October 24, 2025 by Dan Mitchell @ International Liberty

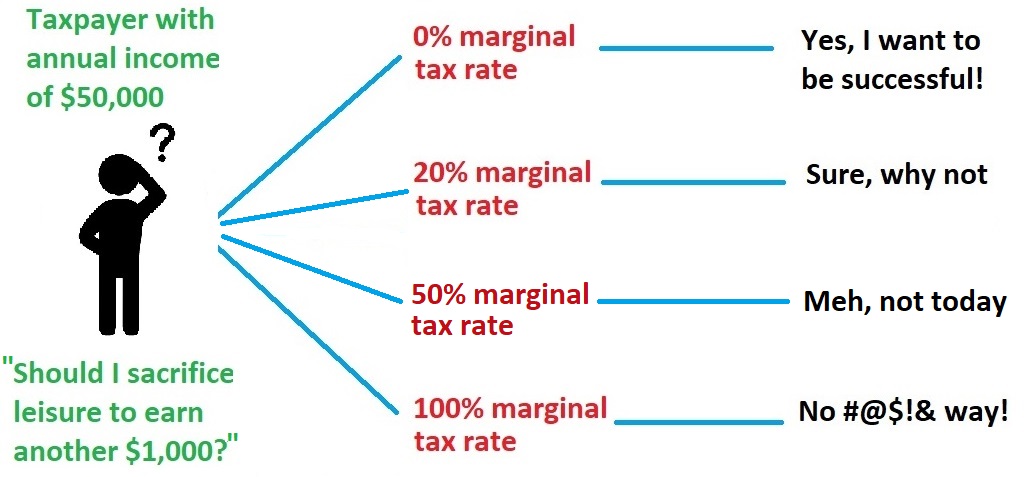

Economic analysis of taxation is fairly simple and straightforward: The more you tax of something, the less you get of it.

Yes, you want to focus on marginal tax rates, and yes, you want to look at “double taxation” to get effective marginal tax rates.

If you have quantitative skills, you can even estimate the slopes of supply and demand curves and try to quantify the “deadweight loss” from a tax.

But it still boils down to the fact that the more you tax of something, the less you get of it.

In this series (previous editions available here, here, here, and here), I’m using simple examples to show that taxes matter. They change behavior.

Today, let’s go to Japan to see that politicians in a scenic city decided to impose higher taxes because they wanted to reduce the number of tourists. Here are some excerpts from a report in USA Today by Kathleen Wong.

Travelers wanting to see the ancient temples and shrines in Kyoto will soon need to increase their budget as the historic city announced on Oct. 3 a 900% hike on its tourist tax. This will mark Japan’s highest tourist tax. …the increase will apply to the city’s accommodation fee – a per-night tax calculated based on the daily rate of your hotel, according to the website. …

Those staying in more expensive accommodations will be charged a higher tax. Hotels with nightly rates at 100,000 yen (about $665) or more will face the biggest tax increase from $6.65 to $66.55 per night added to their final bill at checkout. …The move makes Kyoto the latest destination to implement a tourist tax as a way to curb overtourism, with Greece, New Zealand, Bali, Amsterdam and Venice all introducing some sort of similar fee within the past several years.

I have no idea if this tax is a good idea or bad idea (my knee-jerk assumption is that any tax is bad, but maybe there really is over-tourism and this is the most efficient way of dealing with the issue).

That being said, the politicians in Kyoto have shown that they understand the economics of taxation. At the risk of repeating myself (again): The more you to of something, the less you get of it.

My frustration with politicians is that they often fail to demonstrate the same economic insight when considering tax rates on behaviors that are unambiguously good for society – such as work, saving, investment, and entrepreneurship.

P.S. I actually suspect many politicians do understand the damage of high tax rates on productive behavior, but they pretend otherwise because they put vote-buying about the national interest.

No comments:

Post a Comment