By Rich Kozlovich

By Rich Kozlovich

First, I've met Stephen Moore, and admire him tremendously, because I think he's brilliant and for the same reason I think Thomas Sowell is brilliant. They take complex issues and explain them in such a way anyone can understand them.

He's featured in this first piece being interviewed by Harris Faulkner. He makes it clear this whole mess falls on Biden and Democrat spending and borrowing policies. Just as the collapse in 2008 was the fault of Jimmy Carter and the Community Reinvestment Act, passed thirty years before, this is entirely their fault. Not to mention their pandemic policies which have caused credit card debt to soar, car debt is piling up, and Americans are struggling to make the payments.

Now interest rates on housing are going up, and at some point, this will all to come to fruition in a very negative way in the very near future, and Joe Biden wants pass another massive 6.5 trillion dollar budget. Elections have consequences; stolen elections have catastrophes!

The second piece is by Jeffrey Tucker, another brilliant writer, and I might add both Stephan and Jeffrey have given me permission to publish their work.

Normally, I don't do commentaries on arcane economic issues, because they're too complex, and I'm out of my depth with so much of this stuff. This article, which is listed below is an example. Statistics, charts, and arcane economic policies, principles, and government rules make my eyes roll back into my head, so I post and quote those who do understand what's going on, and shocking as it may seem, they not only understand all the rhetoric and jargon, they seem to like it. Imagine that! However, that presents a problem. Who to trust?

When it comes to understanding economics, I think there are three areas in which I consider my strengths. Logic, correlation, and history. I do write about consequences regarding stupid economics, and all those are based of too much spending, too much taxation, too many regulations, too much waste and entirely too much corruption, none of which is being fixed. But in the end there are consequences for all that, and in the end the result can't be hidden. In the end, everyone understands they're suffering as a result of these insane policies. All of which is what we're seeing here, and what we're seeing is a pattern that's played out over and over again.

|

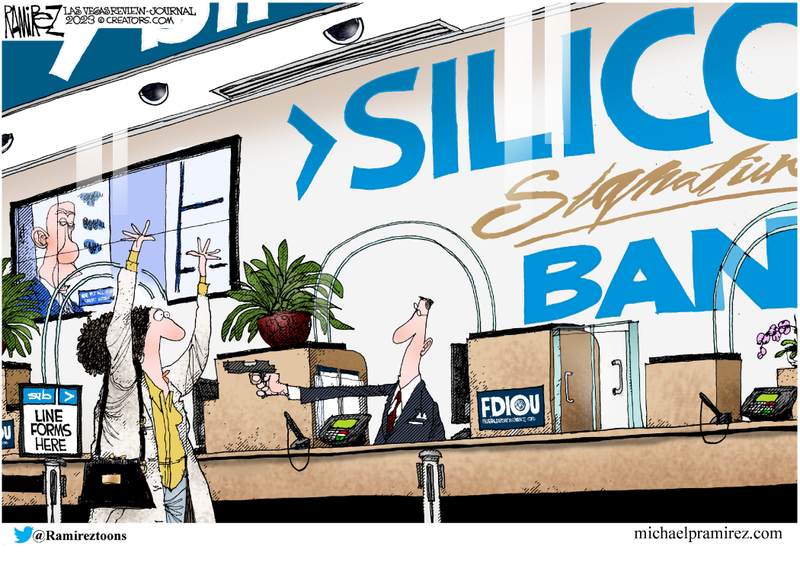

This list of links deals with who's responsible, who's corrupt, what should be done, both sides represented here, and where this is going. I will say this. This bank was manned by left wing DEI lunatics with so little understanding of economics and banking it boggles the mind.

What in the world could possibly make them think donating over $73 Million dollars of their customer's money to Black Lives Matter, a corrupt leftist Marxist movement trying to destroy capitalism and America, was good for their economic future, or for the nation?

ESG is a loser, and it's been shown to be a loser as it focuses on leftist environment and racial justice insanity instead of profitability, which is their legal fiduciary responsibility. This bank was doomed, this just brought it to a head faster, and in my opinion, the only thing that needs answering is who's going to jail over this?

And since Barney Frank was on their board, I hope Barney Frank is one of them.

Stephen Moore: SVB Happened Because of 'Massive Inflation' and 'Trillions' Borrowed by Federal Govt -Economist Stephen Moore, a co-founder of the Club for Growth and former adviser to President Donald Trump, said the reason the Silicon Valley Bank (SVB) collapsed is because of the "massive inflation" fueled by the Biden administration's spending and the "trillions and trillions of dollars of borrowing that the federal government has done." Moore made his remarks on the Fox News Channel, March 13, hosted by Harris Faulkner. When asked what went wrong with SVB in California and Signature Bank in New York, Moore replied, "By the way, I agree with the president that we don't have an overall banking crisis. The system is sound. But I do think you have a lot of major banks that are in some trouble. And SVB, the Silicon Valley Bank, may just be the tip of the iceberg here."............

