September 30, 2025 by Dan Mitchell @ International Liberty

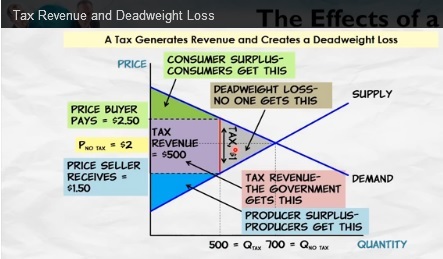

There are several visual ways of helping people understand how fiscal policy (and especially marginal tax rates) can change behavior.

To augment these examples, I’ve started a series that is based on real-world examples.

Part I of the series highlighted how the capital gains tax discourages people from selling their homes.

For the second edition of our series, let’s visit the other side of the world and look at how taxation of pickup trucks has distorted the Australian vehicle market.

Here are some excerpts from a report in the U.K.-based Guardian by Elias Visontay, and keep in mind that pickup trucks are known as “utes” in Australia.

A loophole in Australia’s tax law is in effect subsidising the price of luxury utes such as Ram and Chevrolet SUVs… [T]he Luxury Car Tax…applies to any car that costs more than $80,576. However, the LCT does not apply if a car is “a commercial vehicle designed mainly for carrying goods and not passengers”. This is defined as a car that can carry twice the weight in payload than it can carry in people – a requirement which almost every dual-cab ute on the market in 2024 can meet, according to the Australia Institute. …

The Australia Institute research found this exemption acts as a loophole and that the difference in tax treatment “incentivises people to buy utes” by making them cheaper when compared with sedans and smaller, more fuel efficient cars. …The analysis provided the example of a 2024 Mercedes-Benz EQE 300 electric car, which costs $133,575, compared with the Chevrolet’s price of $138,000.

But after LCT is taken into account, the Chevrolet would be $8,231 cheaper due to the exemption. …The analysis found that the LCT ute exemption led to more than $250m in forgone tax revenue in 2023, “almost three-quarters of which was due to sales of Ram and Chevrolet vehicles”.

By the way, the Guardian is a left-wing newspaper, so parts of the article rubbed me the wrong way. The most obvious example is the title, which states that the tax preference for commercial vehicles “costs Australians $250m a year.”

In reality, it deprives the government of that much money. Taxpayers, by contrast, get to save $250 million.

But I’m digressing. The purpose of the article is to demonstrate that people respond to incentives. If a tax causes one type of vehicle to be more expensive than others, people will logically respond by avoiding the tax.

In this case, I don’t care whether readers think Australia’s policy is a good idea or bad idea. Or whether they think the tax should be abolished completely or applied to all vehicles.

I simply want people to understand that taxes change behavior. Simply stated, the more you tax of something, the less you get of it.

And once people understand that basic principle, I want them to contemplate whether it is a good idea to impose high tax rates on work, saving, investment, and entrepreneurship.

The bottom line, as the following quote illustrates, is that incentives matter.

As you can see (and read), President John F. Kennedy understood tax policy.

As did presidents such as Ronald Reagan and Calvin Coolidge. With a bit of luck, perhaps we can educate some of today’s lawmakers.

P.S. Other folks on the left (see here, here, here, here, and here) share the Guardian‘s view that all income belongs to the government.

No comments:

Post a Comment