I wrote earlier this month about the shocking first-place finish by a libertarian in Argentina’s presidential primary. Today, let’s take a close look at what is arguably Javier Milei’s most radical proposal, which is to eliminate his country’s central bank and instead adopt the US dollar as the national currency.

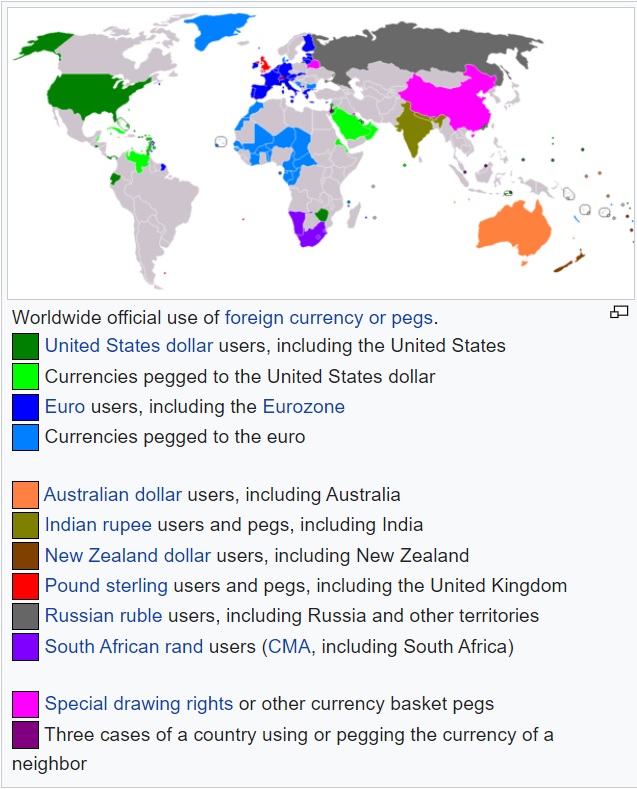

The first thing to understand about “dollarization” is that it is not an untested theory. Panama has been using the dollar for more than 100 years. And Ecuador and El Salvador have been dollarized for more than 20 years. There are also nations that use the euro, as well as many nations that explicitly link (“peg”) their currencies to dollars or euros. So there is no debate about whether dollarization works. Instead, the issue is whether it would be appropriate for Argentina. At the risk of understatement, the answer is a resounding yes. Argentina has a chronic problem of bad monetary policy, mostly because the government uses the printing press to finance wasteful spending. Dollarization would end that possibility.

In a column for Bloomberg, Professor Tyler Cowen explains why Argentina will be better off without its own currency.

The case for dollarizing is straightforward: Since 1980, by one measure, Argentina has had an average annual inflation rate of more than 200%. Significant portions of the economy already have moved to the use of dollars, and for that matter crypto. Why not go all the way and give the economy a stable currency, one which its politicians cannot manipulate? Argentines would find it easier to safeguard their savings, economic calculations would be easier, and foreign investors would be encouraged.

…For whatever reasons, Argentina’s political economy has some features that are not conducive to monetary stability and fiscal responsibility, and so further fine-tuning is unlikely to fix the problem. A drastic step is necessary. Three Latin American economies — Panama, Ecuador and El Salvador — have already moved to explicit dollarization. …

They have all moved from regimes of very high periodic inflation to relative monetary stability. None appears likely to return to its national fiat currencies anytime soon. …Argentina…has been losing ground since the 1920s, when it was one of the richest nations in the world. …it needs dramatically better public policy. At this point, doing nothing, or continuing on the same path, is more risky than chancing some radical reforms.

Patrick Horan makes similar points in an article he wrote for National Review.

Perhaps Milei’s most controversial economic proposal is to abandon the Argentine peso, close the central bank, and adopt the U.S. dollar as the country’s new currency. …Embracing another country’s currency (the dollar being the most common) is a radical move, but it has been done before. Panama has used the dollar since 1904. Ecuador and El Salvador dollarized in 2000 and 2001. These are examples of official dollarization, in which the government formally adopts the dollar. …

Typically, an economy dollarizes because high inflation has seriously weakened the local currency. For example, economists have estimated that roughly half of all transactions in inflation-ravaged Venezuela and Lebanon in the past two years have been conducted in dollars. …Argentina suffers from severe inflation. Since February, the year-over-year inflation rate has exceeded 100 percent.

Also, …many Argentines already deal in dollars. …Dollarization would mean that the government would no longer be able to turn to monetary policy, a tool Argentine governments have repeatedly misused, to fund imprudent fiscal policy. …dollarization would bring an end to Argentina’s inflationary woes. Also, since monetizing deficits would no longer be an option, dollarization could also motivate policy-makers to pursue pro-market, pro-growth reforms.

In a column for the Wall Street Journal, Max Raskin focuses on the economic benefits that accrue when a government no longer has the ability to finance wasteful spending by printing money.

Mr. Milei has promised to close the central bank and dollarize the economy—a process that would essentially outsource the country’s monetary policy to the Federal Reserve. …my recent co-authored research in the Journal of Financial Stability and Brown Journal of World Affairs demonstrates the economic gains that can be had for a country that chooses to forgo its monetary prerogative. Currency competition, especially through liberalizing legal-tender laws, restrains the inflationary impulses of a central bank.

If foreign currencies are able to be used and not taxed or regulated disfavorably, then the central bank will have less power to inflate because of consumer choice. …Argentina used to be one of the most developed and wealthiest countries in the world, but a century of state intervention in the economy has shown how dangerous it is to disrupt the normal functioning of markets. Even a selfish government that’s keen on reaping increased tax revenue from growth should have an interest in making a commitment to monetary liberalization.

Let’s close with some excerpts from an article that Marcos Falcone authored for the Foundation for Economic Education.

This article was published back on May 5, well before Milei’s shocking first-place finish in Argentina’s presidential primary, and it has some good information on how Ecuador has benefited from dollarization.

Initially, those who supported the elimination of the peso were viewed as crazy: How could a nation deprive its 45 million inhabitants of their currency? But Argentina is a country with never-ending inflationary conditions: The current annual inflation rate is over 100 percent and rapidly accelerating, while many fear that hyperinflation—which the country experienced multiple times during the 20th century—is coming back.

… the use of dollars would not be an imposition by the government, but merely a recognition of the current state of affairs. Dollarization has, in some aspects, already occurred. …pesos lose value more rapidly than dollars, euros, or other currencies. This happens, in turn, because the government continues to print money to finance its deficit. …adoption of the dollar has helped other countries stabilize, like Ecuador. …inflation has ceased to be a problem in this country… not even a strong populist leader like Rafael Correa was able to overturn dollarization, as the dollar itself was always more popular than him.

By the way, the adoption of the euro currency has some parallels for dollarization. Consider the cases of Italy and Greece, which habitually suffered from high inflation. Joining the euro was a positive step for those nations because it meant their governments no longer could print money to finance wasteful spending. Sadly, this story does not have a happy ending. The European Central Bank has become politicized in recent years and is now indirectly printing money to subsidize wasteful spending by the Italian and Greek governments.

Fortunately, I don’t think the US Federal Reserve would adopt bad monetary policy to help Argentina (though the Fed certainly is capable of adopting bad monetary policy for other reasons).

P.S. One reason to support cryptocurrencies is that they provide an option for people in nations with terrible monetary policy (Sri Lanka being a recent example).

P.P.S. Nations are less likely to dollarize if the US government engages in global bullying.

Editor's Note: Please take some time and review My Argentina File, which goes back to 2012. RK

No comments:

Post a Comment