The Laffer Curve is the common-sense notion that changes in tax rates lead to changes in taxable income.

But, as I explain in this clip from a TV program in Hawaii, that doesn’t mean tax cuts “pay for themselves.”

Before any readers accuse me of being an apologist for class warfare, I’m a strong advocate of the Laffer Curve.

And I’ve cited examples of tax cuts that have produced more revenue.

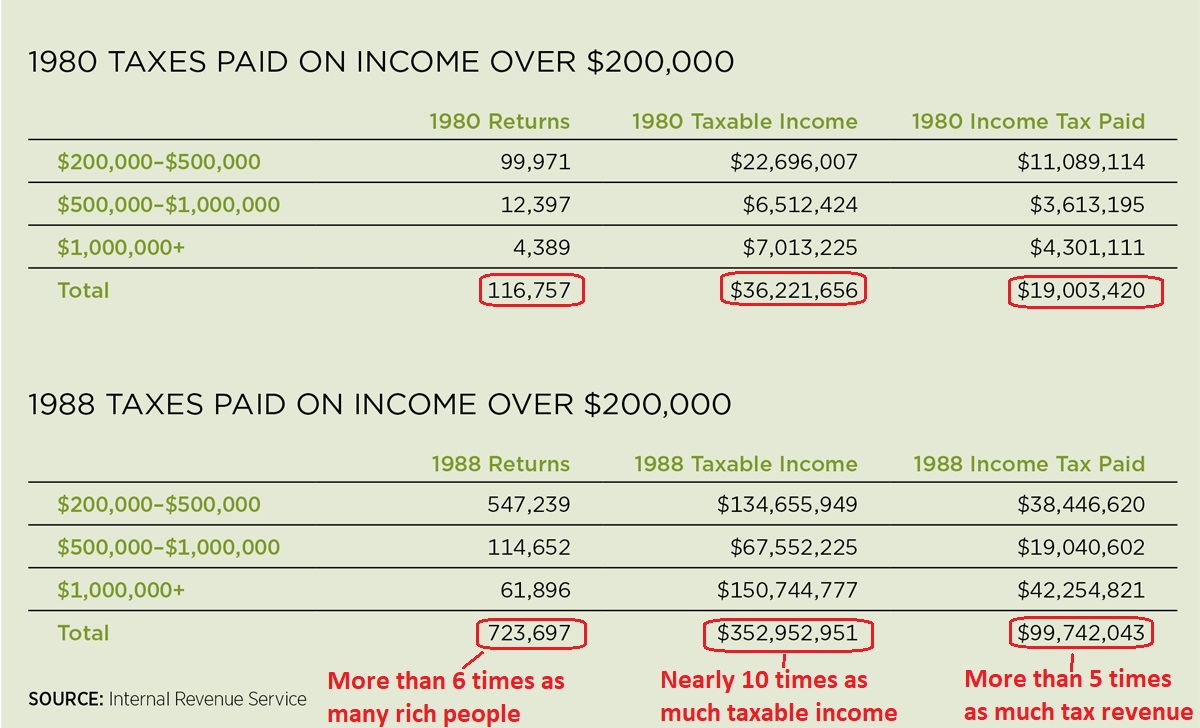

- Lower personal income tax rates on rich people in the 1980s.

- Lower corporate income tax rates in Ireland in the 1980s and 1990s.

- Maybe even Trump’s corporate tax cut (though we need a few more years of evidence).

But most tax cuts are not self-financing. There will almost always be revenue feedback, of course, but the revenue loss from the lower rate generally will be larger than the revenue gain from higher taxable income.

However, that is not an argument against lowering taxes. As I stated in the discussion, it would be a win-win situation if we could convince politicians to lower tax rates and restrain government spending.

Heck, because of the starve-the-beast theory, I’d applaud a revenue-losing tax cut precisely because it would reduce the amount of loot available to politicians.

P.S. I mentioned that Hawaii has a spending cap. That’s the good news. The bad news is that the legislature routinely waives it. To build on an analogy I’ve used before, having a speed limit in a school zone is a good idea, but not if it’s set at 70 MPH. Or, in the case of Hawaii, a speed limit in a school zone is pointless if the cops announce they will never patrol that road.

No comments:

Post a Comment