Back in 2014, I applauded German lawmakers for being fiscally responsible between 2003 and 2007. During that era, the burden of government spending barely increased.

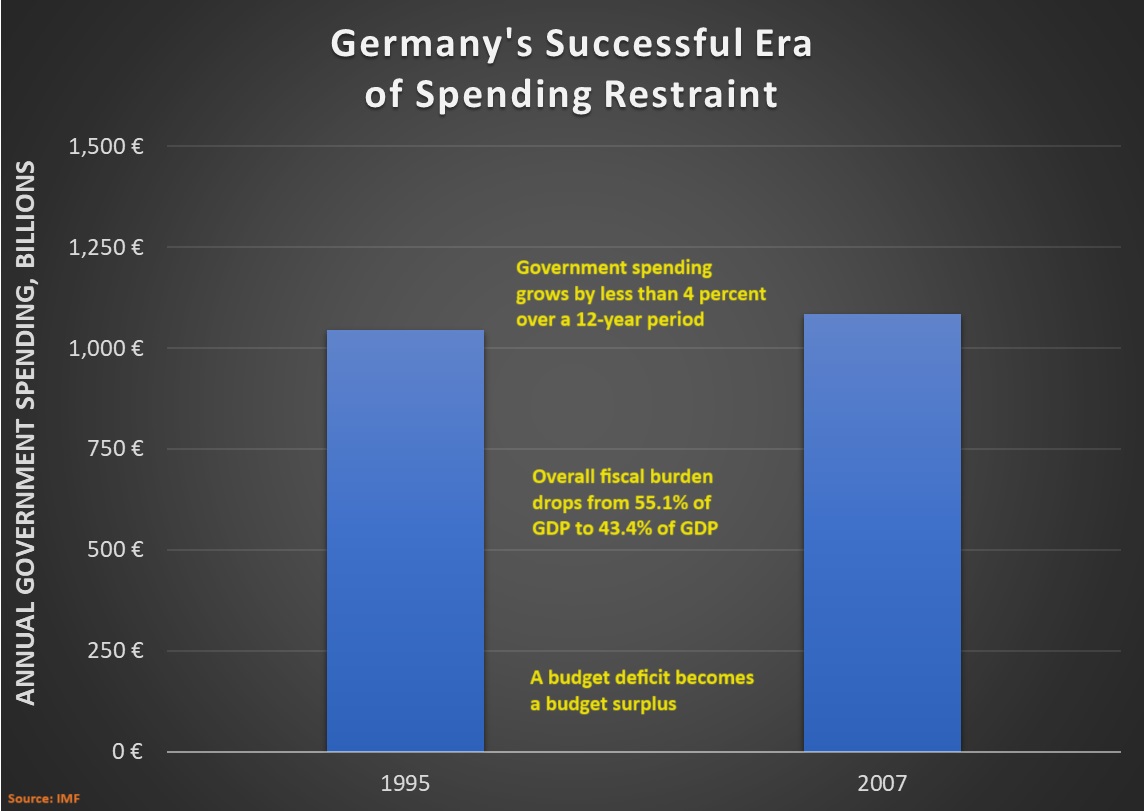

Today, I’m going to add more applause. I took another look at the IMF data and calculated Germany’s budgetary performance between 1995 and 2007.

Lo and behold, the Golden Rule of fiscal policy was in effect for a 12-year period. And that meant the burden of government spending dropped significantly as a share of economic output and a budget deficit became a budget surplus.

That’s impressive, though keep in mind that politicians used unification with East Germany as an excuse to dramatically increase the spending burden in the early 1990s.

But at least they eventually applied the brakes.

That being said, the purpose of today’s column is to explain that German politicians now deserve jeers rather than applause.

For context, here are some excerpts from a just-published New York Times report by Melissa Eddy.

The German government said on Tuesday it would immediately halt all new spending as it grappled with how to plug a gap of tens of billions of euros following a court ruling… The Constitutional Court, Germany’s highest, ruled last week that Chancellor Olaf Scholz’s government had acted improperly by taking money borrowed in 2020 to combat the coronavirus pandemic and shifting it to a new fund to finance environmental projects and green technology. …

The halt in new spending authorizations applies to all ministries. …Among the spending commitments that could be threatened are billions in subsidies aimed at attracting new industries to Germany, such as the chipmakers Intel and TSMC. …The pledges were made to help Germany transform its industrial sector from heavy industries to green technology, aimed at helping the country meet its goal of carbon neutrality by 2045. …

Lawmakers were expected to pass Germany’s 2024 budget last week. But after the ruling effectively ripped a $64.6 billion hole in this year’s spending plan, the talks were postponed pending a solution.

