wrote on this topic for his column in the Boston Globe.

And here are some passages from Jessica Melugin’s article for FEE. She makes the key point that extraterritorial tax powers would undermine – if not cripple – the liberalizing impact of tax competition.First, the flow of interstate commerce must not be impeded by one state’s impositions. And second, there should be no taxation without representation; vendors should not be liable for taxes in states where they have no vote or political recourse. The Supreme Court upheld this “physical connection” standard in a 1992 case, Quill v. North Dakota. …the high court should reaffirm it. In the 26 years since the justices rebuffed North Dakota’s claim, the case against allowing states to exert their taxing power over remote sellers has grown even stronger. …there are now 12,000 taxing jurisdictions — not only states, counties, and cities, but also parishes, police districts, and Indian reservations. A lone online seller, unprotected by the Quill rule, could be obliged to remit taxes to any combination of them, with all their multitudinous rules and definitions, tax holidays and filing deadlines. …South Dakota can impose onerous burdens on companies operating within its borders, but not on vendors whose only connection to the state is that some of their customers happen to live there. The court got it right the first time. No merchant — whether selling online, via mail order, or in a traditional shop — is obliged to be a tax collector for states it doesn’t operate in.

…the Remote Transactions Parity Act (RTPA)…seeks to get rid of that physical presence limit on state taxing powers. It would let states reach outside their geographical borders and compel another state’s business to calculate, collect, and remit to that first state. …the long-term effect is that this arrangement will lessen the downward pressure on taxes between jurisdictions. Think of it like this: it’s the difference between driving your car across the D.C. border to Virginia to fill up with lower Virginia gas taxes—that’s how it works now and that’s what keeps at least some downward pressure on D.C. tax rates. If D.C. made the rate high enough, everyone would exit and fill up in Virginia. But if the approach in the RTPA is applied to this thought experiment, it would mean that when you pull into that Virginia gas station, they look at your D.C. plates and charge you the D.C. gas tax rate. …it’s a makeshift tax cartel among the states. …the RTPA is a small-business killer—which is why big box retailers support it. It crushes small competitors with compliance costs. State politicians are for it because they’d rather tax sellers in other states who can’t vote them out of office. Consumers will be left with less money in their pockets and fewer choices.By the way, there are some pro-market people on the other side. Alex Brill of the American Enterprise Institute has written in favor of extraterritorial taxation.

…lawmakers have proposed legislation to allow (not require) states to collect sales tax on goods purchased from out-of-state sellers. …critics of this legislation…argue that “internet freedom is under attack by politicians willing to distort markets and tilt the playing field toward their favored businesses.” Internet freedom is certainly not being “attacked” by a policy to improve enforcement of existing tax liability. Second, these critics oppose the legislative reform based on the belief that just because the internet benefits people, online retail activities should be advantaged by public policy. If public finance were based on this type of specious logic, we would have a tax code far more unfair and distorted than it currently is.

I actually agree with both of his arguments. Giving states extraterritorial tax powers isn’t an attack on the Internet. And I also agree that tax policy shouldn’t provide special preferences.

I actually agree with both of his arguments. Giving states extraterritorial tax powers isn’t an attack on the Internet. And I also agree that tax policy shouldn’t provide special preferences.