More than 15 years ago, I shared a 2007 video about the corporate income tax. One of my first points in that nine-minute video was that businesses pay the tax, but people bear the burden.

I elaborate in this much-shorter clip from a recent interview

But what’s my proof?

We have lots of evidence that lower corporate tax rates are good for growth (see here, here, and here), so that’s indirect proof.

There’s also plenty of evidence that lower corporate tax rates have a Laffer Curve effect (see here, here, and here), so that’s more indirect proof.

Today, let’s look at a direct estimate.

We’ll start with this chart looking at the effect of increases in local corporate tax rates in Germany.

I’ve highlighted the impact on wages.

But what does it actually mean? Well, here are some relevant excerpts from the accompanying study, starting with a description of theory and methodology.

The obligation to pay a tax and bearing its economic burden are two different things. Typically (a part of) the economic burden of a tax is passed on to other economic agents through price adjustments. The fact that the legal incidence of taxation differs from its economic incidence is particularly evident in the case of corporate income taxation. While the taxpayer is a legal entity, the economic burden of a tax can only be borne by people. This paper offers the so far most comprehensive analysis of the incidence of corporate in come taxation. Combining theoretical modeling with an empirical analysis, we investigate how changes in corporate income tax rates affect the economic welfare of four groups: firm owners, workers, owners of residential real estate, and owners of commercial real estate.

And here are some results.

Our main finding is that higher corporate income tax rates significantly reduce profits, wages, as well as residential and commercial property prices. The negative effect of tax hikes on property prices and wages is increasing over time, while the negative effect on profits becomes smaller (in absolute terms). …we find that wages decline by about one percent following a one percentage point tax hike, which is close to the estimate by Fuest et al. …the U.S. Congressional Budget Office (CBO) assumes that 75 percent of the corporate income tax burden falls on capital owners and 25 percent on workers

The part that seems most relevant is the finding that wages drop by one percent if the corporate tax rate goes up by one-percentage point.

Not that different from some similar research unveiled back in 2017.

The moral of the story is that American workers should feel very grateful that Joe Biden’s plan to boost the corporate tax rate was not successful.

Or that Kamala Harris isn’t in the White House to push her proposed higher corporate tax rate.

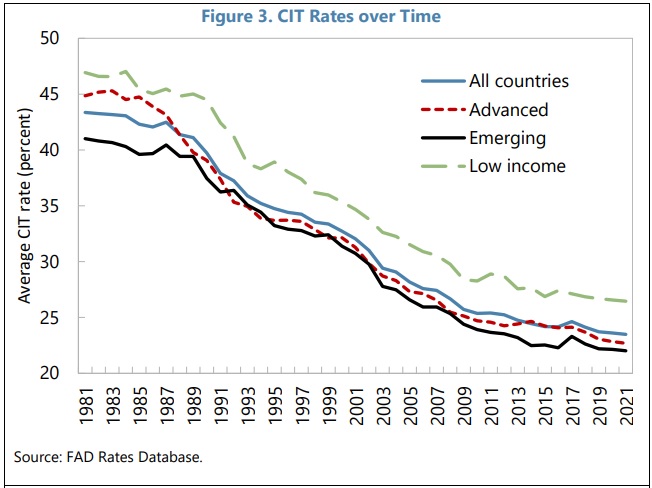

P.S. The good news is that corporate tax rates have been declining, largely thanks to tax competition.

All the more reason why the U.S. should stop subsidizing the Paris-based Organization for Economic Cooperation and Development. That bureaucracy’s campaign for a global corporate minimum tax would be terrible news for just about every group in society, including workers.

This article provides a compelling perspective that truly resonates with ongoing global issues. Movements and discussions around figures like Steve Bannon show how deeply politics and power can shape society. Exploring such topics not only educates us but also encourages meaningful dialogue. We need more open conversations like this to inspire awareness and positive change.

ReplyDelete