I’ve half-joked in the past that spending restraint is the answer to every fiscal problem.

But I wouldn’t be surprised if it’s the right answer to 98 percent of fiscal problems. Some fiscal discipline is what we need in America, for instance, and it’s certainly an approach that works whenever and wherever it is tried.

Could it also be the answer in Jordan, which has stumbled into a fiscal crisis and is now facing domestic unrest?

The trouble began in January when the government announced a big IMF-supported tax increase. Here’s some of what was reported by Reuters.

The victims of those tax increases are not happy. As reported earlier this month, they took to the streets.

The New York Times has the cheerful news.

Maybe, just maybe, the IMF is right and tax increases are necessary because there is no leeway to reduce the burden of government spending. Perhaps the government already has been complying with Mitchell’s Golden Rule and has slashed the budget, meaning that higher revenues are the only feasible option still on the table.

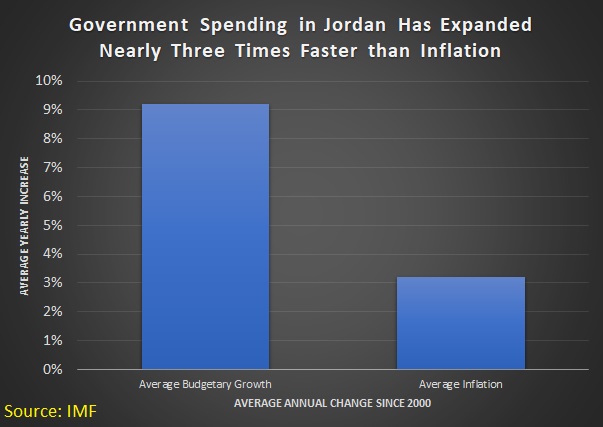

So I decided to check the IMF’s World Economic Outlook database. Lo and behold, I discovered that the budget has soared from 2 billion dinar in 2000 to more than 9 billion dinar this year. What’s especially remarkable is that government spending has grown far faster than needed to keep pace with inflation.

In other words, what happened in Jordan is exactly what happened in Greece. Government grew too fast. But not just Greece. The mess in Jordan is a repeat of what happened in Western Australia. In Puerto Rico as well. And don’t forget Alberta and Alaska. The list could go on and on.

It’s sort of like the sun rising in the east and setting in the west. Or the swallows returning to Capistrano.

And for those who value predictability, it’s no surprise to once again see the IMF pushing for higher taxes. Those bureaucrats are the Dr. Kevorkian of the global economy and there’s only one medicine they prescribe.

But I wouldn’t be surprised if it’s the right answer to 98 percent of fiscal problems. Some fiscal discipline is what we need in America, for instance, and it’s certainly an approach that works whenever and wherever it is tried.

Could it also be the answer in Jordan, which has stumbled into a fiscal crisis and is now facing domestic unrest?

The trouble began in January when the government announced a big IMF-supported tax increase. Here’s some of what was reported by Reuters.

Interestingly, the article acknowledged that the country got in a fiscal mess because of too much spending.Jordans cabinet announced on Monday a major package of IMF-guided tax hikes… The package announced on state media includes removing exemptions on general sales tax and unifying low 4 to 8 percent rates on a large number of items at 10 percent while leaving it at 16 percent ceiling for others, alongside raising special taxes on tobacco, premium gasoline and streamlining customs duties.

The debt is at least in part due to successive governments adopting an expansionist fiscal policy characterized by job creation in the bloated public sector, and by lavish subsidies for bread and other staple goods. …Economists said Jordans ability to maintain a costly subsidy system and a large state bureaucracy was increasingly untenable in the absence of large foreign capital inflows or infusions of foreign aid.But politicians almost always prefer tax hikes rather than spending restraint (even though – or perhaps because – higher taxes are not an effective way of controlling red ink).

The victims of those tax increases are not happy. As reported earlier this month, they took to the streets.

And the protests worked.Jordanians took to the streets of the capital Amman on Sunday in a fourth day of nightly protests against IMF-backed price increases that have shaken the kingdom, witnesses said. …demonstrators who converged near the cabinet office chanted slogans calling for the sacking of Prime Minister Hani Mulki and saying they would disband only if the government rescinded a tax bill it sent to parliament last month which critics say worsens living standards. …Public anger over IMF-driven government policies has grown since a steep general sales tax hike earlier this year… The government says it needs more funds for public services and argues that tax reforms reduce social disparities by placing a heavier burden on high earners.

The New York Times has the cheerful news.

Incidentally, taxpayers in the United States have been subsidizing Jordanian profligacy.The government of Jordan announced on Thursday that it would withdraw a divisive tax bill after nationwide protests rocked the country, leading to the resignation of the prime minister and his cabinet. The newly appointed prime minister, Omar Razzaz, said in a statement that he had consulted members of both houses of Parliament, and that there was a consensus that the tax bill should be withdrawn. …The decision to withdraw the bill, which proposed increasing the tax rate on workers by at least five percentage points and on businesses by 20 to 40 percentage points, was lauded by many in Jordan.

In 2015, the Obama administration and Jordan signed a three-year agreement in which the United States pledged $1 billion in assistance annually, subject to the approval of Congress. More recently, Washington pledged $6.3 billion in aid through 2022, making Jordan one of the top recipients of American foreign assistance.These three news reports were interesting, but I wondered if they told the full story.

Maybe, just maybe, the IMF is right and tax increases are necessary because there is no leeway to reduce the burden of government spending. Perhaps the government already has been complying with Mitchell’s Golden Rule and has slashed the budget, meaning that higher revenues are the only feasible option still on the table.

So I decided to check the IMF’s World Economic Outlook database. Lo and behold, I discovered that the budget has soared from 2 billion dinar in 2000 to more than 9 billion dinar this year. What’s especially remarkable is that government spending has grown far faster than needed to keep pace with inflation.

In other words, what happened in Jordan is exactly what happened in Greece. Government grew too fast. But not just Greece. The mess in Jordan is a repeat of what happened in Western Australia. In Puerto Rico as well. And don’t forget Alberta and Alaska. The list could go on and on.

It’s sort of like the sun rising in the east and setting in the west. Or the swallows returning to Capistrano.

And for those who value predictability, it’s no surprise to once again see the IMF pushing for higher taxes. Those bureaucrats are the Dr. Kevorkian of the global economy and there’s only one medicine they prescribe.

No comments:

Post a Comment