Anatomy of the Banking Crisis of 2023, By For three years, I’ve been amazed at the relative calm in the financial system. It truly did not seem believable to me that governments and central banks could utterly shatter all market functioning and flood the world with paper money and yet there be no structural consequences for the banks. My only question was what would be the trigger and how would it unfold. In retrospect, the whole thing is perfectly obvious. Between the first week of March 2020 and exactly two years later, the Federal Reserve printed $6.5 trillion, at some point reaching a per annum increase of 26 percent. We’ve never experienced anything like this before. It also represented a complete reversal of Fed policy, which had been attempting a tightening for the prior six months........ Instead of calming markets, the Biden promise made it even worse. Everyone wanted to know just how sound the system really is. And the markets began to eye these bank valuations with grave skepticism. Suddenly everything was in question................

Federal Reserve’s Bank Rescue Could Inject $2 Trillion of Liquidity, Raising Inflation Concerns, - Strategists at JPMorgan Chase predict that the Federal Reserve’s

emergency lending program to bolster stressed banks could inject as much

as $2 trillion into the U.S. banking system, with some analysts raising

concerns that the program could fuel inflation or boost moral hazard. Following the abrupt failures of Silicon Valley Bank (SVB) and Signature Bank, the Federal Reserve rolled out

an emergency funding mechanism called the Bank Term Funding Program to

ensure banks ample have access to cash to meet depositor demand. “The usage of the Fed’s Bank Term Funding Program is likely to be big,” JPMorgan strategists wrote in a client note Wednesday.The strategists said that the maximum usage for the emergency lending

facility is close to $2 trillion. They said it would be able to provide

the U.S. banking system with enough funds to reduce reserve scarcity

and reverse the central bank’s recent tightening of financial

conditions. ..............

Failed SVB Gave Black Lives Matter over $73 Million, Joel B. Pollak, Silicon Valley Bank (SVB), whose collapse last week has triggered a global banking crisis, donated over $73 million to the Black Lives Matter (BLM) movement — but found itself unable to pay depositors in a cash crunch. As Breitbart News reported last week, SVB’s donations were part of nearly $83 billion that the Black Lives Matter movement received from corporate America, as documented by a Claremont Institute database:........It is unclear what BLM did with the money............

Are We Headed Toward Central Government Control of America’s Banks?, by | Mar 15, 2023 - The narrative about this excessive intervention paints a picture of the Biden Administration’s swift and deft stewardship saving us all from a collapse of the banking sector. The opposite is true. In fact, in their zeal to score political points while preventing losses among their donors, the administration actually planted unjustified seeds of doubt about the state of the nation’s banks…....

Central Bank Digital Currency Is the Truth Behind the Banking Collapse, by | Mar 15, 2023- The Tom Renz Show – The bank bailouts from the feds will ensure that inflation continues to spiral out of control for the next few years. When the feds step in and say they will insure all of the accounts, it means they will be printing a monumental amount of money. This will result in inflation on a scale we’ve never even come close to in the past. The feds are totally ok with printing a ton of money as it will crash the economy quickly and effectively so they can usher in CBDC…..

Banking Failures Are a Harbinger of Our Pending Economic Crisis, by | Mar 14, 2023 - Some of the biggest investment houses in the world are putting DIE and ESG ahead of business performance, investing our 401k and pension funds in companies that, like SVB, are focused on DIE and ESG, and hiring leadership teams who are also focused on DIE and ESG rather than hiring people based on competence. All of this creates a…........

How DIE kills the American Dream, By M.B. Mathews - DIE (Diversity, Inclusion, Equity) is the cause du jour of the American hard left in its quest to destroy capitalism. DIE is the practice of elevating the meritless or those of lesser merit above the truly accomplished. This is done according to race; people of color (PoC) are given preferential (or exclusive) access to jobs, positions, and rewards. Those who actually work hard and succeed are left twisting in the wind for having the wrong color skin. All this has nothing to do with merit, but with getting even with those who have done nothing wrong to get even about...........

Incredulous: leftwing reporter wonders ‘what the hell’ a ‘woke bank’ is, - A huge shout out to Whizy Kim at Vox, who just inadvertently validated what conservatives have been saying all along: leftism begets catastrophe. Andy Kessler of The Wall Street Journal recently speculated that maybe, just maybe, Silicon Valley Bank “may have been distracted by diversity demands.” (You can find the bank’s “wokesterly profile” by Monica Showalter here.) That speculation was enough to send Vox writer Kim into a tizzy, and yesterday, the outlet released her article inquiring as to “what the hell” a “woke bank” was........Kim dismissed the idea that “woke” policies could affect profits and sound financial decisions, declaring “woke” nothing more than the “favorite boogeyman” of conservatives; she even included a quote from an SVB patron who, in response to Kessler’s postulation said:.............

'That's a Lie': Janet Yellen Faces Grilling Before Senate Finance CommitteeSpencer Brown | March 16, 2023 - Biden Treasury Secretary Janet Yellen appeared before the Senate Finance Committee on Thursday morning and things did not go well as she tried to explain the Biden administration's "not a bailout" bailout of two failed banks in the last week, why she claimed inflation was "transitory" earlier in the cost crisis, and why the Biden administration is refusing to negotiate with Republicans to raise the debt ceiling. ............

