I’ve written previously about Pakistan getting into trouble because government spending grew too fast over a multi-year period.

And I also wrote about Kenya suffering economic problems for the same reason.

Today, let’s look at the fiscal data for two more nations.

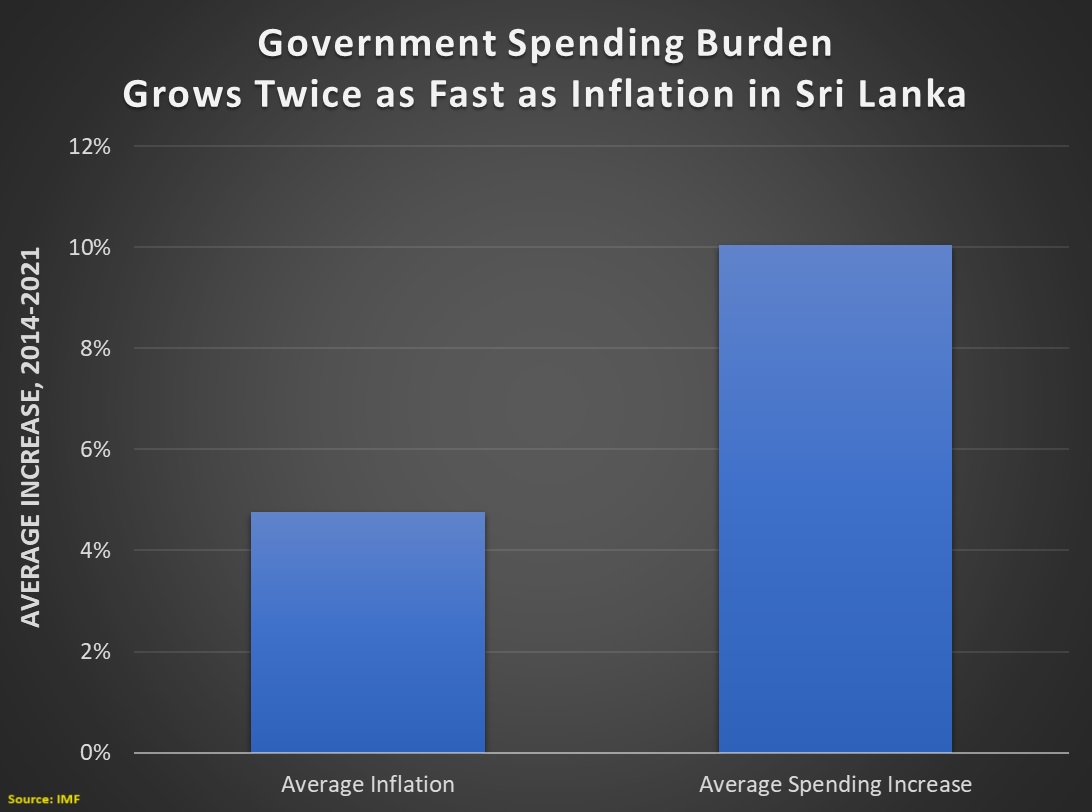

First, we have Sri Lanka.

