Judged by the amount of attention various provisions produced, last year’s fight over tax reform was about reducing the corporate tax rate and limiting the deduction for state and local taxes.

But there were many other important changes, including a a big increase in the standard deduction (i.e., the amount households can protect from the IRS), a shift that will reduce the number of people who utilize itemized deductions.

A report in the Washington Post suggests that this reform could hurt charities.

Many charities opposed this change.Many U.S. charities are worried the tax overhaul bill signed by President Trump…could spur a landmark shift in philanthropy, speeding along the decline of middle-class donors… The source of concern is how the tax bill is expected to sharply reduce the number of taxpayers who qualify for the charitable tax deduction — a big driver of gifts to nonprofits. …the number of people who qualify for the charitable deduction is projected to plummet next year from about 30 percent of tax filers to as low as 5 percent. That’s because the new tax bill nearly doubles the standard deduction and limits the value of other deductions, such as for state and local taxes.

One study predicts that donations will fall by at least $13 billion, about 4.5 percent, next year. …“The tax code is now poised to de-incentivize the heart of civic action in America,” said Dan Cardinali, president of Independent Sector, a public-policy group for charities, foundations and corporate giving programs. “It’s deeply disturbing.” The tax bill’s treatment of charities led the Salvation Army to express serious concerns, and it’s why United Way opposed the legislation, as did the U.S. Conference of Catholic Bishops. Cardinali’s group turned its home page — normally a place for a feel-good story — into a call to protest, with the banner headline: “KILL THE TAX REFORM BILL.” …Rep. Kevin Brady (R-Tex.), the main tax bill writer in the House…argued that people would soon have more money to donate because of the economic growth driven by the bill’s tax cutsAs an aside, here’s the part of the story that most irked me.

“The government has always seen fit to reward the goodness of Americans with a tax incentive,” said Lt. Col. Ron Busroe, development secretary at the Salvation Army.Huh, how is it goodness if people are only doing it because they’re being bribed by the tax code?

But let’s stick with our main topic of whether the tax bill will hurt the non-profit sector.

A Bloomberg column also hypothesized that the GOP tax reform will be bad news for charities.

I agree that lower tax rates increase the “tax cost” of giving money to charity.Will Americans give as generously now that the incentives have completely shifted? Recent research provides little hope for them. …last year’s tax reform…doubled the standard deduction, effectively eliminating most taxpayers’ ability to itemize deductions via contributions to charity…. Tax cost refers to the actual, post-tax price that someone pays when they make a donation. Imagine someone with a marginal tax rate of 25 percent. Every dollar donated only “costs” the taxpayer 75 cents after he or she takes the charitable deduction. …What happens when you change these “tax costs”? …Almost everyone who studied taxpayer behavior found that the charitable deduction encouraged people to donate more than they would if it didn’t exist. But studies yielded very different price elasticity figures ranging from -0.5 (a dollar in lost tax revenue generates an additional 50 cents in donations) to -4.0 (every dollar in forgone tax revenue generates a whopping four dollars of donations). A recent meta-analysis of approximately 70 of these studies yielded a price elasticity a median of -1.2. A recent study by Nicholas Duquette of the University of Southern California…examined how taxpayer contributions changed after the Tax Reform Act of 1986, which increased the tax cost of giving by dramatically lowering marginal tax rates. The result was eye-popping: A 1 percent rise in the tax cost of giving caused charitable donations to drop 4 percent.

And Reagan’s tax policy (the 1981 tax bill as well as the 1986 tax reform) had a huge impact. In 1980, it only cost 30 cents for a rich person to give a dollar to charity. By 1988, because of much lower tax rates, it cost 72 cents to give a dollar to charity.

Yet I’m a skeptic of Duquette’s research for the simple reason that real-world data shows that charitable contributions rose after Reagan slashed tax rates.

What Duquette overlooks is that charitable giving also is impact by changes in disposable income and net wealth. So the “tax cost” of donations increased, but that was more than offset by a stronger economy.

