January 19, 2024 by Dan Mitchell @ International Liberty

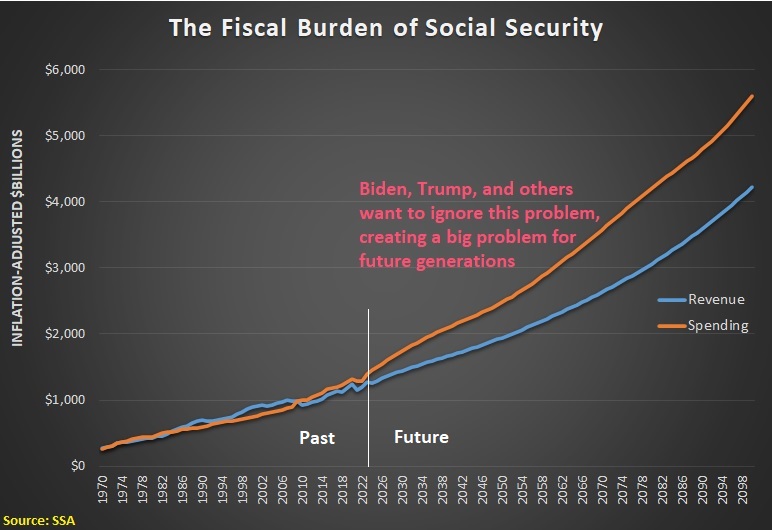

Serious and responsible people (in other words, not Trump or Biden) know that Social Security has a massive long-run problem.

A fast-growing number of seniors are expecting future benefits but only a slow-growing number of workers will be paying into the system.

But even if this demographic problem didn’t exist, there is the underlying flaw of a retirement system based on tax-and-spend (or debt-and-spend) rather than wealth accumulation.

The solution is obvious.

We need to shift to a system based on personal retirement accounts.

The transition to a modern system will be expensive, to be sure, but not nearly as costly as the $60 trillion-plus burden of propping up the current system.

But some people prefer the more-expensive option.

Andrew Biggs of the American Enterprise Institute and Alicia Munnell of Boston College want to divert a massive amount of money from the private sector to the government, and they want to do it by double-taxing the money Americans have in retirement accounts.

Here are excerpts from their new report.

The U.S. Treasury estimates that the tax preference for employer-sponsored retirement plans and IRAs reduced federal income taxes by about $185-$189 billion in 2020, equal to about 0.9 percent of gross domestic product. …it actually offers policymakers an opportunity to strengthen the nation’s retirement income system. Revenues saved from repealing the retirement saving tax preferences could be reallocated to address the majority of Social Security’s long-term funding gap. …an opportunity to use taxpayer resources more productively. …the case is strong for eliminating the current tax expenditures on retirement plans, and using the increase in tax revenues to address Social Security’s long-term financing shortfall. …Tax expenditures for employer-sponsored retirement plans are expensive – costing about $185 billion in 2020. … reducing tax expenditures for retirement plans could be an effective way to help address other pressing demands on the federal budget, such as Social Security’s financing shortfall.

By the way, it is no exaggeration to say the authors “want to divert a massive amount of money” to politicians over the next decade. Based on the Congressional Budget Office’s latest 10-year forecast, 0.9 percent of GDP is about $3 trillion.

It’s not just that the authors want to prop up a system that needs reform.

They also want to undo provisions in the tax code (IRAs and 401(k)s) that allow people to protect themselves against two layers of tax on income that is saved and invested.

It’s also laughable that the report states that a huge tax increase will “use taxpayer resources more productively.” If higher taxes to fund bigger government was a good idea, Europe’s welfare states would be richer than the United States rather than way behind.

Even the title of the Biggs-Munnell study is offensive. It implies that taxpayers are getting a handout or favor if politicians don’t impose double taxation. At the risk of understatement, being taxed one time rather than two times is not a subsidy.

P.S. The better option is a shift to retirement systems based on private savings, like the ones in Australia, Chile, Switzerland, Hong Kong, Netherlands, the Faroe Islands, Denmark, Israel, and Sweden.

P.P.S. Biggs and Munnell are misguided for wanting a big tax increase to prop up a bankrupt system. That’s the bad news. The worse news is that some people want to expand the bankrupt system. And they are proposing tax increases that arguably would cause even more economic damage.

No comments:

Post a Comment