September 20, 2025 by Dan Mitchell @ International Liberty

My views on immigration are a bit unconventional.

I very much believe people should have a right to leave countries (because of political oppression, high taxes, etc), but I don’t think that means other nations are obliged to welcome them.

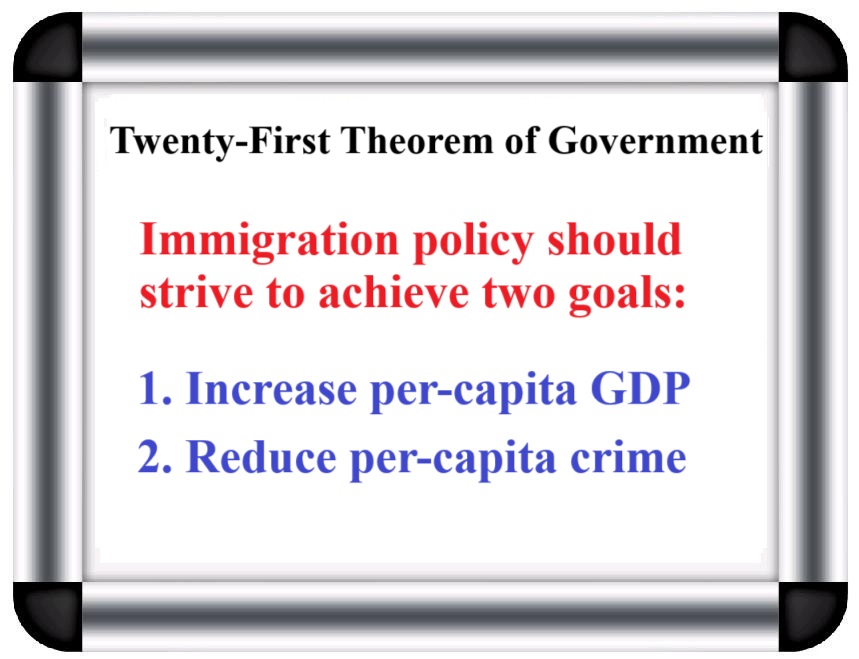

From a U.S.-centric perspective, I want a policy that is based on my 21st Theorem of Government. Simply stated, America should welcome people who are statistically likely to boost per-capita GDP and reduce per-capita crime (I also have another motive, which is to help freedom conservatism prevail over national conservatism).

Given my views, I applaud Donald Trump’s plan for so-called Golden Visas.

He’s been talking about this idea since last year (and his family has been pushing the idea of economic citizenship for much longer), but we now have some details.

Here are some excerpts from a Washington Post report by Cat Zakrzewski, Lauren Kaori Gurley, and David Nakamura.

As the story notes, these programs are not necessarily popular with everyone. In some European nations, housing prices have increased because rich foreigners bid up prices. There’s also a fairness debate since rich foreigners sometimes get to pay lower tax rates than local people. Indeed, this is one of the excuses British politicians have used to restrict the United Kingdom’s “non-dom” policy.

Though I think their real motive was grabbing more money. But that’s backfired. Rich foreigners are leaving London and moving elsewhere. And the government is losing revenue. Especially to Italy, which has their version of a non-dom system. Here are some excerpts from Liz Rowlinson’s article in the U.K.-based Telegraph.

Italy is..attracting disenchanted multi-millionaires from overseas to embrace la dolce vita, thanks to its flat tax regime. By paying a lump sum of €200,000 (£168,000) annually on their foreign-sourced income, they could in theory save hundreds of thousands – even millions – in tax. …

Even though this flat rate has doubled since the scheme began in 2017, it has become more popular than ever, according to agents and advisers. …In London, the abolition of the non-dom regime and changes to inheritance tax breaks on assets held in overseas trusts have sent ultra-wealthy people fleeing. Italians describe their flat tax scheme as “svuota Londra” or “empty London” – such is the allure of its tax breaks. …Milan is now full of French and English-speaking people.

I’ll close with some wonky tax analysis.

The biggest issue for international tax migrants is not so much the personal income tax rate. These are people much more concerned about three other tax policies.

And they especially want to avoid worldwide double taxation, which is why territorial taxation is the key to the old British system, the current Italian system, and Trump’s newly labeled Platinum Card.

What’s needed, of course, is to eliminate such taxes on everyone, not just wealthy international migrants. Fortunately, we know exactly how to do that.

P.S. Unsurprisingly, the tax-free bureaucrats at the OECD, as part of their campaign against tax competition, want to restrict economic citizenship programs.

Update, here's more on this issue:

- Trump’s Immigration Reset: H-1B and Gold Card Orders Put America First - President Donald Trump’s two recent executive orders, one imposing a $100,000 annual fee on H-1B visas and the other launching the “Gold Card” fast-track residency program, represent the most significant immigration reforms in decades. The H-1B program was initially created to help U.S. companies fill rare, high-skilled roles when American expertise was unavailable. However, in practice, it has become a pathway for cheap foreign labor. According to the Economic Policy Institute (EPI), in 2022, the top 30 H-1B employers brought in 34,000 new visa workers even as they laid off at least 85,000 Americans. From MAGA to making the rest of the world great again.........

No comments:

Post a Comment