Way back in 2009, I narrated a video explaining that people worry too much about deficits and debt. Red ink isn’t desirable, to be sure, but I pointed out that the real problem is government spending.

And the bottom line is that most types of government spending are bad for an economy, regardless of whether they are financed by taxes or borrowing.

It is possible, of course, for a nation to have a debt crisis. But keep in mind that this simply means a government has accumulated so much debt that investors no longer trust that they will receive payments on government bonds.

It is possible, of course, for a nation to have a debt crisis. But keep in mind that this simply means a government has accumulated so much debt that investors no longer trust that they will receive payments on government bonds.

That’s not a good outcome, but replacing debt-financed spending with tax-financed spending is like jumping out of the frying pan and into the fire. Or the fire into the frying pan, if you prefer. In either case, politicians are ignoring the real problem.

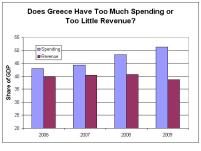

Greece is a cautionary example. Thanks to a period of overspending, Greek politicians drove the country into a debt crisis. But this dark cloud had a silver lining. The good news (at least relatively speaking) is that the government no longer could borrow from the private sector to finance more spending.

But the bad news is that Greek politicians subsequently hammered the economy with huge tax increases in hopes of propping up the country’s bloated welfare state. And the “troika” made a bad situation worse with bailout funds (mostly to protect big banks that unwisely lent money to Greek politicians, but that’s a separate story).

In other words, Greece got in trouble because of too much government spending and it remains in trouble because of too much government spending. As is the case for many other European nations.

And I fear the United States is slowly but surely heading in that direction. I elaborate about the problem of government spending – and the concomitant symptom of red ink – in this interview with the Mises Institute.

For all intents and purposes, I’m trying to convince people that deficits and debt are bad, but they’re bad mostly because they are a sign that government is too big. Sort of like a brain tumor being the real problem and headaches being a warning sign.

I feel like Goldilocks on this issue. Except instead of porridge that is too hot or too cold, I deal with people on both sides who think red ink is either wonderful or terrible.

For an example of the former group, here’s some of what Stephanie Kelton wrote for the New York Times last October.

But here’s the part I don’t like. She’s a believer in the perpetual motion machine of Keynesian economics. She thinks deficits are actually good for the economy and she wants to use debt to finance an ever-larger burden of government spending.

Now let’s check out the view of the so-called deficit hawks who think red ink is an abomination.

Here are some passages from a Hill report on the battle over last year’s tax plan.

The threat isn’t the red ink. The real danger is an ever-increasing burden of government spending, driven by entitlements.

Besides, the GOP tax bill actually is a long-run tax increase!

Let’s close with a video on the topic from Marginal Revolution. It has too much Keynesianism in it for my tastes, but the discussion of Argentina’s default is useful for those who wonder about whether the United States is going to have a debt meltdown at some point.

P.S. I don’t agree with Keynesians and I don’t agree with the self-styled deficit hawks. But I can appreciate that both groups have a consistent approach to public finance. What really galls me are the statist hypocrites who are cheerleaders for debt when there are proposals to increase government spending, but then do a back flip and pretend that debt is terrible and must be reduced when tax increases are being discussed.

And the bottom line is that most types of government spending are bad for an economy, regardless of whether they are financed by taxes or borrowing.

It is possible, of course, for a nation to have a debt crisis. But keep in mind that this simply means a government has accumulated so much debt that investors no longer trust that they will receive payments on government bonds.

It is possible, of course, for a nation to have a debt crisis. But keep in mind that this simply means a government has accumulated so much debt that investors no longer trust that they will receive payments on government bonds.That’s not a good outcome, but replacing debt-financed spending with tax-financed spending is like jumping out of the frying pan and into the fire. Or the fire into the frying pan, if you prefer. In either case, politicians are ignoring the real problem.

Greece is a cautionary example. Thanks to a period of overspending, Greek politicians drove the country into a debt crisis. But this dark cloud had a silver lining. The good news (at least relatively speaking) is that the government no longer could borrow from the private sector to finance more spending.

But the bad news is that Greek politicians subsequently hammered the economy with huge tax increases in hopes of propping up the country’s bloated welfare state. And the “troika” made a bad situation worse with bailout funds (mostly to protect big banks that unwisely lent money to Greek politicians, but that’s a separate story).

In other words, Greece got in trouble because of too much government spending and it remains in trouble because of too much government spending. As is the case for many other European nations.

And I fear the United States is slowly but surely heading in that direction. I elaborate about the problem of government spending – and the concomitant symptom of red ink – in this interview with the Mises Institute.

For all intents and purposes, I’m trying to convince people that deficits and debt are bad, but they’re bad mostly because they are a sign that government is too big. Sort of like a brain tumor being the real problem and headaches being a warning sign.

I feel like Goldilocks on this issue. Except instead of porridge that is too hot or too cold, I deal with people on both sides who think red ink is either wonderful or terrible.

For an example of the former group, here’s some of what Stephanie Kelton wrote for the New York Times last October.

…bigger deficits wouldn’t wreck the nation’s finances. …Lawmakers are obsessed with avoiding an increase in the deficit. …It’s also holding us back. Politicians of both parties should stop using the deficit as a guide to public policy. Instead, they should be advancing legislation aimed at raising living standards and delivering…long-term prosperity.Hard to disagree with the above excerpt.

But here’s the part I don’t like. She’s a believer in the perpetual motion machine of Keynesian economics. She thinks deficits are actually good for the economy and she wants to use debt to finance an ever-larger burden of government spending.

Government spending adds new money to the economy, and taxes take some of that money out again. …we should think of the government’s spending as self-financing since it pays its bills by sending new money into the economy. …the deficit itself could be deployed as a potent weapon in the fights against inequality, poverty and economic stagnation.Ugh.

Now let’s check out the view of the so-called deficit hawks who think red ink is an abomination.

Here are some passages from a Hill report on the battle over last year’s tax plan.

A handful of GOP deficit hawks are worried that their party’s tax plan could add trillions to the deficit, deepening a debt crisis for future generations. …The tax plan could cost the government $1.5 trillion in revenue over the next decade… Sen. Bob Corker (R-Tenn.), who recently announced his retirement at the end of this Congress, has warned he’ll oppose the tax plan if it adds to the deficit. …In a separate interview, he told The New York Times that the debt is “the greatest threat to our nation,” more dangerous than the Islamic State in Iraq and Syria, or North Korea.Ugh, again.

The threat isn’t the red ink. The real danger is an ever-increasing burden of government spending, driven by entitlements.

Besides, the GOP tax bill actually is a long-run tax increase!

Let’s close with a video on the topic from Marginal Revolution. It has too much Keynesianism in it for my tastes, but the discussion of Argentina’s default is useful for those who wonder about whether the United States is going to have a debt meltdown at some point.

P.S. I don’t agree with Keynesians and I don’t agree with the self-styled deficit hawks. But I can appreciate that both groups have a consistent approach to public finance. What really galls me are the statist hypocrites who are cheerleaders for debt when there are proposals to increase government spending, but then do a back flip and pretend that debt is terrible and must be reduced when tax increases are being discussed.

No comments:

Post a Comment