I’m not qualified to comment on the legal issues, so I have no idea if the Constitutional Court made the right choice.

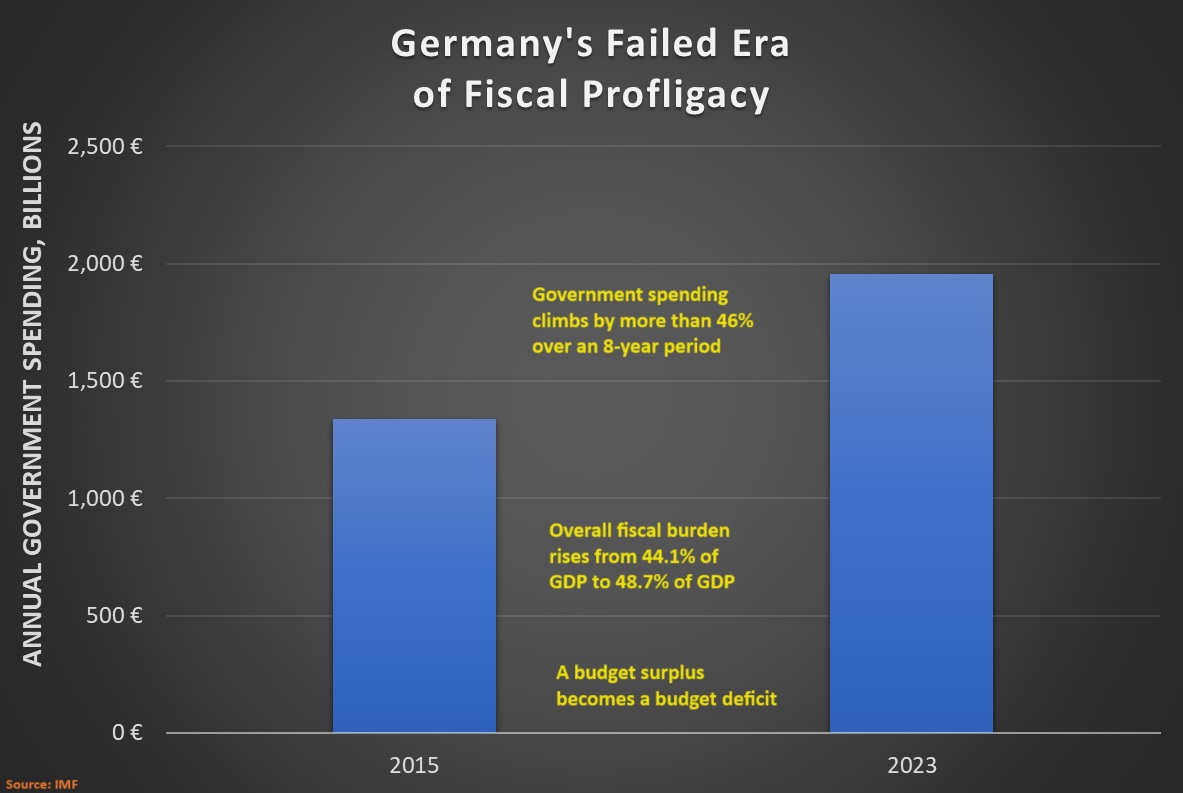

But I can look at budget numbers to see the real cause of Germany’s current fiscal problems.

Here’s a look at what’s happened to spending over the past eight years.

Now you know everything you need to know about why Germany is in fiscal trouble.

By the way, Germany is like Switzerland in that it has a “debt brake.”

But Switzerland’s version is far better (and far more effective) because it is designed to control spending rather than deficits. In other words, a spending cap.

Here’s what the story says about the misguided German version.

In 2009, Germany imposed strong borrowing limits on itself. The so-called debt brake, written into its Constitution, restricts annual borrowing to 0.35 percent of gross domestic product, or roughly €12 billion a year. Exceptions are allowed in emergencies, including natural disasters or a pandemic. The court ruled that the €60 billion, borrowed during the pandemic, could not be used for purposes unrelated to the spread of Covid.

In conclusion, I’ll note that the German government is pushing for European-wide spending caps. Maybe those officials should lead by example by capping spending in Germany.

P.S. While today’s column is critical of Germany, there are some positive things to say about the economic history of West Germany (and one positive thing to say about current German policy).

P.P.S. But I can’t resist pointing out that the Germans go overboard with regards to taxation (see here, here, here, here, and here).

No comments:

Post a Comment