So our question today is whether we’re going to see a repeat of the 1980s. Will a reduction in the tax incentive for charitable giving be offset by better economic performance?

Some research from the Mercatus Center suggests that the non-profit sector should not fear reform.

I would put this more bluntly. Only about 30 percent of taxpayers itemize, so 70 percent of taxpayers are completely unaffected by the charitable deduction. Yet many of these people still give to charity.…one study by William C. Randolph casts doubt on the claim that the deduction increases giving in the long run. Randolph’s paper analyzes both major tax reforms in the 1980s and follows individuals for 10 years, finding that taxpayers alter the timing of their giving in response to changes in tax policy, but not necessarily the total amount of giving. …lower-income households also donate to charities in large numbers. …However, very few of them benefit in terms of their tax burden, because many lower-income households have no positive tax liability. …For the 80 percent of middle-income filers who do not currently claim the charitable deduction, any cut in marginal tax rates is a pure benefit. Most taxpayers would be better served by eliminating the charitable contributions deduction and using the additional revenue to lower tax rates.

And they’ll presumably give higher donations if the economy grows faster.

This is one of the reasons the Wall Street Journal opined that tax reform will be beneficial.

A column in the Wall Street Journal also augments the key points about generosity and giving patterns.…nonprofits…sell Americans short by assuming that most donate mainly because of the tax break, rather than because they believe in a cause or want to share their blessings with others. How little they respect their donors. …Americans don’t need a tax break to give to charities, which should be able to sell themselves on their merits. …The truth is that Americans will donate more if they have more money. And they will have more money if tax reform, including lower rates and simplification, helps the economy and produces broader prosperity. The 1980s were a boom time for charitable giving precisely because so much wealth was created. Like so many on the political left, the charity lobby doesn’t understand that before Americans can give away private wealth they first have to create it.

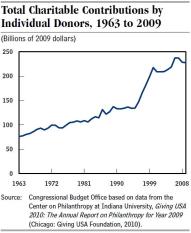

Last but not least, Hayden Ludwig, writing for the Washington Examiner, explains that charitable contributions increase as growth increases.…a drop in the amount of deductible gifts does not necessarily mean an equivalent drop in actual giving. …recessions aside, Americans have steadily increased their giving despite numerous tax law changes. Individual donations increased by 4% in 2015 and another 4% in 2016. If donations continue to increase at such rates, it won’t take long to make up for changes brought about by tax reform. …Americans have continued to give to charities no matter what benefits the tax code conveys on them for doing so.

Liberal groups such as the National Council of Nonprofits claim that the plan will be “disastrous” for charities… The thrust of the Left’s argument is that allowing Americans to keep more of their money makes them stingier, and high taxes are needed to force Americans to take advantage of charitable tax write-offs. It’s ironic that anyone in the nonprofit sector, which is built entirely on the generosity of individuals and corporations, can argue that higher taxes encourage charity – or that charity needs to be legislated. …if the Left’s argument about tax incentives is true, we should see sharp declines in charitable donations after every tax cut in U.S. history. We don’t. According to a 2015 report in the Chronicle of Philanthropy, individuals’ charitable giving rose four percent in 1965 and more than two percent in 1966, following the Kennedy and Johnson tax cuts of 1964 and 1965, respectively. Between the Reagan tax cuts in 1981 and 1986, individual giving rose a whopping 21 percent from $119.7 billion to $144.9 billion. By 1989, individual giving grew another 4.7 percent. …The reason is simple: Prosperity and generosity are inextricably linked.Amen. Make America more prosperous and two things will happen.

Fewer people will need charity and more people will be in a position to help them.

I’ll conclude by noting that the charitable deduction is the itemized deduction I would abolish last. Not because it is necessary, but because it doesn’t cause macroeconomic harm. The state and local tax deduction, by contrast, is odious and misguided because it subsidizes bad policy and the home mortgage interest deduction is harmful since it is part of a tax code that tilts the playing field and artificially lures capital from business investment to residential real estate.

Things to keep in mind for the next round of tax reform.

No comments:

Post a Comment