SVB, ESG, and Biden’s ERISA Rule - The collapse of Silicon Valley Bank (SVB) occurred just days after Congress passed the Braun-Barr resolution, which overturns the Biden administration’s “Prudence and Loyalty” rule and its encouragement of environmental, social, and governance (ESG) investing by pension managers under the Employee Retirement Income Security Act (ERISA). The timing could hardly be more instructive. The Prudence and Loyalty rule, the White House had recently argued in its defense, “reflects what successful marketplace investors already know—there is an extensive body of evidence that environmental, social, and governance factors can have material impacts on certain markets, industries, and companies.”.............

Is This Why Gavin Newsom Wanted SVB to Get Bailed Out?- California Gov. Gavin Newsom was in contact with the “highest levels of leadership at the White House and Treasury” after the collapse of the Silicon Valley Bank and cheered its bailout, but failed to mention his own interests in the decision. .........According to The Intercept, however, Newsom failed to disclose his own financial interest, as at least three of his wineries—CADE, Odette, and PlumpJack—are clients of SVB, and that the charity his wife founded, California Partners Project, received a $100,000 donation from SVB in 2021, at the request of her husband..........

SVB Hired Major Biden Donor to Help its “Liquidity Crisis”, By And he talked to Biden’s deputy treasury secretary. It helps to know the right people. And Silicon Valley Bank had hired someone close to the ‘Big Guy’. The New York Times story, “How Washington Decided to Rescue Silicon Valley Bank’s Depositors” is a bit vague about who Blair Effron is. ....Let’s go back to 2019 and the Democrat primaries to understand Effron’s place in Bidenworld......

SD Gov. Kristi Noem: Federal Government Should Not Bail Out Depositors of ‘Woke’ Regional Banks, Melanie Arter March 15, 2023 - South Dakota Gov. Kristi Noem said Tuesday that it’s not the role of government to bail out depositors of regional banks pushing woke agenda. When asked whether the federal government should bail out “the depositors of regional banks when they go woke and then go broke,” Noem said, “No. That is not the role of the government and certainly not when it comes down to all of this happening because of poor management. “Listen, Jesse, we have seen this going on for quite some time, not just in these two banks and their situation, but we have also seen ESG policies happen in different states and at the federal government level where they are pushing this woke liberal agenda and they are deciding who can do business and who can't do business,” she told Fox News’ “Jesse Watters Primetime.”.........

GOP Presidential Candidate Ramaswamy: 'Let SVB Fail,' a Govt Bailout is 'Crony Capitalism, Michael W. Chapman | March 13, 2023 -Commenting on the collapse of the Silicon Valley Bank (SVB), Vivek Ramaswamy, a highly successful asset management chairman, best selling author, and GOP presidential candidate, said the bank should not be bailed out by the government but should be allowed to fail, "if needed." Bailing out SVB is nothing more than "crony capitalism," he added, noting that we saw all this happen before with the bank bailouts in 2008. ............

Silicon Valley Bank: Bespoke, Woke, and Restoked?, Peter C. Earle – March 13, 2023- As these things tend to, the collapse of Silicon Valley Bank (SVB) has given rise to a host of wide-ranging discussions. Again comes a long weekend of fear and conjecture, so familiar to anyone remembering Lehman weekend, the guiding of Bear Stearns into JP Morgan’s commercial embrace, airlines dropping like flies after September 11, jitters over the fate of Long-Term Capital Management in September of 1998, and so many others. And yet, by the time I was just finishing this writing, the situation had (at least temporarily) abated. Let’s start at the beginning. What happened?..............

No, ESG Doesn’t Offer Investors More Choices, nor Is It Part of the Free Market, by Jack McPherrin March 13, 2023 - On Feb. 28, Sen. Chuck Schumer (D-N.Y.) wrote an impassioned appeal in The Wall Street Journal for Republicans to support environmental, social, and governance (ESG) scores because ESG ostensibly represents the free market at work, by offering investors more “choices.” Schumer appears to be deeply confused about how ESG operates. Or, more likely, he’s pandering to his powerful donors; pro-ESG asset management titan BlackRock reportedly donated more than $100,000 to Schumer’s reelection campaign in 2022. Whatever the case may be, in reality, ESG results in the complete opposite of what Schumer claims.........It blatantly attempts to fundamentally transform the economy by severely altering traditional methods of assessing risk and allocating capital and credit.......

Climate Activist Companies at Risk After Svb Collapse, Bank Was Vital to ‘Climate-Tech Sector’, by The Post Millennial March 13, 2023 -Silicon Valley Bank collapsed on Friday and

following its seizure by regulators with the Federal Deposit Insurance

Corporation (FDIC) it has been revealed that the bank was vital to the

"climate-tech sector," in addition to it being heavily used by.............c

No comments:

Post a Comment