September 2, 2024 by Dan Mitchell @ International Liberty

Massachusetts used to have a flat tax, but I warned back in 2019 that it was in danger. Sadly, my fears were warranted.

In 2022, the state’s misguided voters approved a referendum to replace the flat tax with a system based on class warfare (a choice that made my list for the “worst news of 2022“).

But if those voters are fans of the New England Patriots, they cut off their noses to spite their faces.

Is this just idle speculation by a couple of guys who don’t know what they’re talking about?

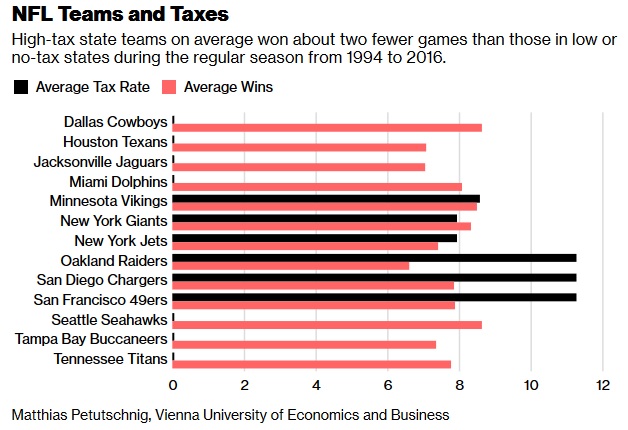

Hardly. According to academic research, football teams in high-tax states are at a disadvantage. On average, they lose two more games per season that teams in low-tax states.

And we see similar evidence that taxes have an impact when looking at other sports such as baseball, track, golf, boxing, auto racing, soccer, and basketball.

Sticking to football, the Wall Street Journal opined on the issue last week. Here are some excerpts.

For the latest evidence that state tax policy influences taxpayer decisions, take a look at the National Football League. …states with millionaire surtaxes like Massachusetts are at a disadvantage in attracting the best free-agent players. …It’s “just another thing you’ve got to contend with in negotiations up there,” Mr. Belichick added. “It’s not like Tennessee or Florida or Nevada or some of these teams that have no state income tax.” …

Massachusetts used to have a 5% flat tax on all incomes above $8,000. But in 2022 the state imposed a four percentage point surtax on incomes over $1 million. …A player making $50 million would pay $4,968,457 playing for Minnesota Gov. Tim Walz’s home-state Vikings compared to $586,902 on that same contract at the Dallas Cowboys. …

Those are eye-watering numbers, but the same tax calculations exist for all taxpayers. High-income earners have more flexibility than most to relocate. Democrats who think surtaxes on the affluent make good policy might reconsider that line of scrimmage.

Since I’m a fan of the New York Yankees, I’m not happy.

New York has a terrible state tax system, so that makes it harder for my Yankees to reclaim their rightful spot as world champions.

But this isn’t about my personal preferences. It’s simply more evidence that high tax rates are bad news. Bad news for pro athletes. But also bad news for entrepreneurs, investors, and small business owners.

The good news is that many of those people have the ability to escape. The bad news is that the rest of us don’t have the same flexibility to move across borders.

Always remember that ordinary people suffer when politicians target the rich.

No comments:

Post a Comment