I’ve been explaining for years that economists are lousy forecasters. But we are capable of noticing trends, including trends that will lead of bad outcomes if not reversed.

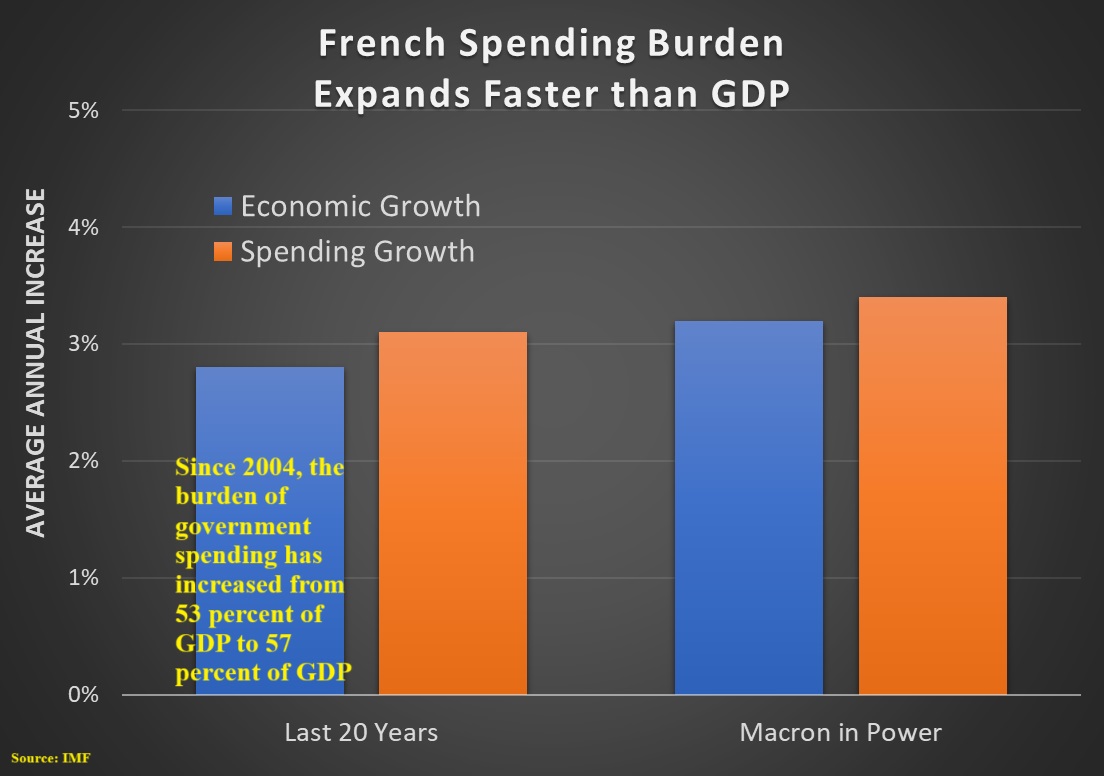

For instance, my recent series on “France and Fiscal Suicide” points out (see Part I, Part II, Part III, and Part IV) that the country will have some sort of crisis unless there is a serious effort to reduce the burden of government spending.

Heck, I’ve been beating that drum for a long time, and I also made France a case study for my 20th Theorem of Government.

So even though I’m still not willing to make specific predictions, it certainly appears that a fiscal meltdown may be on the horizon.

Here are some excerpts from a Wall Street Journal editorial last week.

…after all these years Paris still can’t get a grip on its budget or the economy. Prime Minister François Bayrou said Monday he’ll call a confidence vote on Sept. 8. He’s likely to lose. …Cue a steep drop in French shares…and surging bond yields.

…French unemployment remains persistently high, and the productive parts of the economy are straining under a welfare state that extracted 51.4% of GDP last year in revenue… You’d think an economic and fiscal disaster of this magnitude would produce a burst of creative policy and political thinking. Instead, politicians mostly agree that they’d prefer to raise taxes than cut any spending or reform any entitlements.

That’s not encouraging.

But prepare to be even more pessimistic after perusing passages from Matthew Lynn’s column in the U.K.-based Telegraph.

The Government is teetering on the edge of collapse, the budget is out of control, there are emergency tax rises on the way and the rioters are gearing up for protests… With worries about government debt and the affordability of lavish welfare systems rising all the time, France could be about to trigger a full-blown market crash. …

State spending has hit 58pc of GDP, while the tax burden on workers has hit 47pc, one of the highest levels in the OECD. And yet despite that, the deficit is forecast to hit 5.7pc of GDP this year and will probably punch through 6pc, while its debt-to-GDP ratio is over 113pc… It is hardly surprising that investors are starting to feel nervous about lending the country even more money. Yields have already spiked above Greece and Portugal, two countries at the epicentre of the last eurozone crisis, and that is hardly reassuring, while the finance minister, Eric Lombard, has started warning about an IMF bailout.

Here’s a chart that accompanied the column.

As you can see, one symptom of excessive government spending is that debt is becoming an ever-greater burden.

The author warns that a crisis in France may spread to other nations, which is a very real possibility given their fiscal problems.

…watch out for contagion. …France is the most fiscally irresponsible of all the major developed global economies. …if it crashes, then other countries – most notably the UK – will very quickly get caught up in the storm as well, just as Ireland and Portugal were after Greece crashed. The markets will be looking for the next domino to fall, and it won’t be long before they find it.

I’ll close with two comments.

- First, if France does have a crisis (i.e., a loss of confidence by investors, leading to a sudden spike in yields on government bonds, perhaps accompanied by troubles for the entire financial system), I will have to eat crow because I’ve been speculating for years that Italy will be the first domino to fall.

- Second, Mr. Lynn seems to think it would be good if France still had its own currency so it could just use inflation as a means of partially repudiating its debt. That is wrong. France’s problem is excessive government, not the euro currency. French politicians instead should opt for “internal devaluation,” which is just a wonky way of saying they need small government and free markets.

Because France seems to be a cesspool of statism, I won’t be holding my breath waiting for the right approach.

Though, five years ago, I never would have predicted Argentina’s renaissance, so one should never give up hope.

P.S. I’m going to add one more comment.

- Third, a nation’s debt burden matters, but what also matters is whether policy is moving in the right direction or wrong direction. For instance, the EU chart below shows that Greece has the highest debt burden in the European Union, yet it is now considered to be in decent shape because of short-run spending restraint and long-run pension reform. In other words, it is heading in the right direction and debt is declining. France, by contrast, is vulnerable because politicians are in a never-ending cycle of more taxes, more spending, and more debt.

Here’s the chart showing European debt burdens, courtesy of Eurostat.

P.P.S. The chart also shows that it is possible to be a high-tax welfare state with reasonable debt levels, though it is worth noting that nations such as Sweden, Denmark, and Luxembourg are very pro-market in areas other than fiscal policy. And Denmark and Sweden have been moving in the right direction on fiscal policy.

No comments:

Post a Comment