Kathryn Porter in The Telegraph, has compiled quite the list of failures as offshore wind projects get frozen around the world. Decisions are being delayed, contracts abandoned, auctions left without bidders and almost no new projects started. The awful truth of inflation, the maintenance cost shocks and cable failures is all too much. Then there was the problem of needing a 100 years of copper, nickel and lithium production before Christmas.

It’s all been kept quiet. Who knew there were no offshore wind investments in the EU last year, apart from a few floating projects?

After years of subsidies, wind power was meant to get cheap enough to

be profitable and competitive all by itself, instead, 25 years later,

it just needs bigger subsidies. When the great oil and coal price crunch

came, wind power was supposed to rise through the ashes, instead we

discovered that wind turbine and battery factories needed cheap coal and

oil like the rest of the economy.

Right now Australia has no offshore wind turbines and is about to jump onto a burning ship:

The myth of affordable green energy is over Kathryn Porter in The Telegraph, Progress is stalled around the world as nobody wants to admit the real costs

Turbine manufacturers have been losing money hand over fist in recent years. Collectively over the past five years the top four turbine producers outside China have lost almost US$ 7 billion – and over US$ 5 billion in 2022 alone.

But the losses have also been driven by pricing structures designed to win market share, and aggressive windfarm developers who have refused to pay up, often while pocketing billions in subsidies. The market has started to look, if not like a Ponzi scheme, then like a house of cards built on the shakiest of foundations.

Offshore wind projects have been drying up around the world. During the whole of 2022 there were no offshore wind investments in the EU other than a handful of small floating schemes. Several projects had been expected to reach financial close last year, but final investment decisions were delayed due to inflation, market interventions, and uncertainty about future revenues. Overall, the EU saw only 9 gigawatts worth of new turbine orders in 2022, a 47 percent drop on 2021.

Over in the United States, despite the massive support offered by the Inflation Reduction Act, windfarm projects are also struggling. Orsted, the global leader in offshore wind, has indicated it may write off more than US$2 billion in costs tied to three US-based projects – Ocean Wind 2 off New Jersey, Revolution Wind off Connecticut and Rhode Island, and Sunrise Wind off New York – that have not yet begun construction, saying it may withdraw from all three if it can’t find a way to make them economically viable.

Meanwhile, projects off New York are asking for an average 48 percent increase in guaranteed prices that could add US$ 880 billion per year to electricity prices in the state.

Investors are starting to run

The S&P Global Clean Energy Index is down by 30% this year and most of that is in the last three months:

The S&P Global Clean Energy Index, comprised of major solar and wind power companies and other renewables-related businesses, has lost 30 per cent in 2023, with nearly all of the decline since July.

By contrast, the oil and gas-heavy S&P 500 Energy Index is up slightly this year.

In the last three years the real S&P energy sector is up 287% (white line below), but the clean energy sector (the green line) is down 32%.

Energy Sector Index growth (white) compared to the Global Clean Energy Sector (green) in the last three years.

“The energy sector has been the best-performing market segment so far this month, with oil prices surging 30% over the past three months.” — Globe and Mail

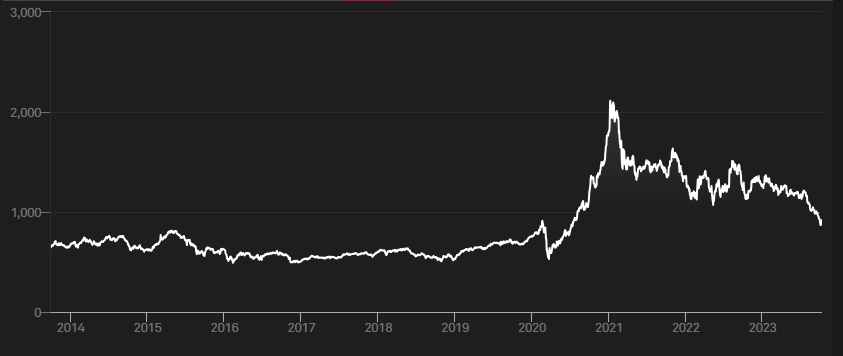

Yahoo Finance graphs the extraordinary growth of the S&P 500 Energy Index since 1994.

This article originally appeared at JoNova

Author

No comments:

Post a Comment