The Congressional Budget Office has released its new Long-Term Budget Outlook and I will continue my annual tradition (see 2018, 2019, 2020, 2021, 2022, 2023) of sharing some very bad news about America’s fiscal future.

Most budget wonks focus on what CBO says about deficits and debt. And those numbers are grim.

But it’s much more important to focus on the underlying problem of excessive spending. After all, red ink is merely one of the symptoms of a government that is too big.

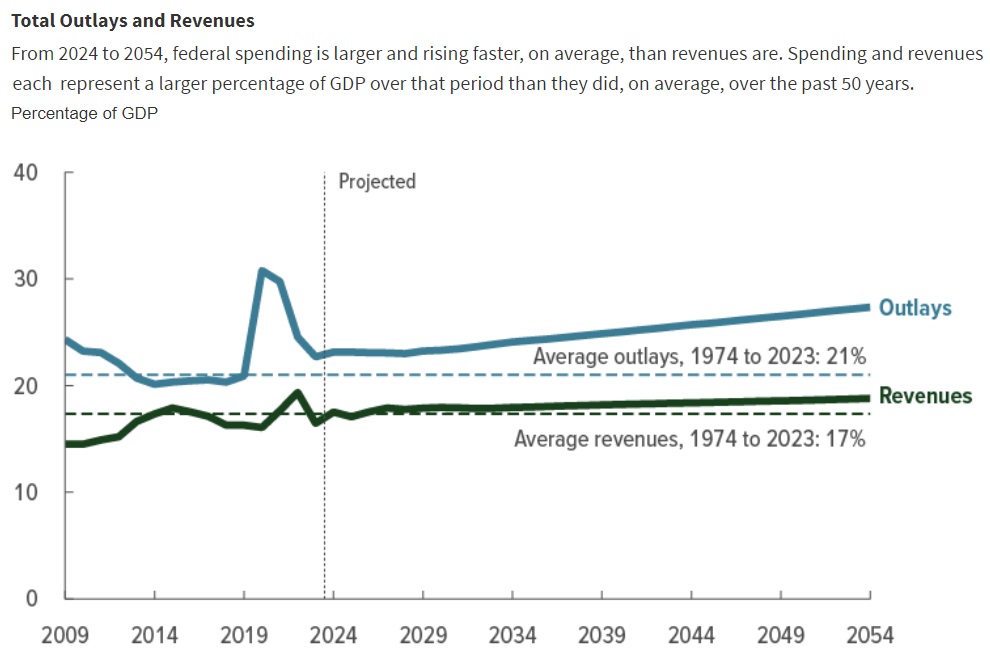

So here’s CBO’s forecast of spending and revenue over the next three decades. As you can see, both taxes and spending are becoming bigger burdens.

The bad news is that the tax burden is rising over time

The worse news is that the spending burden also is rising over time. And the worst news is that the spending burden is rising even faster than the tax burden in rising.

Here’s what CBO wrote in the report.

In the Congressional Budget Office’s projections, deficits…grow larger over the next 30 years because…spending…increases faster than revenues over the subsequent 30 years. Both federal spending and federal revenues equal a larger percentage of the nation’s gross domestic product (GDP) in coming years than they did, on average, over the past 50 years. Under current law, total federal outlays would equal 23.1 percent of GDP in 2024, remain near that level through 2028, and then increase each year as a share of the economy, reaching 27.3 percent in 2054… From 1974 to 2023, outlays averaged 21 percent of GDP; over the 2024–2054 period, projected outlays average about 25 percent of GDP… The key drivers of that increase over the next 30 years are higher net interest costs, which result from rising interest rates and growing federal debt, and growth in spending on major health care programs, particularly Medicare, which is caused by the rising cost of health care and the aging of the population.

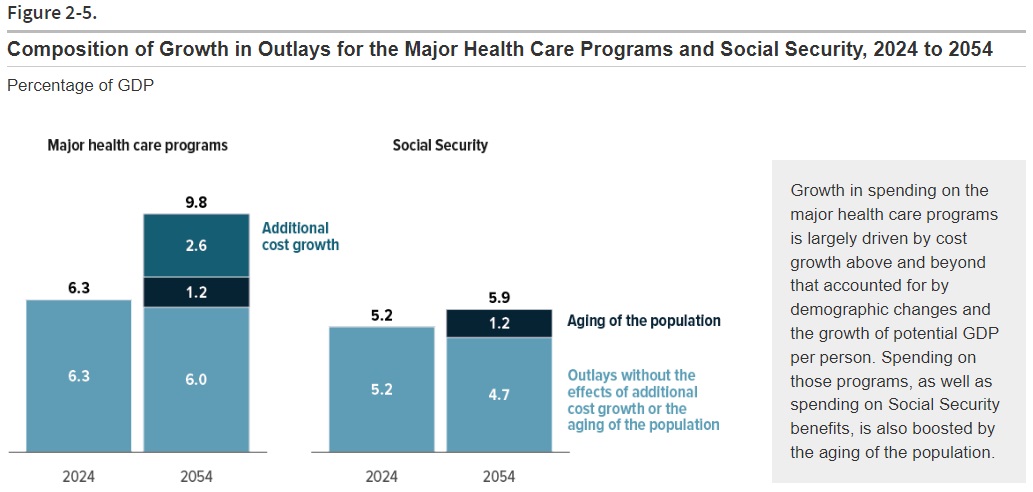

To elaborate on that final sentence, our next visual is CBO’s forecast for both health entitlements and Social Security.

You can see that Social Security is becoming a bigger burden, but programs such as Medicare and Medicaid are easily the nation’s main budget problem.

By the way, this chart is why there is an inevitable and unavoidable choice to make.

We either have entitlement reform or we have massive tax increases. Sadly, the two main presidential candidates in 2024 prefer the wrong option.

P.S. Here’s one final excerpt from the report. CBO acknowledges that higher tax burdens will be bad for growth.

The agency’s economic projections…incorporate the effects of changes in federal tax policies scheduled under current law, including the expiration of certain provisions of the 2017 tax act. Under current law, tax rates on individuals’ income are scheduled to increase at the end of 2025, when those provisions are scheduled to expire. Those changes aside, as income rises faster than inflation, more income is pushed into higher tax brackets over time. That real bracket creep results in higher effective marginal tax rates on labor income and capital.

Higher marginal tax rates on labor income reduce people’s after-tax wages and weaken their incentive to work. Likewise, an increase in the marginal tax rate on capital income lowers people’s incentives to save and invest, thereby reducing the stock of capital and, in turn, labor productivity. In CBO’s projections, that reduction in labor productivity puts downward pressure on wages. All told, less private investment and a smaller labor supply decrease economic output and income in CBO’s extended baseline projections.

This may seem obvious, especially for people familiar with the academic research on this topic, but CBO used to have some very silly views on tax policy.

P.P.S. CBO also used to produce some very silly analysis on spending policy, but in recent years has been much better.

No comments:

Post a Comment