Want to know who to blame for the failure of Silicon Valley Bank, Signature Bank, and the general turmoil in the banking sector?

Poor management is part of the answer, of course, but the Federal Reserve also should be castigated because of bad monetary policy.

Why?

Because the central bank’s easy-money policy created artificially low interest rates, but those policies also produced high inflation, and now interest rates are going up as the Fed tries to undo its mistake.

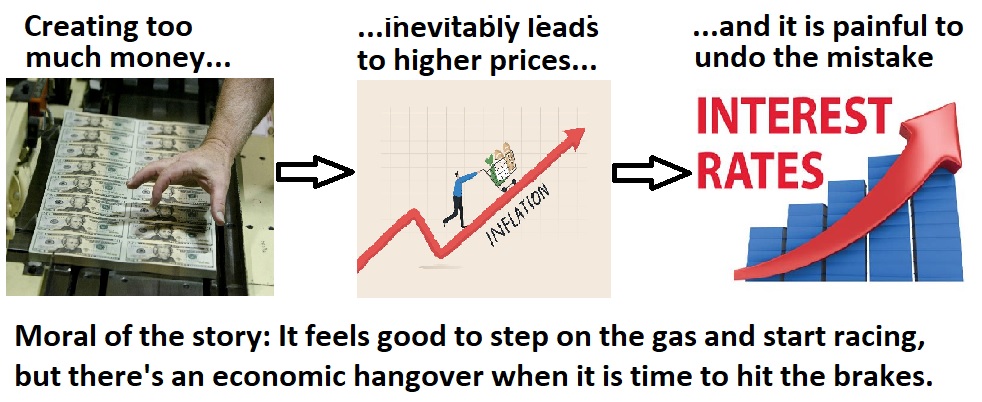

Inspired by my “magic beans” visual, here’s a new one that shows the Fed’s boom-bust cycle.

By the way, the center box (higher prices) also includes asset bubble since bad monetary policy sometimes leads to financial bubbles instead of (or in addition to) higher consumer prices.

And higher interest rates can occur for two reasons. Most people focus on the Federal Reserve tightening monetary policy as it tries to reverse its original mistake of easy money. But don’t forget that interest rates also rise once lenders feel the pinch of inflation and insist on higher rates to compensate for the falling value of the dollar.

But let’s not digress too much. The focus of today’s column is that the Fed goofed by creating too much money in 2020 and 2021. That’s what set the stage for big price increases in 2022 and now economic instability in 2023.

Joakim Book of Reason shares my perspective. Here are excerpts from his article.

The Federal Reserve is in the unenviable position of achieving its mandate by crashing the economy. …it’s something that happens as an unavoidable outcome of slowing down an economy littered with excess money and inflation. …This hiking cycle, the fastest that the Fed has embarked upon in a generation, was always likely to break something. And break something they did over the weekend…Silicon Valley Bank (SVB), which faced the second-largest bank run in U.S. history. …this pushes the Fed into a very delicate position: risk systemic bank runs, or roll back the hikes and quantitative tightening that caused this mess, printing money for an even hotter inflation.

The Wall Street Journal also has the right perspective, editorializing that the current mess was largely caused by bad monetary policy.

Cracks in the financial system emerge whenever interest rates rise quickly after an easy-credit mania, and the surprise is that it took so long. …This week’s bank failures are another painful lesson in the costs of a credit mania fed by bad monetary policy. The reckoning always arrives when the Fed has to correct its mistakes. …We saw the first signs of panic in last year’s crypto crash and the liquidity squeeze at British pension funds. …nobody, least of all central bank oracles, should be surprised that there are now bodies washing up on shore as the tide goes out.

This tweet also notes that monetary policy is to blame.

Finally, I can’t resist sharing some excerpts from Tyler Cowen’s Bloomberg column. He pointed out last November that the Austrian School has some insights with regards to the current mess.

The Austrian theory…works something like this: Investors expected that very low real interest rates would hold. They committed resources accordingly, and now forthcoming rates are likely to be much higher. That means the economy is stuck with malinvestment and will need to reconfigure in a painful manner. …The basic story here fits with the work of two economists from Austria, Ludwig Mises and Nobel laureate Friedrich von Hayek, and thus it is called the Austrian theory of the business cycle. The Austrian theory stresses how mistaken expectations about interest rates, brought on by changes in the rate of inflation, will lead to bad and abandoned investment projects. The Austrian theory has often been attacked by Keynesians, but in one form or another it continues to resurface in the economic data.

Needless to say, proponents of the Austrian School are not big fans of central banking.

If you want to learn more about Austrian economics, click here and here.

No comments:

Post a Comment