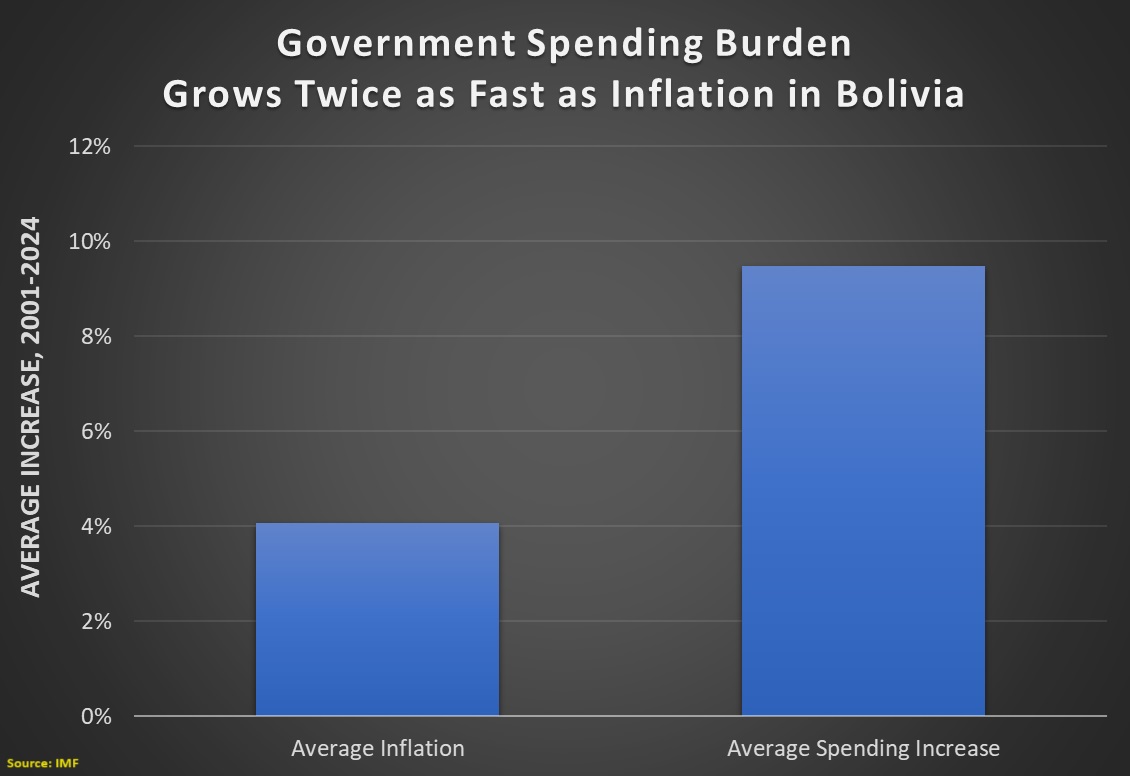

Next we have Bolivia.

So why am I linking Pakistan, Kenya, Bolivia, and Sri Lanka?

Because those four nations are prominently featured in a report for the New York Times by Patricia Cohen and Jack Nicas.

The reporters discuss political and economic turmoil in those nations and have lots of interesting details in their story.

But, as these excerpts illustrate, the one sin of omission is that there’s never a mention of how excessive spending by governments deserves blame for creating the underlying economic instability.

Like a globe-spanning tornado that touches down with little predictability, deep economic anxieties are leaving a trail of political turmoil and violence… In Kenya, a nation buckling under debt, protests over a proposed tax increase last week resulted in dozens of deaths…

At the same time in Bolivia, where residents have lined up for gas because of shortages, a military general led a failed coup attempt, saying the president, a former economist, must “stop impoverishing our country”… In Sri Lanka, stuck under $37 billion in debt, “the people are just broken,” said Jayati Ghosh, an economist at the University of Massachusetts Amherst…and a million people have lost access to electricity over the past year because of unaffordable price and tax increases, she said. …

In Pakistan, the rising costs of flour and electricity set off a wave of demonstrations that started in Kashmir and spread this week to nearly every major city. …Pakistan is deep in debt…and it wants to increase tax revenues by 40 percent to try to win a bailout of up to $8 billion from the International Monetary Fund

Indeed, the reporters want readers to believe the economic unrest is caused by other factors.

The causes, context and conditions underlying these disruptions vary widely from country to country. But a common thread is clear: rising inequality, diminished purchasing power and growing anxiety that the next generation will be worse off than this one.

No, the common problem is excessive spending growth. The things that they mention are consequences or symptoms of too much government.

P.S. I can’t resist sharing one additional passage from the story. The authors cite the economic challenges facing Argentina.

That’s certainly appropriate. I’ve repeatedly written about that nation’s problems.

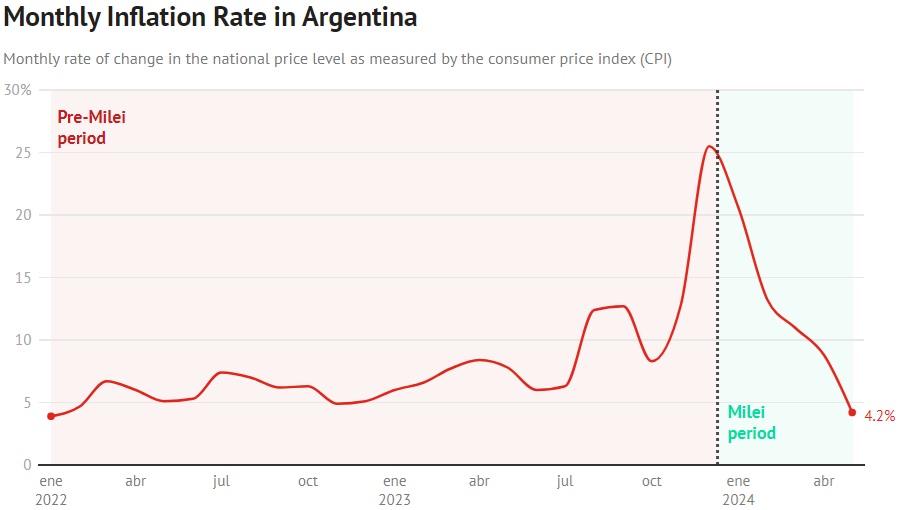

But I was galled that the reporters imply that inflation has gotten worse this year.

Decades of economic mismanagement by a succession of Argentine leaders, including printing money to pay bills, has made inflation a constant struggle. Prices have nearly quadrupled this year compared with 2023.

It is true that prices are higher this year than last year, but that misses the real story, which is that the policies of the relatively new libertarian president have been incredibly successful in reducing inflation.

As shown by this chart.

And it’s worth noting that Argentina is moving in the right direction because the spending burden is being reduced (a degree of fiscal restraint akin to a $1 trillion spending cut in the United States).

Too bad very few governments (or journalists) are learning the right lesson. Or focusing on the right solution.

No comments:

Post a Comment