Three days ago, I explained that modest spending restraint could solve America’s fiscal problems.

In today’s column, let’s expand on that topic. We’ll start with this clip from a recent interview.

If you don’t want to spend a couple of minutes watching the interview, I made six points.

- We have a long-run fiscal problem.

- Spending is the problem, not red ink.

- A spending cap is the solution.

- Entitlement reform is needed.

- The alternative is massive tax hikes.

- Ordinary Americans will be pillaged,

For purposes of today’s column, I want to build on the second point.

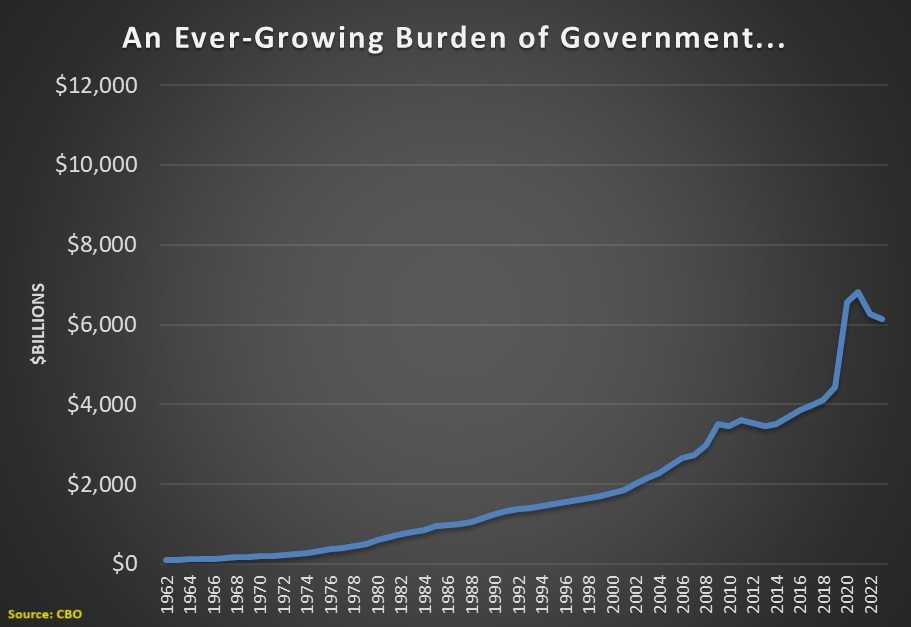

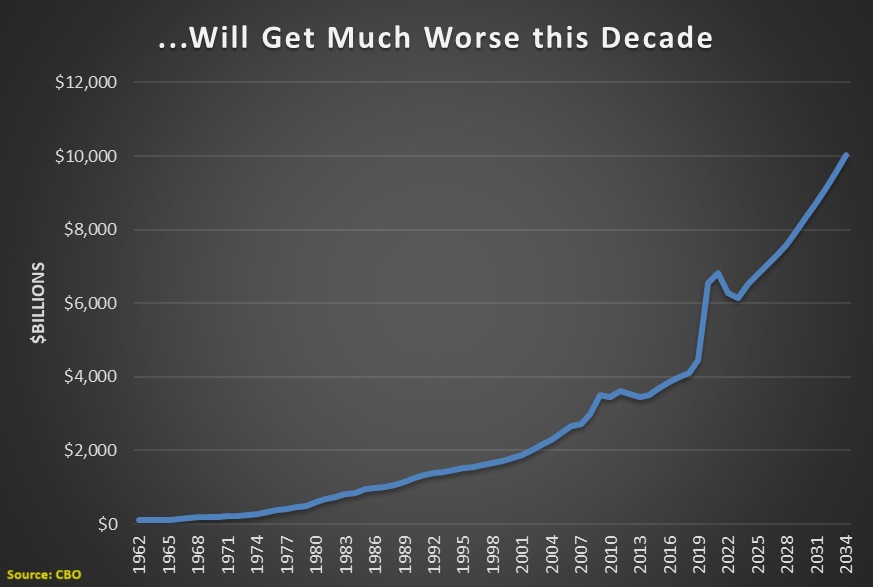

Here are two charts based on data from the Congressional Budget Office.

The first chart shows what has happened to federal spending over the past six decades. It shows a steadily increasing burden, punctuated with one-time spending sprees for the financial crisis (2008-2009) and the pandemic (2020-2021).

The second chart adds CBO’s projections for spending over the next 10 years, assuming the budget is left on autopilot.

As you can see, a bad situation will get much worse.

These are sobering charts.

But not necessarily frightening charts. If you adjust the numbers for inflation, the spending increase doesn’t look quite as bad.

And if you measure spending relative to the economy (share of GDP), the upward trend is further muted.

So the budget numbers are grim, but we have not passed a point of no return.

Heck, I wrote back in 2015 that Greece’s problems were solvable. And it that’s the case, then the same must be true in the United States.

We just need to spendaholics in Washington to comply with the Golden Rule.

But that rosy scenario assumes politicians will try to solve the problem with spending restrain rather than making it worse with new spending burdens.

Sometimes I feel optimistic about achieving the former. But then I look at who is running for president (the Tweedledum and Tweedledee of big government) and it is much more realistic to expect the latter.

No comments:

Post a Comment